- Italy

- /

- Oil and Gas

- /

- BIT:ENI

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets continue to show resilience with the pan-European STOXX Europe 600 Index rising by 1.68%, investors are increasingly looking towards dividend stocks as a stable income source amid fluctuating economic indicators. In this environment, selecting stocks with a strong track record of consistent dividend payouts can enhance portfolio stability and provide reliable returns amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.15% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.77% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.39% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.78% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.15% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.61% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.65% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.53% | ★★★★★★ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

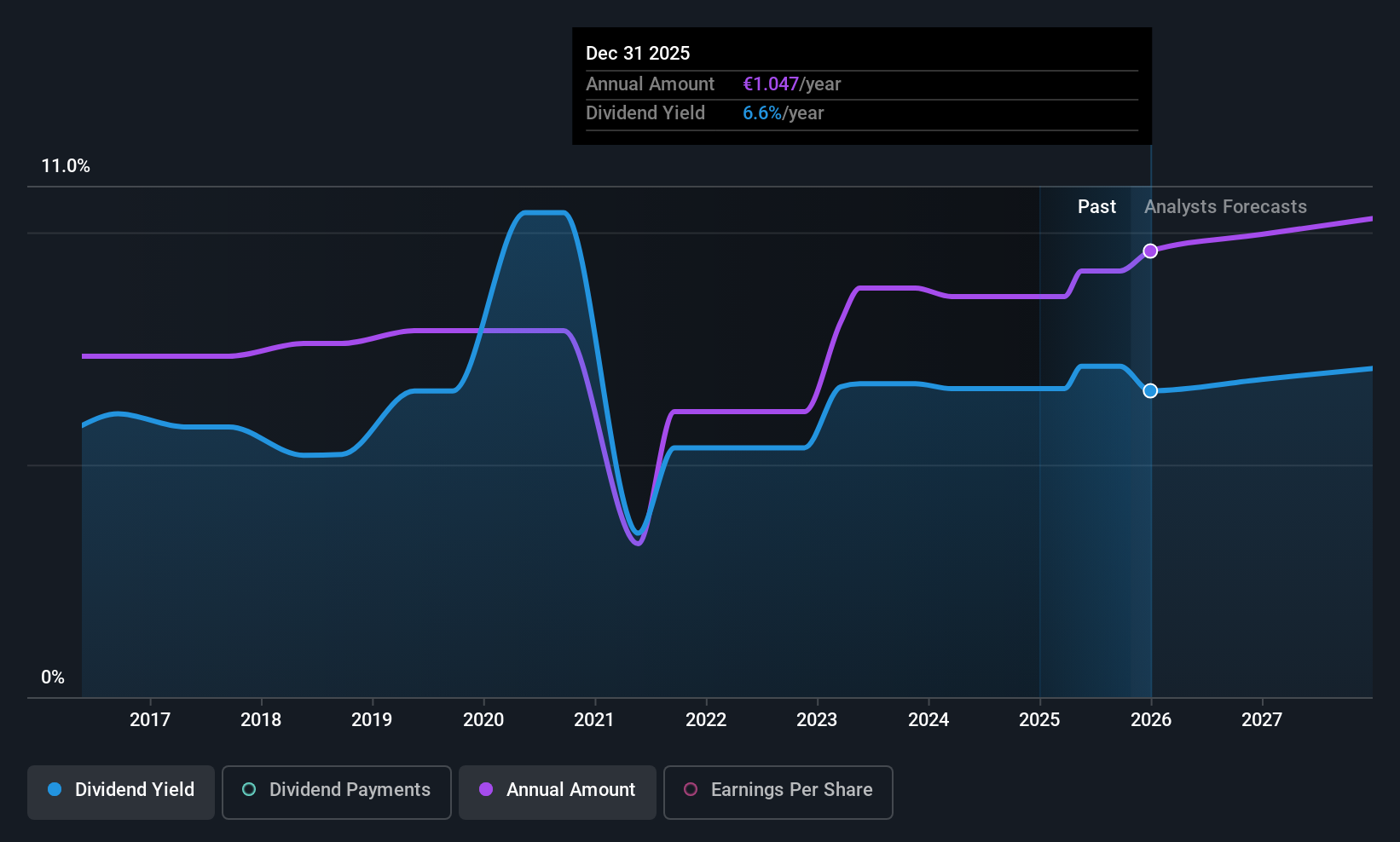

Eni (BIT:ENI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eni S.p.A. is an integrated energy company with operations in Italy, the European Union, the United States, Asia, Africa, and globally; it has a market cap of approximately €48.35 billion.

Operations: Eni S.p.A. generates revenue primarily from its Exploration & Production segment (€51.65 billion), followed by Global Gas & LNG Portfolio and Power (€18.72 billion), and Refining and Chemicals (€18.70 billion).

Dividend Yield: 6.3%

Eni's dividend yield is among the top 25% in Italy, yet its dividend history shows volatility and past reductions. Recent earnings growth of 8.2% and a low payout ratio of 29.2% suggest dividends are well covered by earnings, though cash flow coverage at a 77.2% payout ratio indicates some pressure. The company has been active with share buybacks totaling €980 million, potentially enhancing shareholder value despite the inconsistent dividend track record.

- Get an in-depth perspective on Eni's performance by reading our dividend report here.

- Our valuation report here indicates Eni may be overvalued.

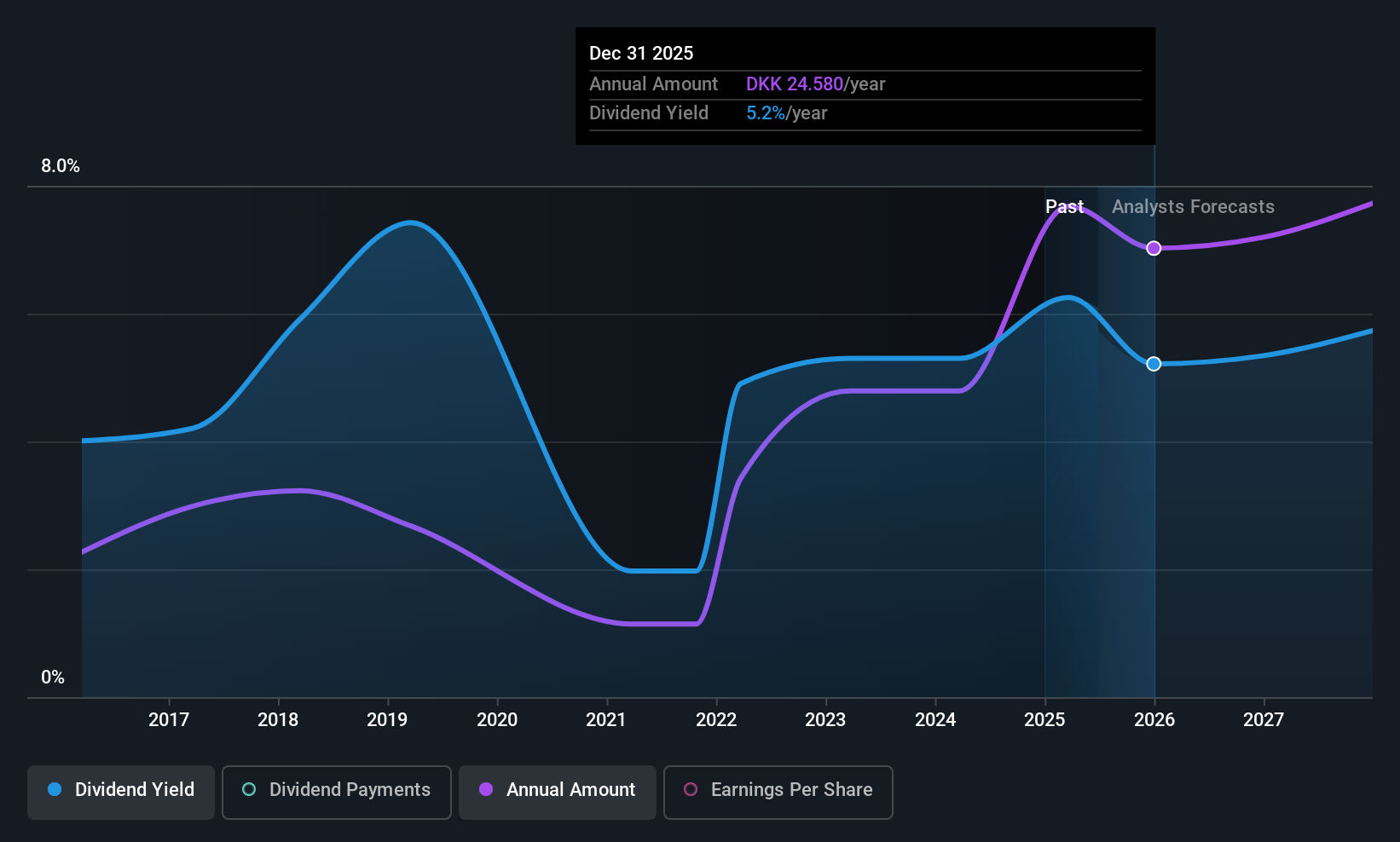

Sydbank (CPSE:SYDB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sydbank A/S, with a market cap of DKK27.18 billion, operates alongside its subsidiaries to offer a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally.

Operations: Sydbank A/S generates its revenue from various segments, including Banking (DKK5.62 billion), Treasury (DKK83 million), Sydbank Markets (DKK365 million), and Asset Management (DKK499 million).

Dividend Yield: 4.9%

Sydbank's dividend payments have grown over the past decade, but their reliability is questionable due to volatility. With a payout ratio of 60.2%, dividends are currently covered by earnings and forecasted to improve with a 50.5% coverage in three years. The dividend yield of 4.86% is below Denmark's top quartile, and high bad loans at 2.2% raise concerns about financial health. Recent share buybacks totaling DKK 1 billion may enhance value amidst fluctuating dividends.

- Take a closer look at Sydbank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Sydbank is trading beyond its estimated value.

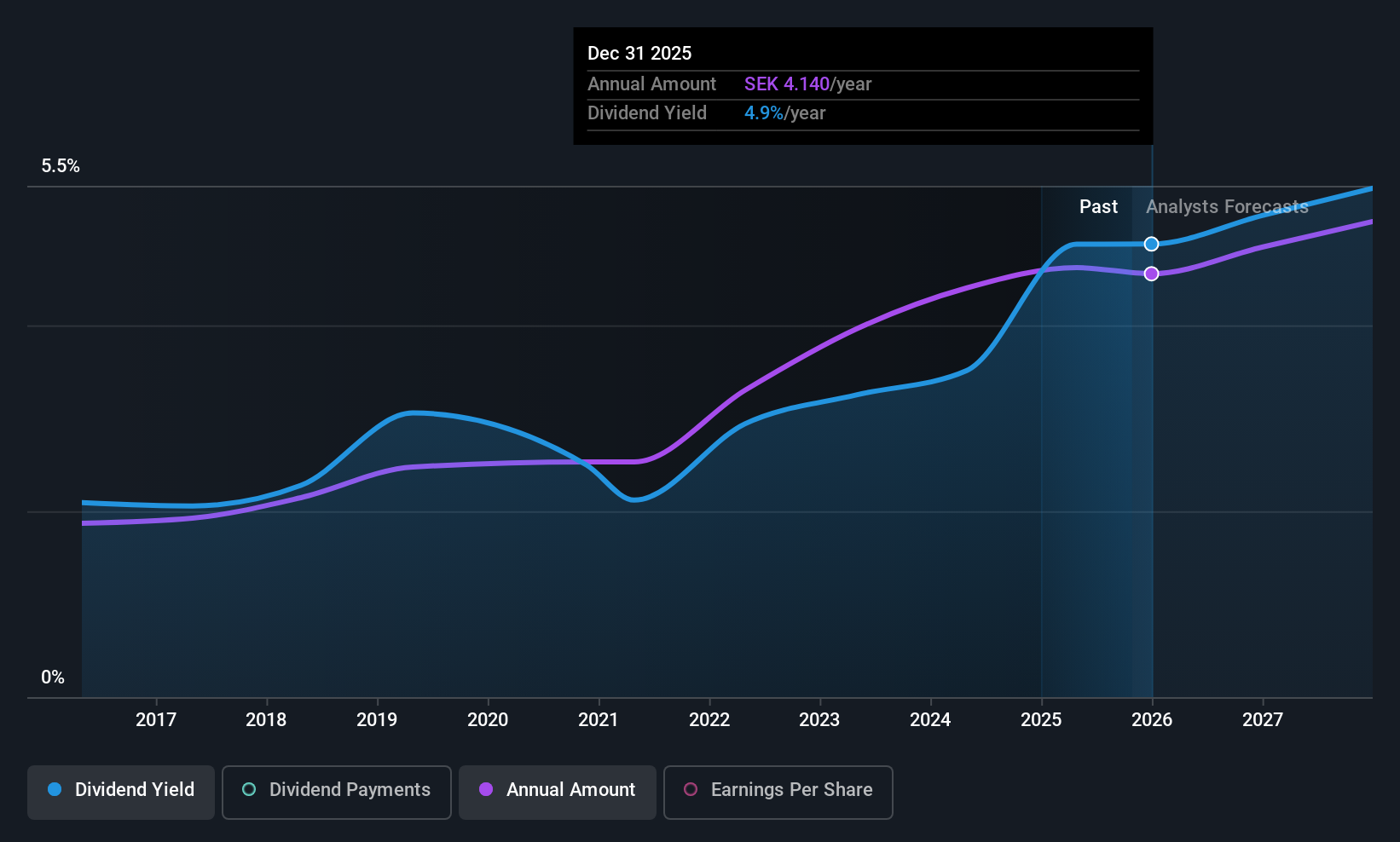

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HEXPOL AB (publ) is a company that develops, manufactures, and sells polymer compounds and engineered products like gaskets, seals, and wheels across Sweden, Europe, the United States, the Americas, and Asia with a market cap of approximately SEK29.88 billion.

Operations: HEXPOL AB's revenue is primarily derived from its HEXPOL Compounding segment, which generated SEK18.65 billion, and its HEXPOL Engineered Products segment, contributing SEK1.70 billion.

Dividend Yield: 4.8%

HEXPOL offers a stable and reliable dividend with a yield of 4.84%, placing it in the top quartile of Swedish dividend payers. The payout is sustainable, covered by both earnings (73.9% payout ratio) and cash flows (73.6% cash payout ratio). Recent earnings showed a decline, with Q3 sales at SEK 4.69 billion and net income at SEK 465 million, reflecting geopolitical impacts on M&A activities despite strong financial resources for acquisitions.

- Delve into the full analysis dividend report here for a deeper understanding of HEXPOL.

- Our valuation report here indicates HEXPOL may be undervalued.

Summing It All Up

- Navigate through the entire inventory of 222 Top European Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives