Does the Lowered Princes Group IPO Valuation Reshape NewPrinces' (BIT:NWL) Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- Italy's NewPrinces recently announced a lowered valuation target of up to £1.2 billion for the IPO of its Princes Group unit in London, a figure that fell short of initial expectations of £1.5 billion.

- This revised target attracted increased market scrutiny, highlighting questions about future growth prospects and the evolving appetite for new listings in the sector.

- With the IPO valuation revision as a focal point, we'll consider how this shift may impact NewPrinces' broader investment narrative moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NewPrinces Investment Narrative Recap

To invest in NewPrinces, you have to believe in the company's ability to integrate acquisitions like Princes Group to drive operational efficiencies and margin expansion, despite near-term pressures from the recently lowered IPO valuation target. This change could impact NewPrinces' most important short-term catalyst, the realization of synergies from the Princes deal, by intensifying scrutiny around execution and growth expectations. However, the main risk remains whether integration and operational improvements will deliver the cost and earnings gains anticipated by investors.

Among recent announcements, NewPrinces' H1 2025 earnings stood out, with both sales and net income showing strong year-on-year growth. This is especially relevant as the group’s ability to generate higher profits underpins optimism about capturing synergies and strengthening the investment case, even as valuation targets and market sentiment fluctuate.

In contrast, investors should be aware that behind operational improvements, the prospect of planned efficiency gains not fully materializing...

Read the full narrative on NewPrinces (it's free!)

NewPrinces' narrative projects €3.0 billion in revenue and €77.6 million in earnings by 2028. This requires 22.8% yearly revenue growth and a €80.3 million decrease in earnings from the current €157.9 million.

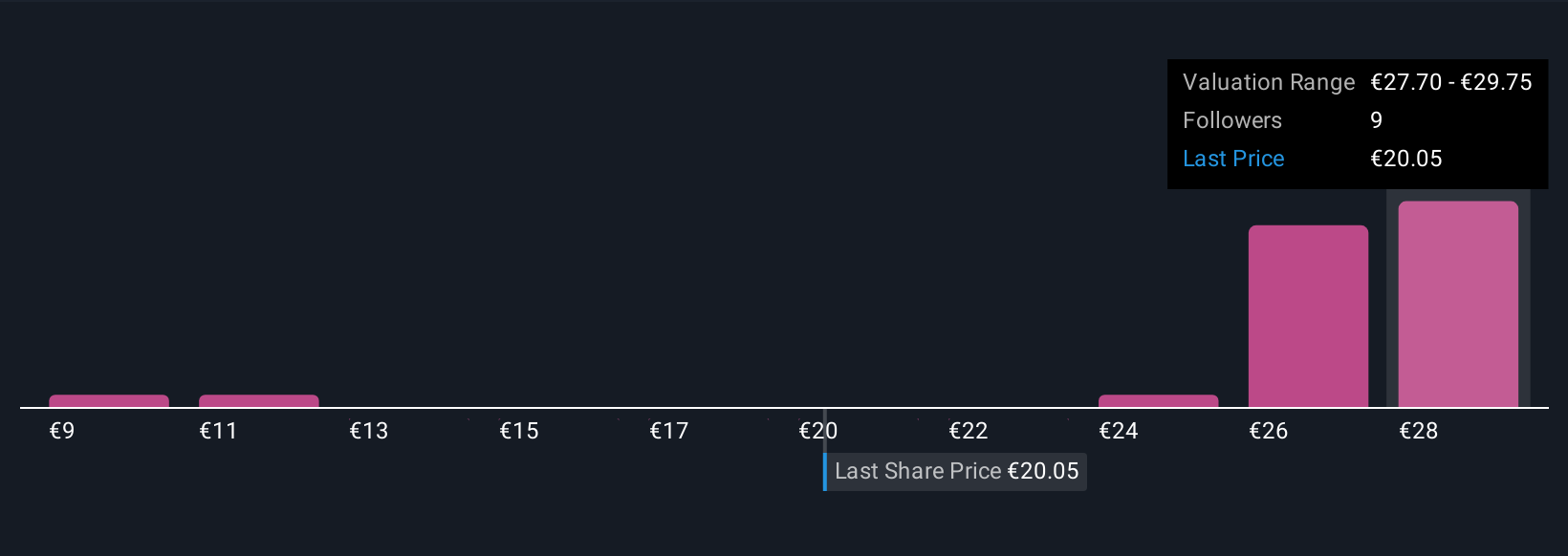

Uncover how NewPrinces' forecasts yield a €29.75 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members gave five different fair value estimates for NewPrinces, ranging from €9.28 to €29.75 per share. While many see value, the short-term challenge remains whether expected synergies from recent acquisitions will meet investor expectations, opinions on this vary widely, so consider multiple perspectives before making decisions.

Explore 5 other fair value estimates on NewPrinces - why the stock might be worth as much as 53% more than the current price!

Build Your Own NewPrinces Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewPrinces research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free NewPrinces research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewPrinces' overall financial health at a glance.

No Opportunity In NewPrinces?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewPrinces might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NWL

NewPrinces

Operates in the agri-food sector in Italy, Germany, the United Kingdom, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives