- Italy

- /

- Healthcare Services

- /

- BIT:AMP

Investors Who Bought Amplifon (BIT:AMP) Shares Five Years Ago Are Now Up 316%

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Amplifon S.p.A. (BIT:AMP) shares for the last five years, while they gained 316%. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 16% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 14% in 90 days).

View our latest analysis for Amplifon

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

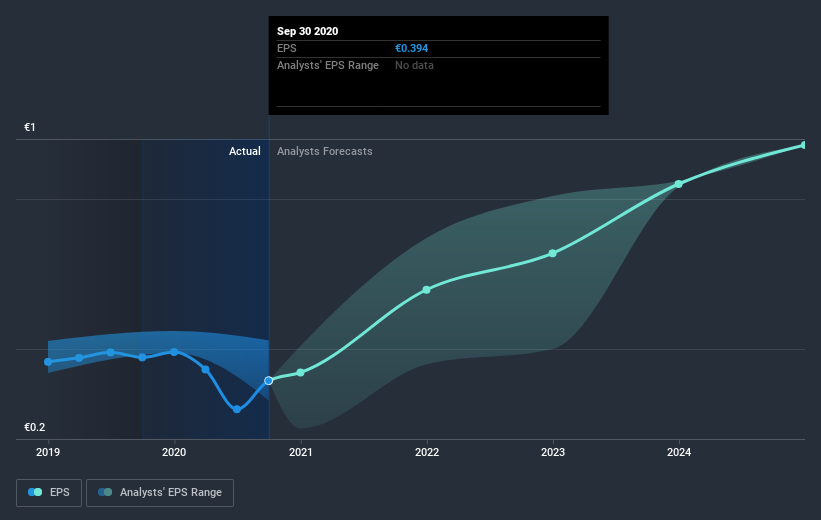

During five years of share price growth, Amplifon achieved compound earnings per share (EPS) growth of 13% per year. This EPS growth is slower than the share price growth of 33% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 84.27.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Amplifon's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Amplifon's TSR of 326% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Amplifon shareholders have received a total shareholder return of 29% over one year. However, the TSR over five years, coming in at 34% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Amplifon has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you’re looking to trade Amplifon, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:AMP

Amplifon

Engages in the distribution of hearing solutions and the fitting of customized products that helps people to rediscover various emotions of sound in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives