- Italy

- /

- Oil and Gas

- /

- BIT:ENI

How Eni’s Full Takeover of Petrel and Tern Gas Fields Will Impact Eni (BIT:ENI) Investors

Reviewed by Sasha Jovanovic

- Eni has recently completed the acquisition of Santos’ interests in the Petrel and Tern gas fields in Australia’s Bonaparte Basin, giving Eni Australia full control of these offshore gas assets and associated infrastructure.

- This move consolidates Eni’s gas footprint in northern Australia, supporting sensitive domestic supply obligations while preserving options for future LNG and carbon capture-linked developments in the wider Asia-Pacific portfolio.

- We’ll now examine how taking full control of the Petrel and Tern gas fields could influence Eni’s investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Eni Investment Narrative Recap

To own Eni, you need to believe in its ability to turn a global gas and LNG expansion, plus transition businesses like Plenitude, into steadily growing cash flows, while managing capital-intensive projects and balance sheet risk. Full control of the Petrel and Tern fields looks incremental rather than a game changer for near term catalysts such as LNG project progress and buybacks, but it does modestly increase exposure to execution and decommissioning risks in Australia.

The most relevant recent announcement here is Eni’s ongoing share buyback program, including the purchase of more than 5.5 million treasury shares. While Petrel and Tern reshape the long term gas portfolio, buybacks and dividends remain central to the short term equity story, especially given Eni’s relatively low return on equity and the need to keep investor confidence high as capital is redeployed across LNG, CCS and renewables.

However, investors should also be aware that Eni’s reliance on large LNG and gas projects could become a problem if global capacity growth leads to...

Read the full narrative on Eni (it's free!)

Eni's narrative projects €88.8 billion revenue and €5.1 billion earnings by 2028.

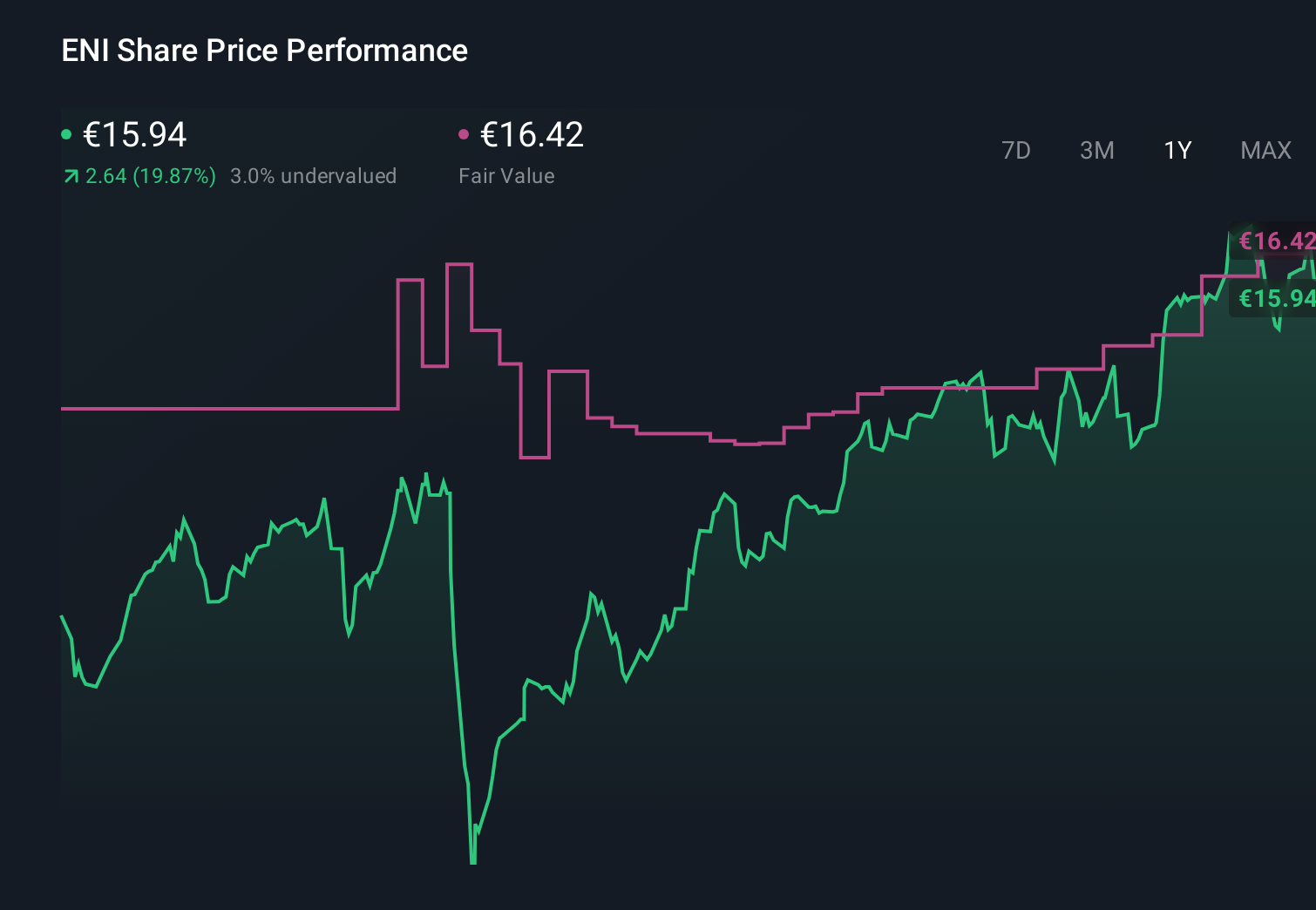

Uncover how Eni's forecasts yield a €16.54 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Eni span roughly €15.95 to €22.08, highlighting how far apart individual views on upside can be. You should weigh this spread against Eni’s dependence on large LNG and gas projects, which ties the company’s future cash generation to project execution, regulatory approvals and long dated energy transition policies.

Explore 3 other fair value estimates on Eni - why the stock might be worth just €15.95!

Build Your Own Eni Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eni research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eni's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion