- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:SLIGR

Undiscovered European Gems With Promising Potential In May 2025

Reviewed by Simply Wall St

As of mid-May 2025, the European markets have been buoyed by a positive shift in global trade dynamics, with the STOXX Europe 600 Index rising 2.10% following a de-escalation in U.S.-China trade tensions. This favorable environment highlights opportunities for discerning investors to explore lesser-known stocks that may benefit from improved economic conditions and potential growth within the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Italian Exhibition Group (BIT:IEG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Italian Exhibition Group S.p.A. organizes and operates exhibitions worldwide with a market capitalization of €278.57 million.

Operations: The group generates revenue primarily through organizing and operating exhibitions globally. It focuses on managing costs to optimize profitability, with particular attention to its net profit margin.

Italian Exhibition Group (IEG) has showcased strong financial health with a notable reduction in its debt to equity ratio from 80.4% to 49.1% over the last five years, reflecting prudent management. The company reported a net income of €31.99 million for the full year ending December 2024, compared to €12.69 million the previous year, indicating robust growth and high-quality earnings. Additionally, IEG's interest payments are well covered by EBIT at 8.2 times coverage, suggesting solid operational performance and strategic positioning within its industry context as it trades significantly below estimated fair value by about 84%.

- Navigate through the intricacies of Italian Exhibition Group with our comprehensive health report here.

Evaluate Italian Exhibition Group's historical performance by accessing our past performance report.

Sligro Food Group (ENXTAM:SLIGR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sligro Food Group N.V. operates in the foodservice industry across the Netherlands and Belgium, with a market capitalization of €596.38 million.

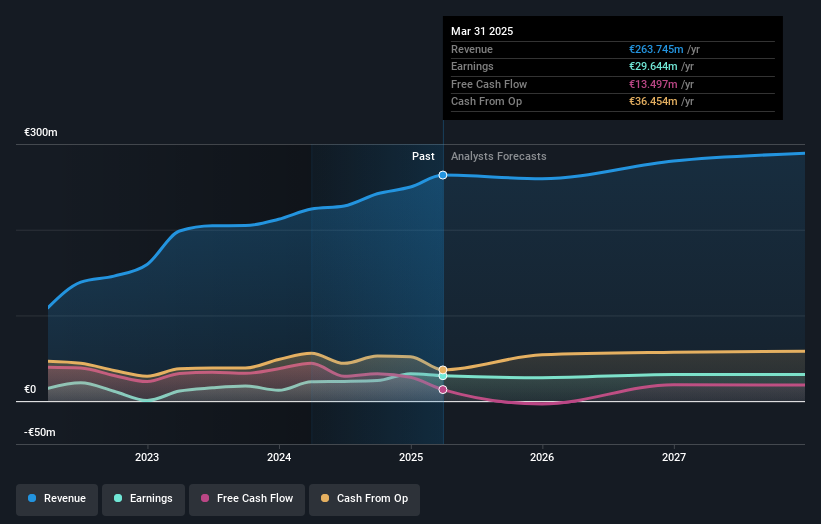

Operations: The company generates revenue primarily from its food service segment, totaling €2.89 billion.

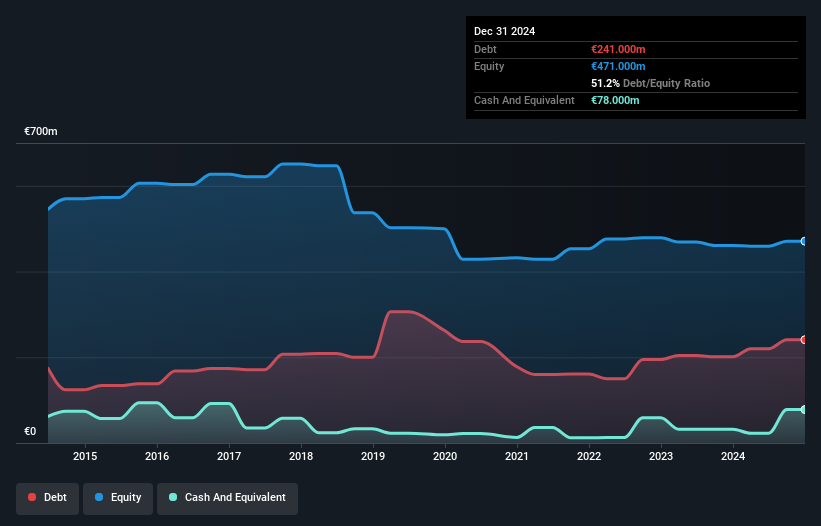

Sligro Food Group, a notable player in the European food distribution sector, has seen its net income soar from €6 million to €24 million over the past year. Trading at 72% below its estimated fair value, it offers a compelling valuation. Despite reducing its debt to equity ratio from 52.7% to 51.2% over five years and maintaining satisfactory net debt levels at 34.6%, interest coverage remains a concern with EBIT covering interest payments only 2.2 times. The company reported sales of €2.89 billion for 2024, reflecting stability and potential for growth in earnings forecasted at over 34% annually.

- Dive into the specifics of Sligro Food Group here with our thorough health report.

Explore historical data to track Sligro Food Group's performance over time in our Past section.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA is a company that produces, distributes, and markets dairy and cheese products across France, the rest of Europe, and internationally, with a market capitalization of approximately €888.18 million.

Operations: Savencia SA generates revenue primarily from its Cheese Products and Other Dairy Products segments, with €4.06 billion and €3.33 billion respectively. The company's net profit margin is a key metric to consider when evaluating its financial performance.

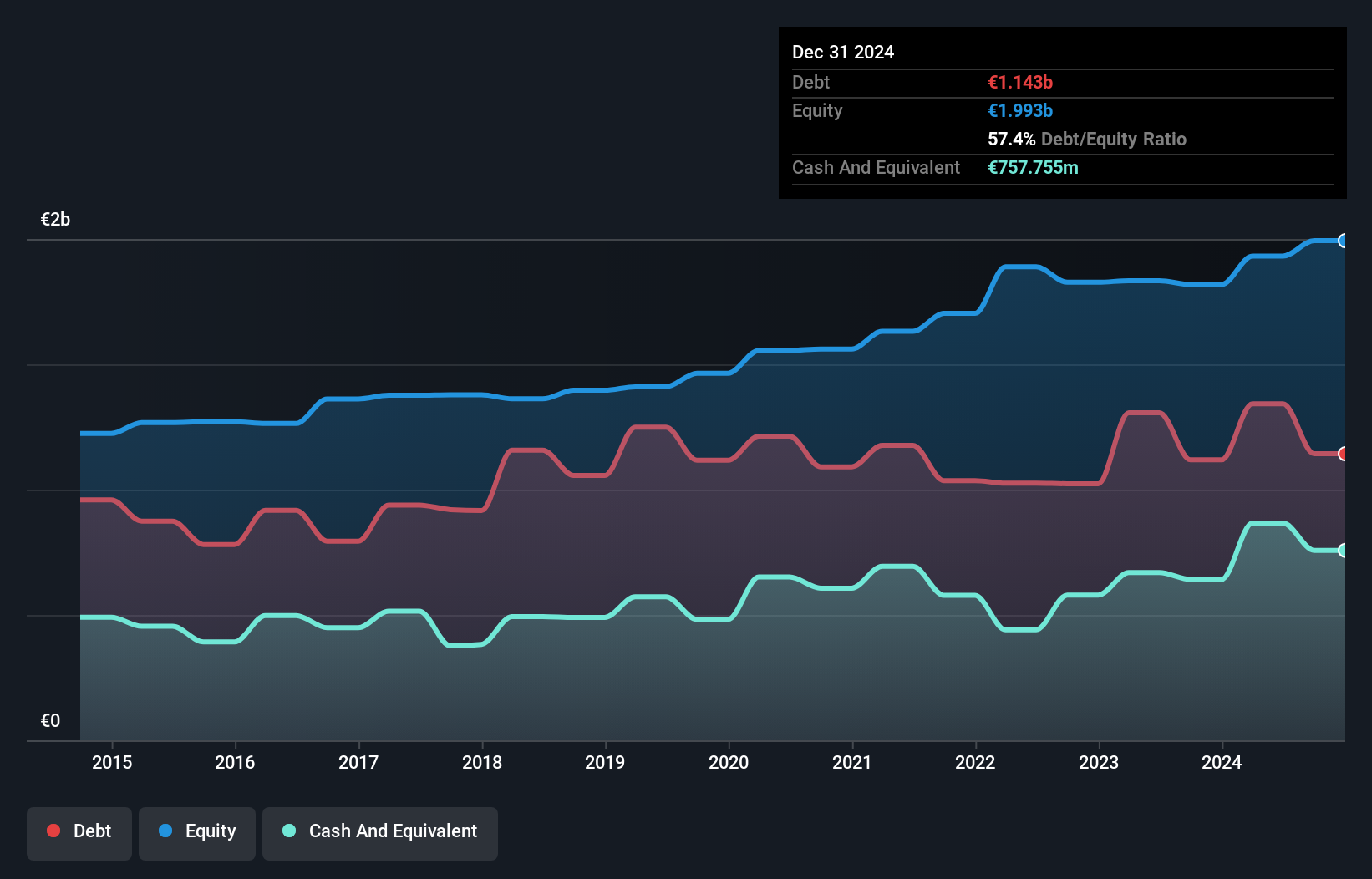

Savencia, a notable player in the food industry, has demonstrated robust financial health with its recent earnings growth of 10.9%, outpacing the industry average of -3%. The company reported net income of €106.97 million for 2024, up from €96.48 million the previous year, indicating strong operational performance. Savencia's debt management appears prudent with a net debt to equity ratio at a satisfactory 19.3%, and interest payments are well covered by EBIT at 4.5 times coverage. Trading significantly below estimated fair value by 75.8%, it offers potential value for investors eyeing under-the-radar opportunities in Europe’s market landscape.

- Unlock comprehensive insights into our analysis of Savencia stock in this health report.

Gain insights into Savencia's historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 330 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:SLIGR

Sligro Food Group

Engages in the foodservice businesses in the Netherlands and Belgium.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives