- Sweden

- /

- Capital Markets

- /

- OM:VO2

European Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

The European market is experiencing a surge, with the pan-European STOXX Europe 600 Index reaching record levels, driven by a rally in technology stocks and expectations for lower U.S. borrowing costs. In this context, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite being considered somewhat niche today. When these stocks are supported by strong financial health and fundamentals, they can offer significant growth opportunities at lower price points.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.134 | €1.43B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.16 | €17.23M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.09 | €28.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €229.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.57 | DKK115.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.92 | €39.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.30 | SEK200.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €297.17M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 270 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

DigiTouch (BIT:DGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DigiTouch S.p.A. offers digital marketing and transformation services in Italy, with a market cap of €28.47 million.

Operations: No specific revenue segments are reported for DigiTouch S.p.A.

Market Cap: €28.47M

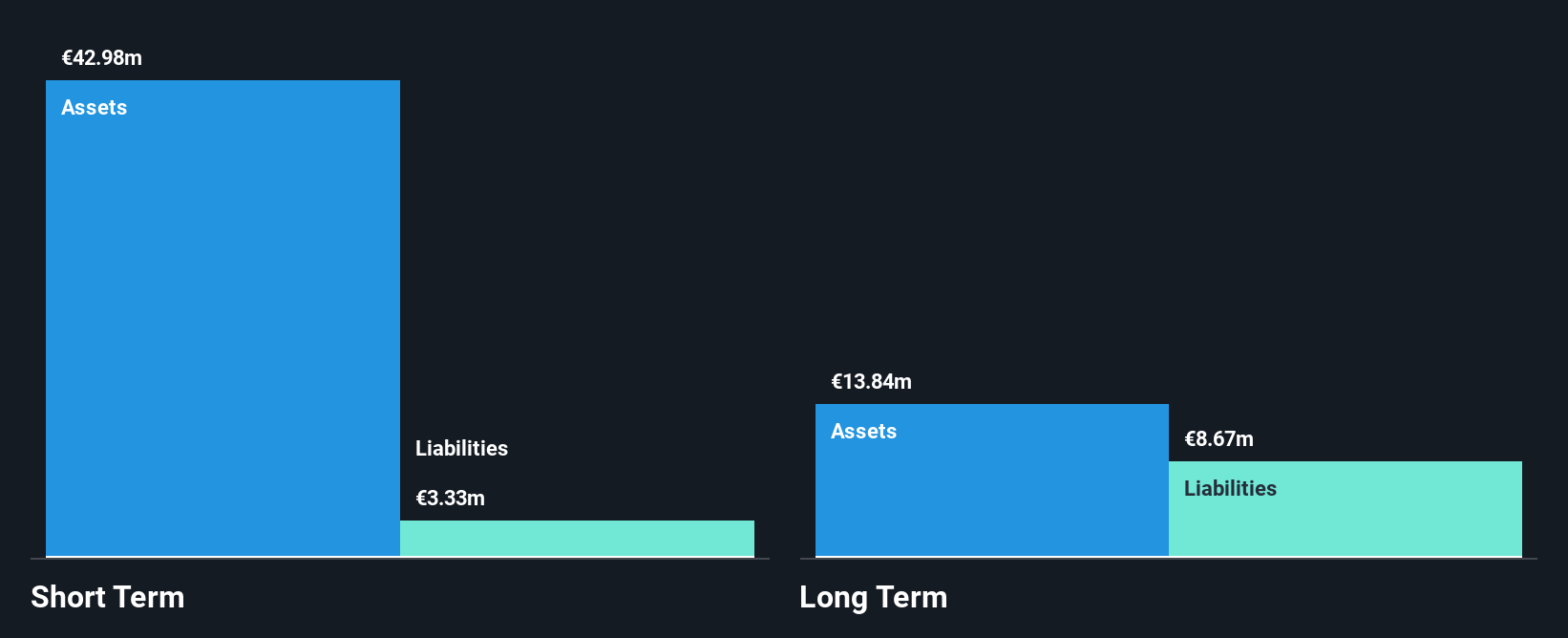

DigiTouch S.p.A. has demonstrated stability in its financial performance, reporting €19.8 million in revenue for the half year ending June 30, 2025, with a slight increase from the previous year. The company is debt-free and trades at a significant discount to its estimated fair value, which may appeal to investors seeking undervalued opportunities. While its earnings growth of 6.6% over the past year is below its five-year average of 22.5%, it still surpasses industry averages significantly. However, concerns about management experience and low return on equity could be potential drawbacks for some investors considering this stock.

- Dive into the specifics of DigiTouch here with our thorough balance sheet health report.

- Assess DigiTouch's future earnings estimates with our detailed growth reports.

Spinnova Oyj (HLSE:SPINN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spinnova Oyj is a company that produces and sells natural fiber materials both in Finland and internationally, with a market cap of €31.38 million.

Operations: The company's revenue primarily comes from its textile manufacturing segment, generating €0.5 million.

Market Cap: €31.38M

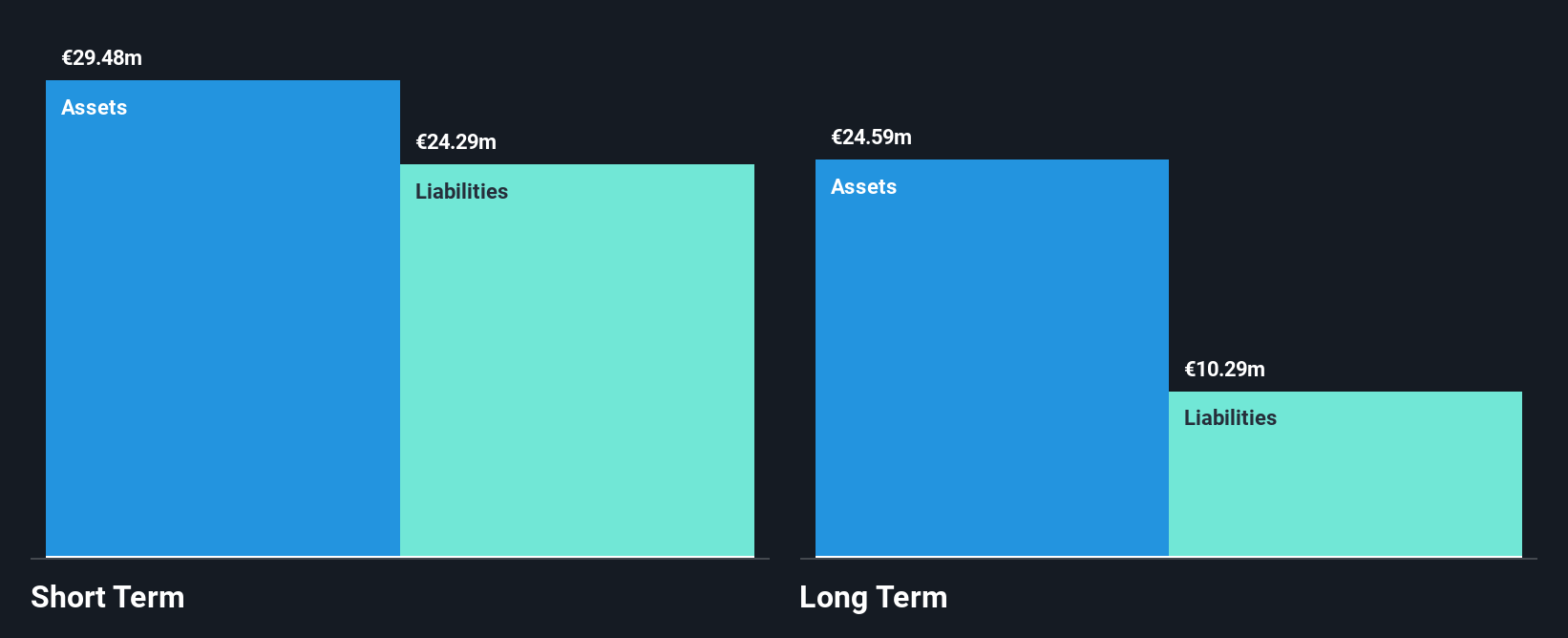

Spinnova Oyj, with a market cap of €31.38 million, remains pre-revenue with sales of only €0.1 million for the first half of 2025 and a net loss increasing to €26.29 million from the previous year. Despite having more cash than debt and short-term assets exceeding liabilities, its share price is highly volatile and unprofitable status persists without forecasted profitability in the near term. Recent strategic moves include acquiring full ownership of Woodspin and Suzano Finland Oy for minimal cost, alongside a capital contribution from Suzano S.A., potentially positioning Spinnova to leverage its technology more freely in future operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Spinnova Oyj.

- Explore Spinnova Oyj's analyst forecasts in our growth report.

Vo2 Cap Holding (OM:VO2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vo2 Cap Holding AB (publ) operates in the media tech industry with a market capitalization of SEK129.39 million.

Operations: The company's revenue is derived from its advertising segment, which generated SEK356.32 million.

Market Cap: SEK129.39M

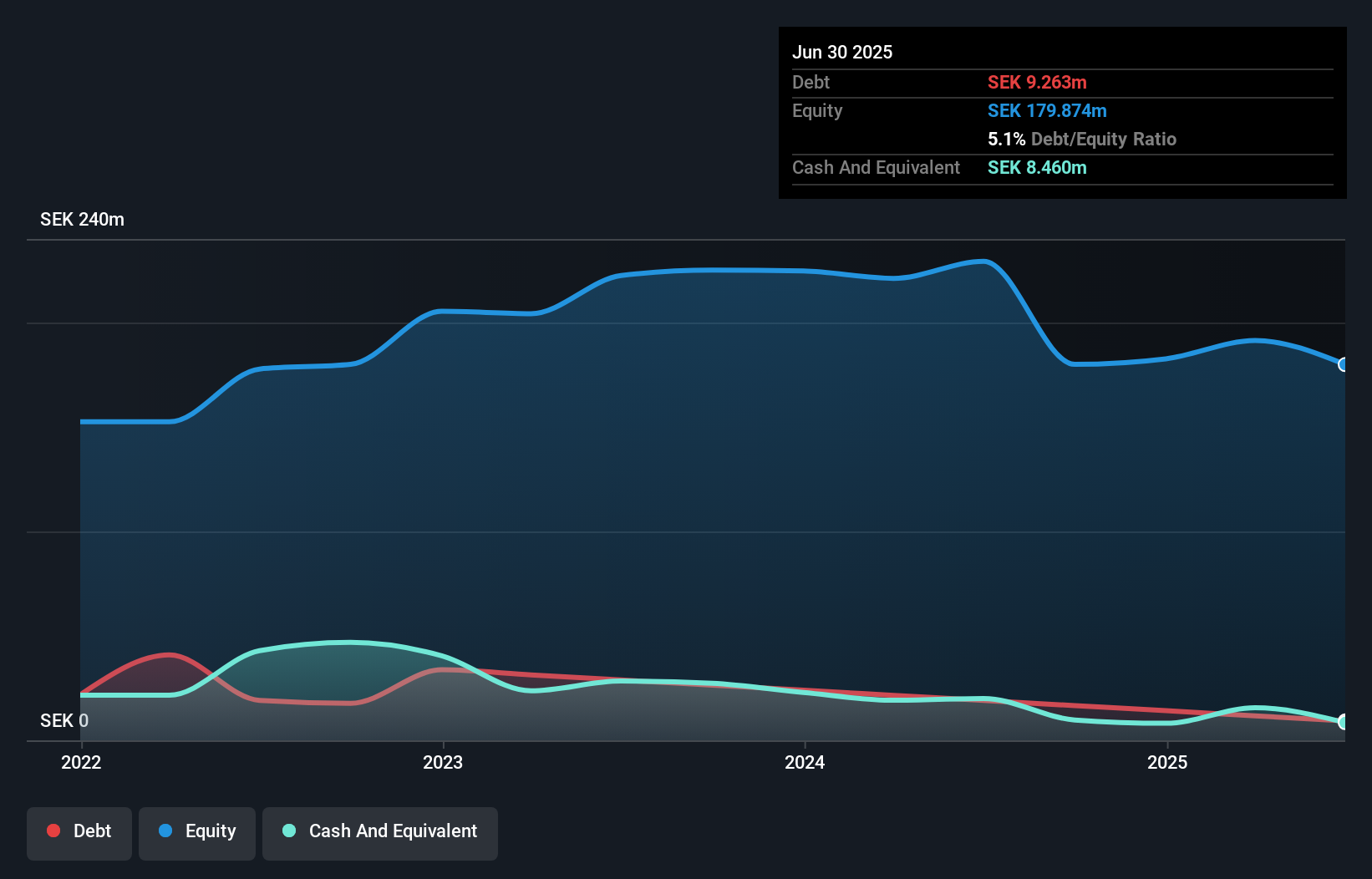

Vo2 Cap Holding AB, with a market cap of SEK129.39 million, operates in the media tech industry and reported second-quarter sales of SEK78.96 million, slightly up from the previous year. Despite this growth, it remains unprofitable with an increasing net loss of SEK21.37 million for the quarter. The company benefits from a satisfactory net debt to equity ratio (0.4%) and has sufficient cash runway for over three years despite shrinking free cash flow by 24.3% annually. However, short-term liabilities exceed its assets by a significant margin, posing potential liquidity challenges amidst its current loss-making status.

- Click here to discover the nuances of Vo2 Cap Holding with our detailed analytical financial health report.

- Examine Vo2 Cap Holding's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Investigate our full lineup of 270 European Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VO2

Adequate balance sheet and fair value.

Market Insights

Community Narratives