- Italy

- /

- Medical Equipment

- /

- BIT:IVN

iVision Tech (BIT:IVN) Shareholders Will Want The ROCE Trajectory To Continue

What are the early trends we should look for to identify a stock that could multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at iVision Tech (BIT:IVN) and its trend of ROCE, we really liked what we saw.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for iVision Tech:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = €1.9b ÷ (€26b - €13b) (Based on the trailing twelve months to June 2024).

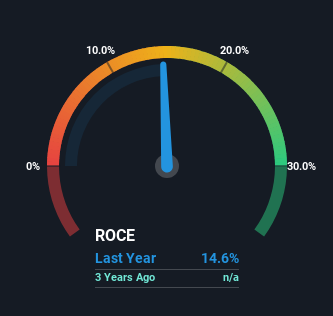

So, iVision Tech has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Medical Equipment industry average of 9.1% it's much better.

Check out our latest analysis for iVision Tech

Above you can see how the current ROCE for iVision Tech compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for iVision Tech .

How Are Returns Trending?

iVision Tech is displaying some positive trends. Over the last two years, returns on capital employed have risen substantially to 15%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 61%. So we're very much inspired by what we're seeing at iVision Tech thanks to its ability to profitably reinvest capital.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. The current liabilities has increased to 51% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

What We Can Learn From iVision Tech's ROCE

To sum it up, iVision Tech has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And a remarkable 107% total return over the last year tells us that investors are expecting more good things to come in the future. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One final note, you should learn about the 3 warning signs we've spotted with iVision Tech (including 1 which makes us a bit uncomfortable) .

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iVision Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IVN

iVision Tech

Designs and produces eyeglasses, optical frames, and sunglasses in Italy.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)