- Italy

- /

- Personal Products

- /

- BIT:PHN

Unearthing Europe's Hidden Stock Gems This August 2025

Reviewed by Simply Wall St

As European markets face a downturn, with the STOXX Europe 600 Index dipping 2.57% amid trade deal disappointments and stagnant economic growth, investors are increasingly on the lookout for opportunities that can withstand such volatility. In this challenging environment, identifying stocks with strong fundamentals and unique market positions becomes crucial for those aiming to uncover hidden gems in Europe's diverse landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

eVISO (BIT:EVISO)

Simply Wall St Value Rating: ★★★★★★

Overview: eVISO S.p.A. develops an artificial intelligence platform for the commodities market in Italy and has a market cap of €220.65 million.

Operations: eVISO generates its revenue primarily through its artificial intelligence platform, focusing on the commodities market in Italy. The company's financial performance is reflected in its market capitalization of €220.65 million.

eVISO, a small player in the European market, is making waves with its impressive performance. Over the past year, earnings skyrocketed by 178%, far outpacing the Electric Utilities industry's modest 1% growth. The company's debt management is noteworthy; its debt to equity ratio has improved from 109% to just under 45% over five years. Additionally, eVISO's interest payments are comfortably covered by EBIT at a multiple of nearly 17 times. With shares trading at roughly 26% below estimated fair value and earnings expected to grow by another 32% annually, eVISO seems poised for continued success in its sector.

- Navigate through the intricacies of eVISO with our comprehensive health report here.

Understand eVISO's track record by examining our Past report.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on the research, design, development, and marketing of nutritional supplements and medical devices across various international markets, with a market cap of €449.43 million.

Operations: Revenue primarily comes from the Italian market at €70.24 million, supplemented by foreign sales totaling €39.34 million and contributions from Akern at €5.92 million.

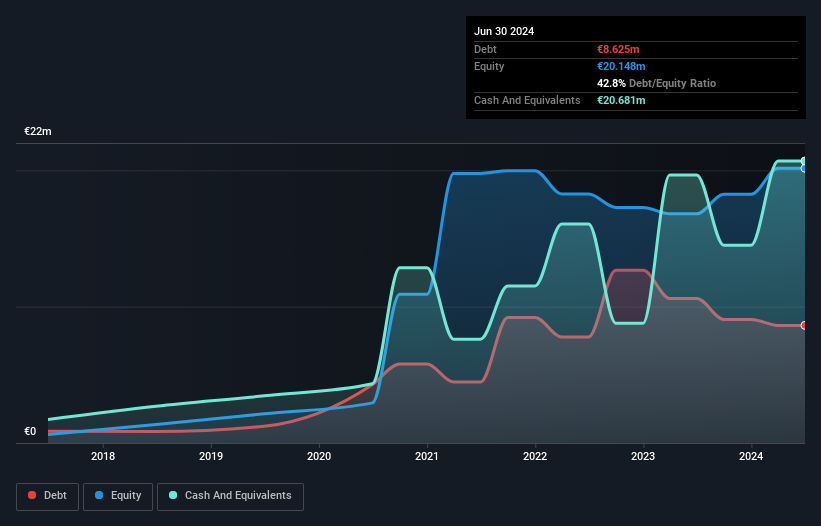

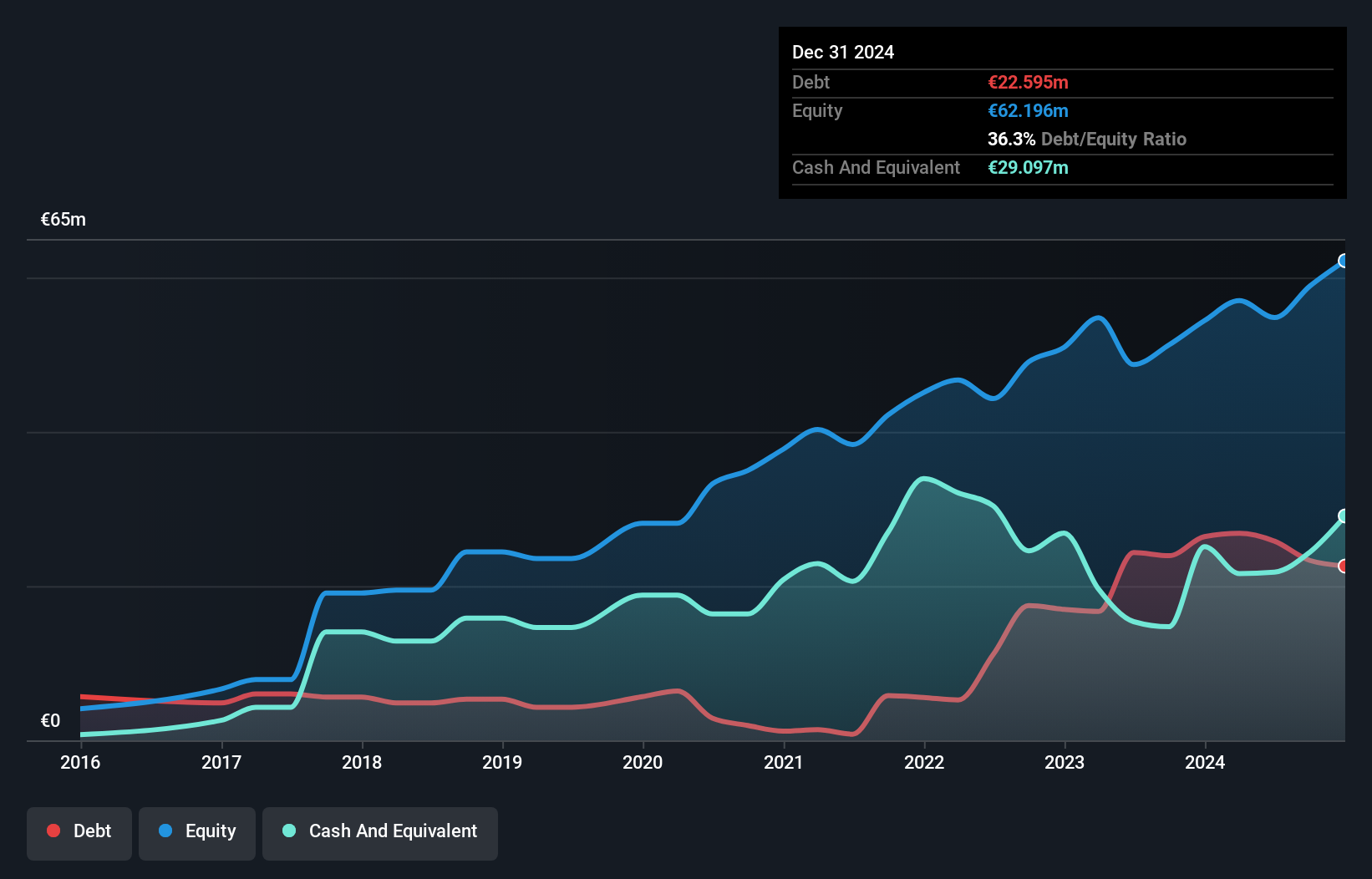

Pharmanutra, a nimble player in the personal products sector, has demonstrated impressive earnings growth of 29.4% over the past year, outpacing the industry's 9.9%. The company's debt to equity ratio has climbed from 20.1% to 36.3% over five years, yet its interest payments are comfortably covered by EBIT at a multiple of 72x. With cash exceeding total debt and high-quality earnings reported, Pharmanutra seems well-positioned financially. Looking ahead, earnings are projected to grow at an annual rate of 15.72%, suggesting potential for continued robust performance in its niche market segment.

- Get an in-depth perspective on Pharmanutra's performance by reading our health report here.

Review our historical performance report to gain insights into Pharmanutra's's past performance.

Sonaecom SGPS (ENXTLS:SNC)

Simply Wall St Value Rating: ★★★★★★

Overview: Sonaecom SGPS, S.A. is a global company engaged in the technology, media, and telecommunications sectors with a market capitalization of €807.23 million.

Operations: Sonaecom SGPS generates revenue primarily from its media segment (€16.38 million) and technology sector (€3.02 million), with a smaller contribution from holding activities (€0.74 million).

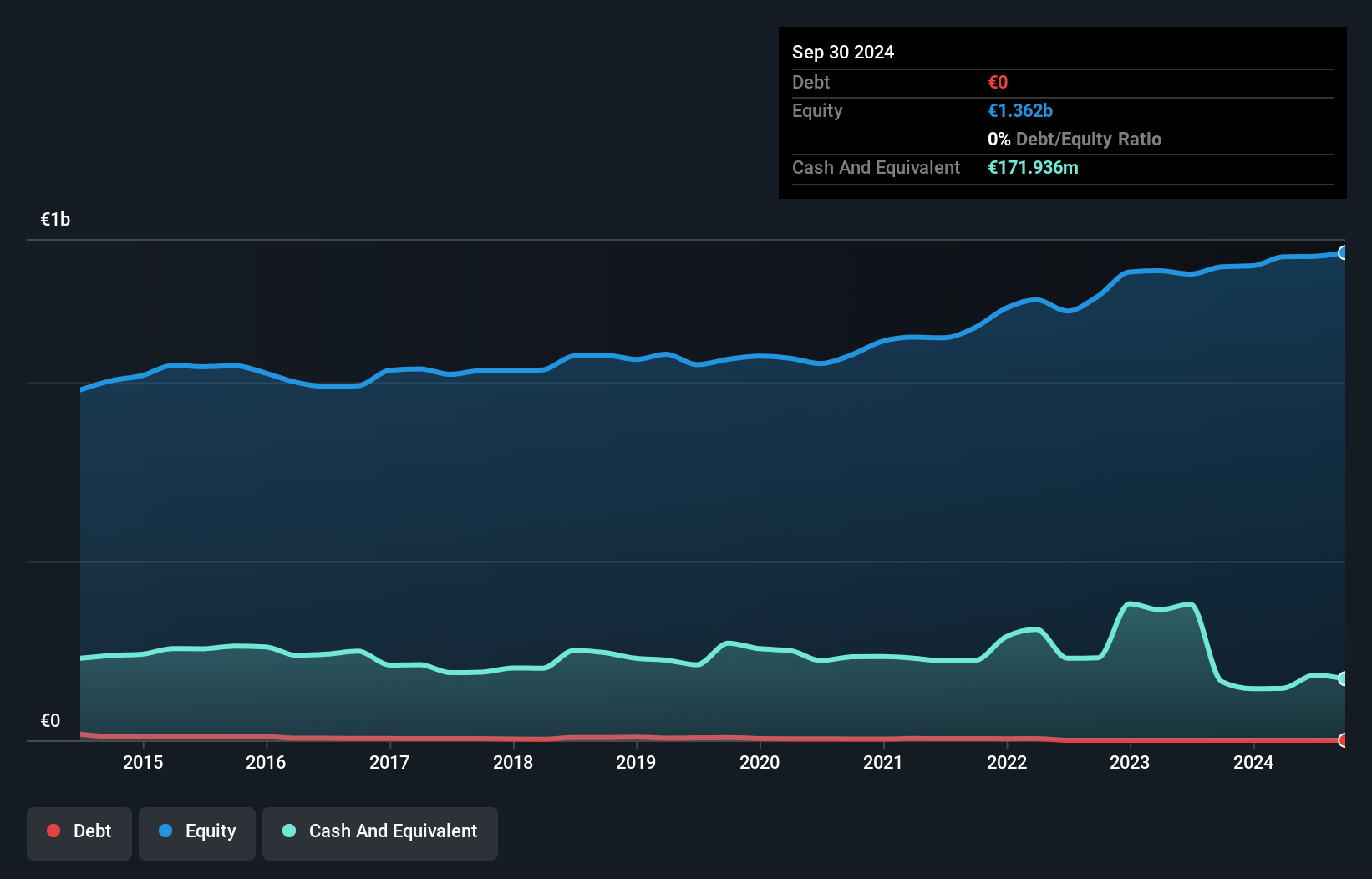

Sonaecom SGPS, a smaller player in the European market, showcases intriguing financial dynamics. The company is debt-free, which eliminates concerns about interest coverage and reflects a solid balance sheet compared to five years ago when the debt-to-equity ratio was 0.7%. Despite facing a notable one-off loss of €19.3 million impacting recent results until September 2024, earnings have surged by 150% over the past year, outpacing the Wireless Telecom industry’s growth of 19.7%. With a price-to-earnings ratio of 11.2x below Portugal's market average of 11.8x, it offers potential value for investors seeking opportunities in this sector.

- Click here to discover the nuances of Sonaecom SGPS with our detailed analytical health report.

Examine Sonaecom SGPS' past performance report to understand how it has performed in the past.

Where To Now?

- Reveal the 320 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PHN

Pharmanutra

A pharmaceutical and nutraceutical company, researches, designs, develops, and markets nutritional supplements and medical devices in Italy, Europe, the Middle East, South America, Far East, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives