Campari (BIT:CPR) Valuation: Is the Spirits Giant Trading Below Its True Worth?

Reviewed by Simply Wall St

Most Popular Narrative: 11.6% Undervalued

The most widely followed narrative suggests Davide Campari-Milano is trading below its estimated fair value, pointing to the potential for future upside if expectations are met.

Significant brand-building investments behind flagship and emerging brands (e.g., Aperol, Crodino, Sarti Rosa) and successful new product launches (RTD formats, non-alcoholic spirits) respond to evolving consumer preferences for premium, experiential, and convenient drinking occasions. This is likely to sustain strong pricing power and drive higher net margins.

Curious how major international expansion, premium brand positioning, and bold profit margin assumptions combine to set this enticing price target? There's a surprising mix of earnings growth and market expectations at play. Discover which financial benchmarks underpin this narrative's undervalued stance and see if they align with your own outlook.

Result: Fair Value of €6.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariffs and weaker consumer spending in key markets could quickly disrupt Campari's growth outlook. This could challenge the current valuation narrative.

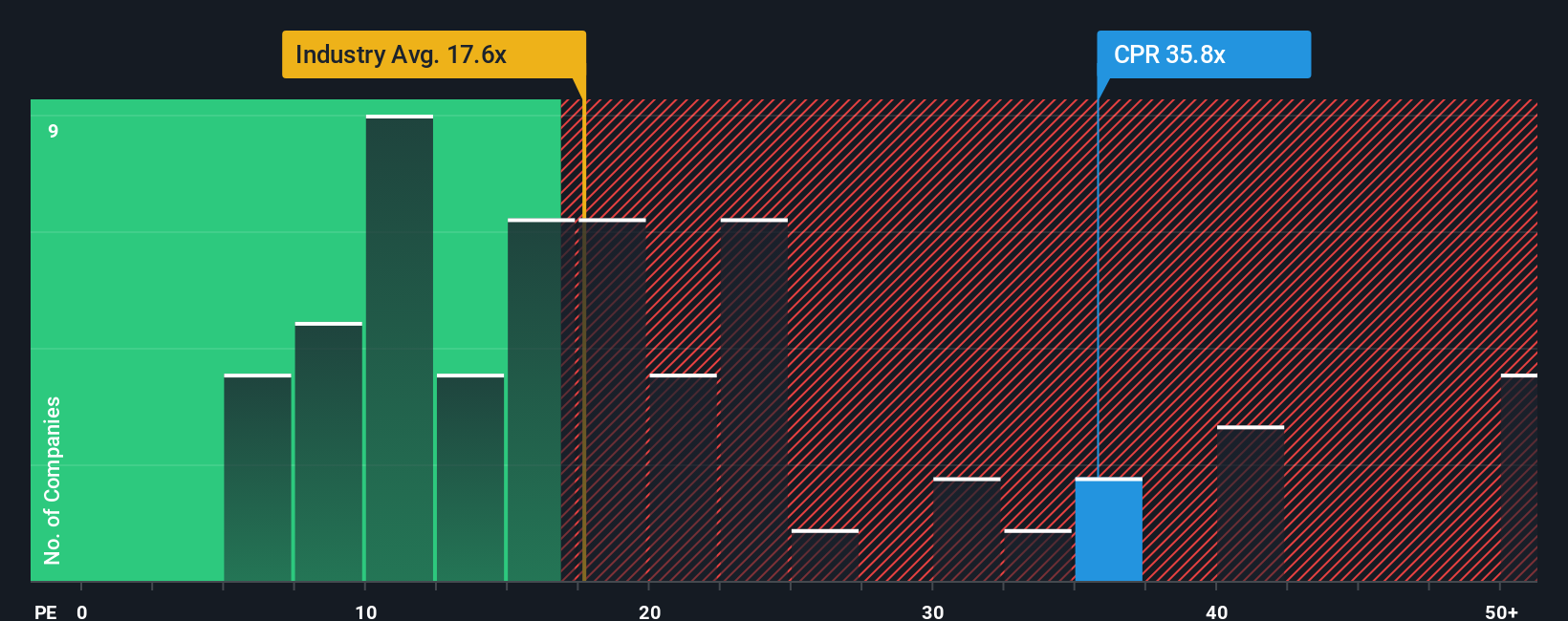

Find out about the key risks to this Davide Campari-Milano narrative.Another View: Market Valuation Method

While the fair value calculation suggests upside, our comparison using a common market-based ratio offers a less optimistic perspective. This approach indicates the shares are expensive compared to others in the industry. Is the first method possibly missing some headwinds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Davide Campari-Milano Narrative

If you see things differently, or want to dig deeper into the numbers yourself, you can build and test your own perspective in just a few minutes. Do it your way.

A great starting point for your Davide Campari-Milano research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at Campari. Get ahead of the crowd with Simply Wall Street, which curates powerful screeners to pinpoint your next opportunity in unexpected places.

- Supercharge your income potential and track down companies with high, reliable yields by tapping into dividend stocks with yields > 3%.

- Spot emerging innovations in artificial intelligence and reveal tomorrow’s leaders using AI penny stocks.

- Seize undervalued hidden gems that the market hasn’t appreciated yet with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:CPR

Davide Campari-Milano

Davide Campari-Milano N.V., together with its subsidiaries, markets and distributes alcoholic and non-alcoholic beverages in the Americas, the Middle East, Africa, Europe, and the Asia-Pacific.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives