- Italy

- /

- Energy Services

- /

- BIT:YRM

Investors Still Aren't Entirely Convinced By Rosetti Marino SpA's (BIT:YRM) Revenues Despite 32% Price Jump

Rosetti Marino SpA (BIT:YRM) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 49% in the last year.

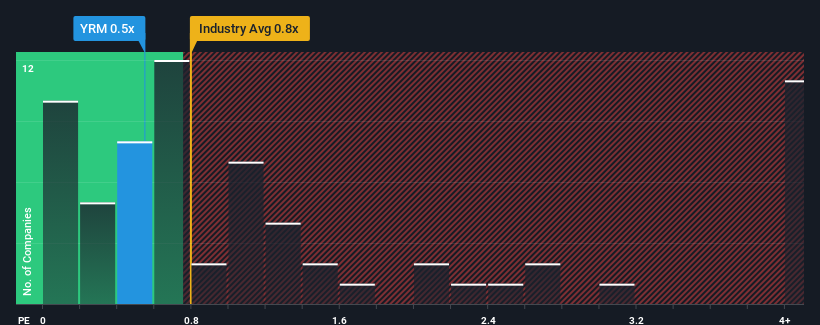

In spite of the firm bounce in price, it's still not a stretch to say that Rosetti Marino's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Italy, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Rosetti Marino

What Does Rosetti Marino's Recent Performance Look Like?

Recent times have been advantageous for Rosetti Marino as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Rosetti Marino's future stacks up against the industry? In that case, our free report is a great place to start.How Is Rosetti Marino's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Rosetti Marino's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 38% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 35% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this information, we find it interesting that Rosetti Marino is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Rosetti Marino's P/S?

Rosetti Marino appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Rosetti Marino currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Rosetti Marino you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:YRM

Rosetti Marino

Engages in the energy, energy transition, and shipbuilding businesses in Italy, rest of the European Union, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026