Did Davide Campari-Milano S.p.A. (BIT:CPR) Use Debt To Deliver Its ROE Of 12%?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Davide Campari-Milano S.p.A. (BIT:CPR).

Our data shows Davide Campari-Milano has a return on equity of 12% for the last year. That means that for every €1 worth of shareholders' equity, it generated €0.12 in profit.

View our latest analysis for Davide Campari-Milano

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Or for Davide Campari-Milano:

12% = €272m ÷ €2.2b (Based on the trailing twelve months to June 2019.)

Most know that net profit is the total earnings after all expenses, but the concept of shareholders' equity is a little more complicated. It is all the money paid into the company from shareholders, plus any earnings retained. The easiest way to calculate shareholders' equity is to subtract the company's total liabilities from the total assets.

What Does Return On Equity Signify?

ROE looks at the amount a company earns relative to the money it has kept within the business. The 'return' is the yearly profit. That means that the higher the ROE, the more profitable the company is. So, all else being equal, a high ROE is better than a low one. Clearly, then, one can use ROE to compare different companies.

Does Davide Campari-Milano Have A Good Return On Equity?

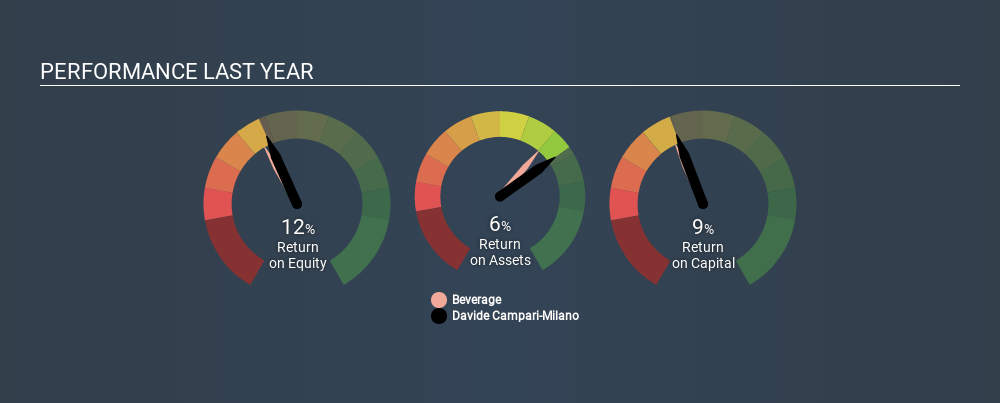

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. If you look at the image below, you can see Davide Campari-Milano has a similar ROE to the average in the Beverage industry classification (11%).

That's not overly surprising. ROE tells us about the quality of the business, but it does not give us much of an idea if the share price is cheap. If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

How Does Debt Impact ROE?

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Combining Davide Campari-Milano's Debt And Its 12% Return On Equity

While Davide Campari-Milano does have some debt, with debt to equity of just 0.73, we wouldn't say debt is excessive. Its very respectable ROE, combined with only modest debt, suggests the business is in good shape. Judicious use of debt to improve returns can certainly be a good thing, although it does elevate risk slightly and reduce future optionality.

The Key Takeaway

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In my book the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:CPR

Davide Campari-Milano

Davide Campari-Milano N.V., together with its subsidiaries, markets and distributes alcoholic and non-alcoholic beverages in the Americas, the Middle East, Africa, Europe, and the Asia-Pacific.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)