Recent 11% pullback isn't enough to hurt long-term Italian Exhibition Group (BIT:IEG) shareholders, they're still up 173% over 3 years

Italian Exhibition Group S.p.A. (BIT:IEG) shareholders might be concerned after seeing the share price drop 11% in the last week. In contrast, the return over three years has been impressive. In fact, the share price is up a full 166% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. If the business can perform well for years to come, then the recent drop could be an opportunity.

Although Italian Exhibition Group has shed €24m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

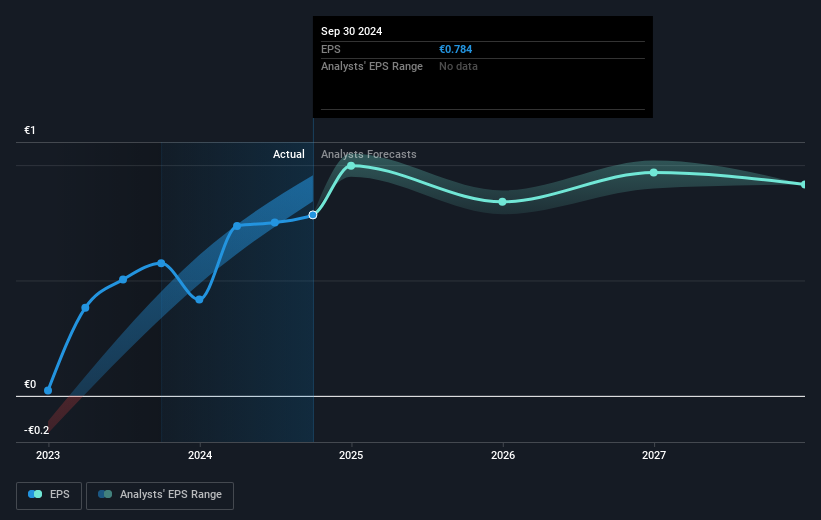

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Italian Exhibition Group became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Italian Exhibition Group has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic .

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Italian Exhibition Group the TSR over the last 3 years was 173%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Italian Exhibition Group shareholders have received a total shareholder return of 47% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 17% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Italian Exhibition Group that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IEG

Italian Exhibition Group

Italian Exhibition Group S.p.A. organizes and operates exhibitions worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives