European Market Stocks That May Be Trading Below Their Estimated Value In April 2025

Reviewed by Simply Wall St

The European stock markets have recently experienced significant declines, with the pan-European STOXX Europe 600 Index dropping by 8.44% due to heightened trade tensions and unexpected tariffs from the U.S. As investors navigate this period of uncertainty, identifying stocks that may be trading below their estimated value could present opportunities for those seeking potential gains amid market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.90 | SEK97.74 | 50% |

| Altri SGPS (ENXTLS:ALTR) | €5.895 | €11.45 | 48.5% |

| Zinzino (OM:ZZ B) | SEK139.80 | SEK278.41 | 49.8% |

| Mips (OM:MIPS) | SEK351.20 | SEK684.17 | 48.7% |

| LPP (WSE:LPP) | PLN15365.00 | PLN30511.81 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK282.00 | SEK551.36 | 48.9% |

| Fervi (BIT:FVI) | €14.70 | €29.13 | 49.5% |

| Dino Polska (WSE:DNP) | PLN447.70 | PLN875.87 | 48.9% |

| Siemens Energy (XTRA:ENR) | €49.50 | €96.49 | 48.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.80 | 48.6% |

Let's explore several standout options from the results in the screener.

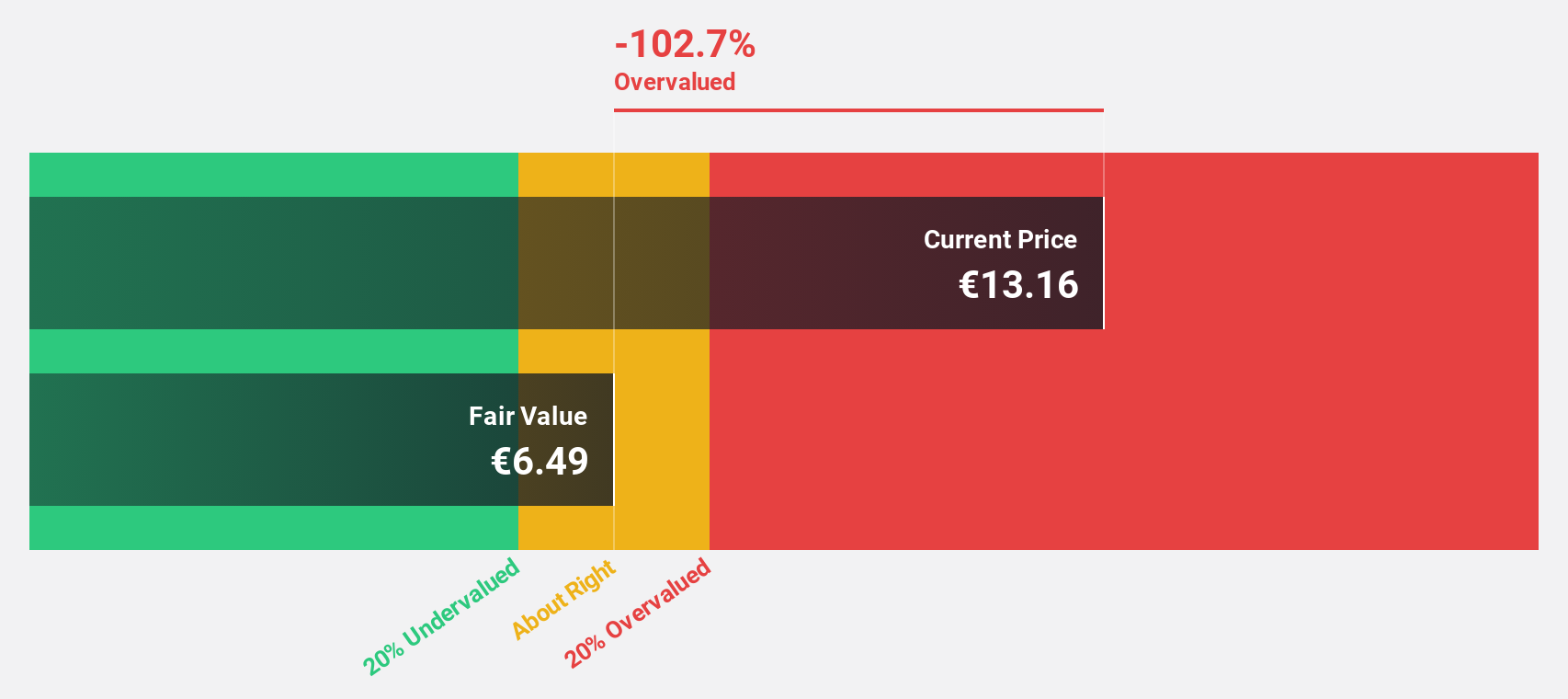

GPI (BIT:GPI)

Overview: GPI S.p.A. offers social-healthcare and information technology hi-tech services both in Italy and internationally, with a market cap of €239.13 million.

Operations: The company generates revenue from Care services (€162.20 million) and Software solutions (€304.10 million).

Estimated Discount To Fair Value: 31.3%

GPI S.p.A. is trading at €8.3, significantly below its estimated fair value of €12.08, suggesting it is undervalued based on cash flows. Despite a robust earnings growth forecast of 29.9% annually, interest payments are not well covered by earnings, and the dividend yield of 6.02% lacks coverage by free cash flows. Recent earnings surged to €104 million from €5.57 million last year, yet revenue growth remains moderate at 4.6%.

- The analysis detailed in our GPI growth report hints at robust future financial performance.

- Click here to discover the nuances of GPI with our detailed financial health report.

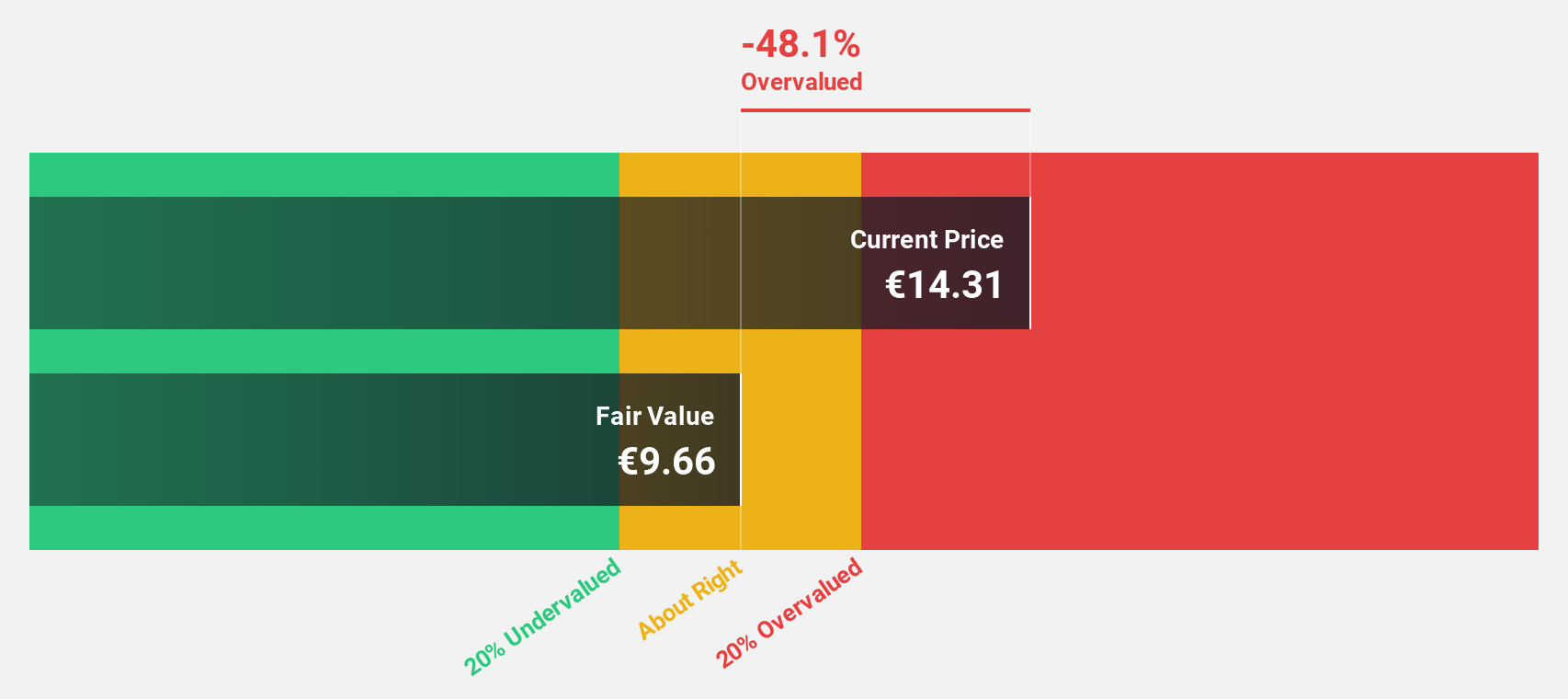

OVH Groupe (ENXTPA:OVH)

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally with a market cap of €1.62 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment at €638.33 million, followed by Public Cloud at €189.67 million and Web Cloud & Other services at €188.80 million.

Estimated Discount To Fair Value: 48.5%

OVH Groupe is trading at €10.65, significantly below its estimated fair value of €20.68, indicating undervaluation based on cash flows. The company reported improved earnings with a net income of €3.15 million for Q1 2025 and expects revenue growth to outpace the French market at 9.7% annually. Despite recent volatility in share price, OVH's strategic partnerships and fixed-income offerings bolster its financial position, supporting future profitability expectations over the next three years.

- Our comprehensive growth report raises the possibility that OVH Groupe is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of OVH Groupe.

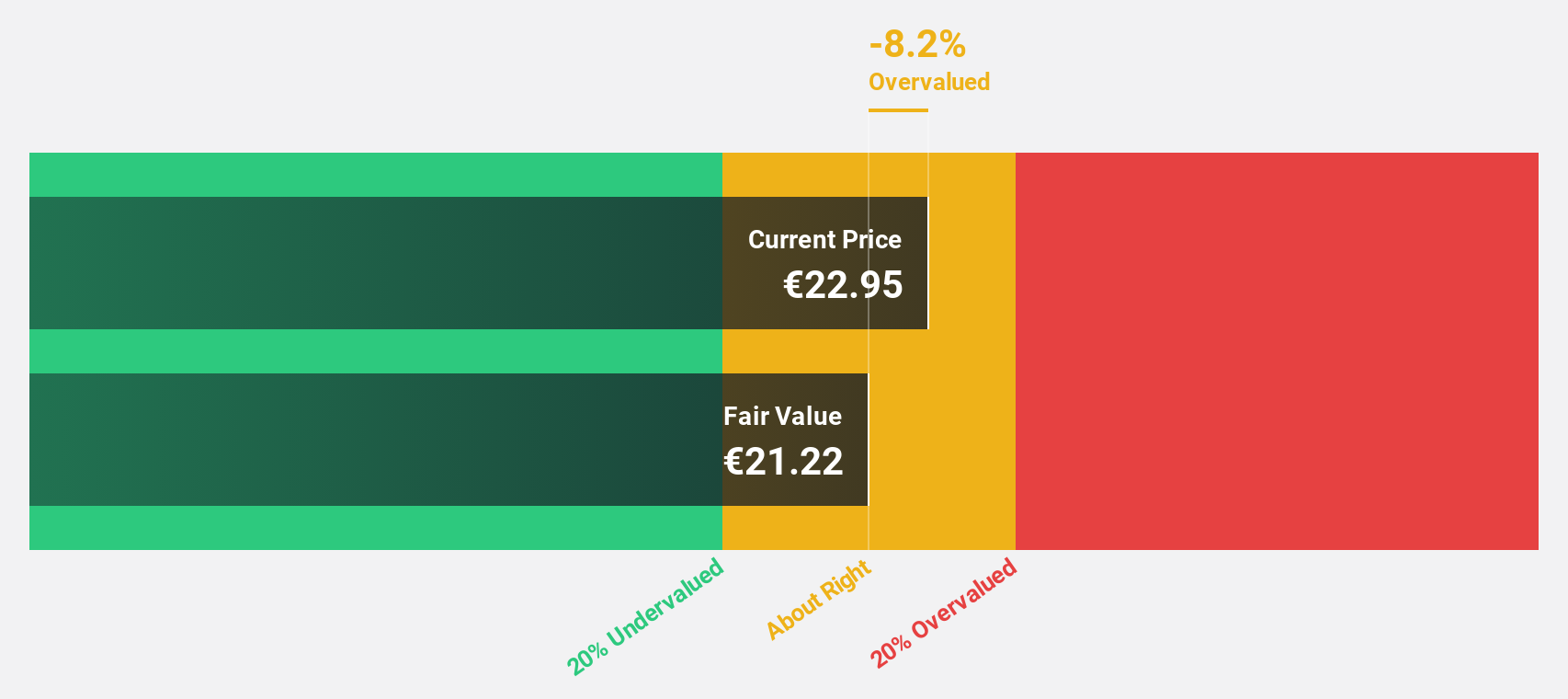

Planisware SAS (ENXTPA:PLNW)

Overview: Planisware SAS is a business-to-business software-as-a-service provider operating in Europe, North America, the Asia-Pacific, and internationally with a market cap of €1.58 billion.

Operations: The company generates revenue from its Software & Programming segment, which amounts to €170.48 million.

Estimated Discount To Fair Value: 10.8%

Planisware SAS is trading at €22.62, below its estimated fair value of €25.35, suggesting it may be undervalued based on cash flows. The company's earnings are projected to grow 18.3% annually, outpacing the French market's growth rate of 12.7%. Recent client acquisition by Northrop Grumman and a proposed dividend payout of €21.4 million underscore its robust financial health and potential for sustained revenue growth at 15.6% per year.

- Our growth report here indicates Planisware SAS may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Planisware SAS.

Summing It All Up

- Access the full spectrum of 181 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PLNW

Planisware SAS

Operates as a business-to-business software-as-a-service provider in Europe, North America, the Asia-Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives