- Switzerland

- /

- Construction

- /

- SWX:BRKN

3 Undiscovered European Gems Backed By Strong Fundamentals

Reviewed by Simply Wall St

Amid a positive shift in European markets, the pan-European STOXX Europe 600 Index recently rose by 2.10%, buoyed by improved sentiment following a de-escalation in the U.S.-China trade tensions. As major indices like Germany’s DAX and Italy’s FTSE MIB also posted gains, investors are increasingly on the lookout for stocks backed by solid fundamentals that can thrive in this evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★★

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy, Europe, and internationally with a market capitalization of €853.32 million.

Operations: EL.En. S.p.A. generates revenue primarily through the sale and distribution of laser solutions, with a significant portion coming from international markets. The company's cost structure includes research and development expenses, impacting its profitability metrics such as net profit margin.

EL.En, a nimble player in the medical equipment space, reported Q1 2025 sales of €140.9 million, up from €129.56 million last year, with net income rising to €16.32 million from €15.95 million. The company's earnings grew by 35% over the past year and its price-to-earnings ratio stands at 13.7x, below Italy's market average of 15.6x, suggesting attractive valuation metrics compared to peers. With interest payments well-covered by EBIT (97x), EL.En's financial health seems robust despite high share price volatility recently observed over three months and potential challenges in non-core divestitures impacting future stability.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31 (ENXTPA:CAT31)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Regionale de Credit Agricole Mutuel Toulouse 31 functions as a cooperative bank in France with a market capitalization of approximately €402.99 million.

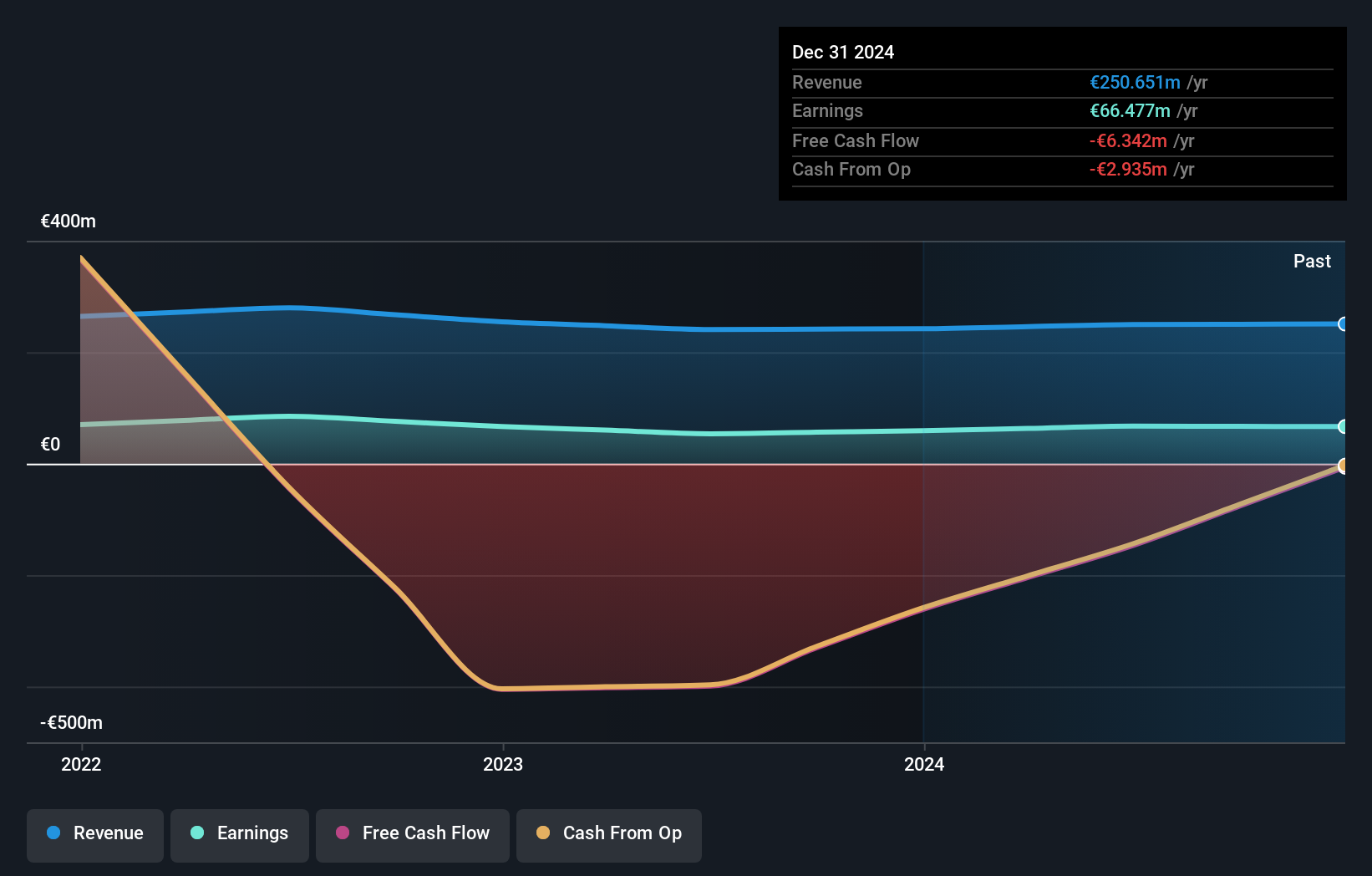

Operations: CAT31 generates revenue primarily from its retail banking segment, amounting to €250.65 million.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31 stands out with total assets of €16.4 billion and equity of €2 billion, reflecting solid financial health. The bank's earnings growth of 12.1% over the past year surpasses the industry average, showcasing its robust performance. Trading at a significant discount, it is valued at 35.5% below fair value estimates, offering potential upside for investors seeking undervalued opportunities. With an appropriate level of bad loans at 1.5% and a low allowance for bad loans set at 85%, the bank demonstrates effective risk management practices while relying on low-risk funding sources for stability.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burkhalter Holding AG operates as a provider of electrical engineering services for the construction industry in Switzerland, with a market capitalization of CHF1.36 billion.

Operations: The company's revenue is primarily derived from its electrical engineering services, totaling CHF1.16 billion.

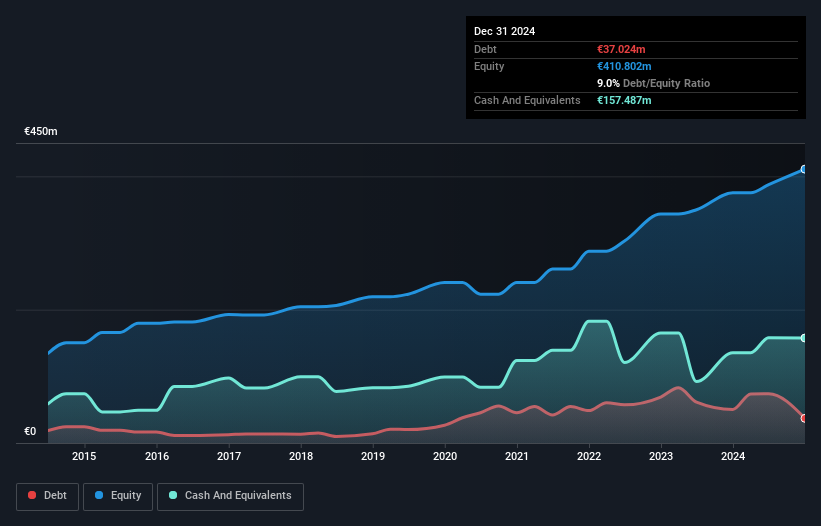

Burkhalter Holding, a small player in the European construction sector, has been making waves with its robust financial performance. Earnings growth of 10.2% over the past year outpaced the industry average of 6%, highlighting its competitive edge. The company is trading at a discount, approximately 12.4% below estimated fair value, which might catch the eye of value seekers. Despite an increase in its debt to equity ratio from 14.8% to 37.5% over five years, Burkhalter maintains strong interest coverage at 58 times EBIT, ensuring financial stability and operational resilience amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Burkhalter Holding stock in this health report.

Examine Burkhalter Holding's past performance report to understand how it has performed in the past.

Make It Happen

- Click through to start exploring the rest of the 330 European Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector primarily in Switzerland.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives