Is Eni S.p.A. (BIT:ENI) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A high yield and a long history of paying dividends is an appealing combination for Eni. We'd guess that plenty of investors have purchased it for the income. Some simple research can reduce the risk of buying Eni for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Eni!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 70% of Eni's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Eni paid out 62% of its free cash flow last year, which is acceptable, but is starting to limit the amount of earnings that can be reinvested into the business. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Dividend Volatility

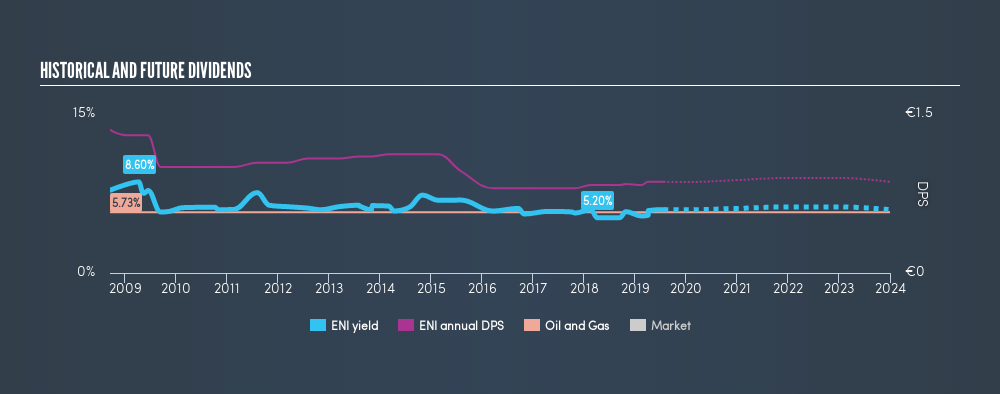

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Eni has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was €1.35 in 2009, compared to €0.86 last year. The dividend has shrunk at around 4.4% a year during that period. Eni's dividend hasn't shrunk linearly at 4.4% per annum, but the CAGR is a useful estimate of the historical rate of change.

We struggle to make a case for buying Eni for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 4.4% a year for the past five years, which is better than seeing them shrink! 4.4% per annum is not a particularly high rate of growth, which we find curious. When a business is not growing, it often makes more sense to pay higher dividends to shareholders rather than retain the cash with no way to utilise it.

Conclusion

To summarise, shareholders should always check that Eni's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Eni's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. Unfortunately, earnings growth has also been mediocre, and the company has cut its dividend at least once in the past. In sum, we find it hard to get excited about Eni from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 22 Eni analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives