- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni (BIT:ENI) Valuation in Focus After Strategic CCS Moves and Hewett Appraisal News

Reviewed by Kshitija Bhandaru

Eni (BIT:ENI) is making headlines after drilling an appraisal well at the depleted Hewett field in the UK North Sea to evaluate its potential for carbon capture and storage. This is a key move supporting its Bacton CCS project.

See our latest analysis for Eni.

It’s been an eventful stretch for Eni, with strategic moves in carbon capture and substantial share buybacks catching investor attention. Momentum has built steadily through the year, as the share price has climbed 10.3% year-to-date and the company’s one-year total shareholder return sits at 13.1%. Over the longer term, Eni’s total returns remain robust, with a 50.9% three-year and a striking 216.6% five-year performance, which hints at both growth potential and evolving market confidence around the company’s energy transition strategy.

If Eni’s reshaping of its portfolio has you thinking bigger, this could be a great moment to discover fast growing stocks with high insider ownership.

The question now is whether Eni’s share price still lags behind its intrinsic value, or if ongoing momentum and carbon capture optimism mean the market has already priced in the company’s future growth story.

Most Popular Narrative: 4.5% Undervalued

According to the most widely followed narrative, Eni’s fair value is placed at €15.54, just above the recent close of €14.84. The stage is set for a deeper dive into the company’s underlying financial blueprints that are driving this slight undervaluation.

Active financial management, including capital recycling through asset sales, strategic partnerships with private equity and NOCs, and cost-efficiency initiatives, allows Eni to reduce leverage, maintain a strong balance sheet, and potentially increase share buybacks. This directly improves EPS and enhances total shareholder return.

Curious how targeted financial maneuvers and fresh cash flow assumptions shape this price target? What key variables are behind the forecasted upside? Uncover which specific growth levers and margin projections are moving the needle in this valuation.

Result: Fair Value of €15.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Eni’s renewables arm fails to achieve cash flow neutrality soon or if legacy restructuring drags on, forecasted growth and margins could fall short.

Find out about the key risks to this Eni narrative.

Another View: What Do Valuation Ratios Say?

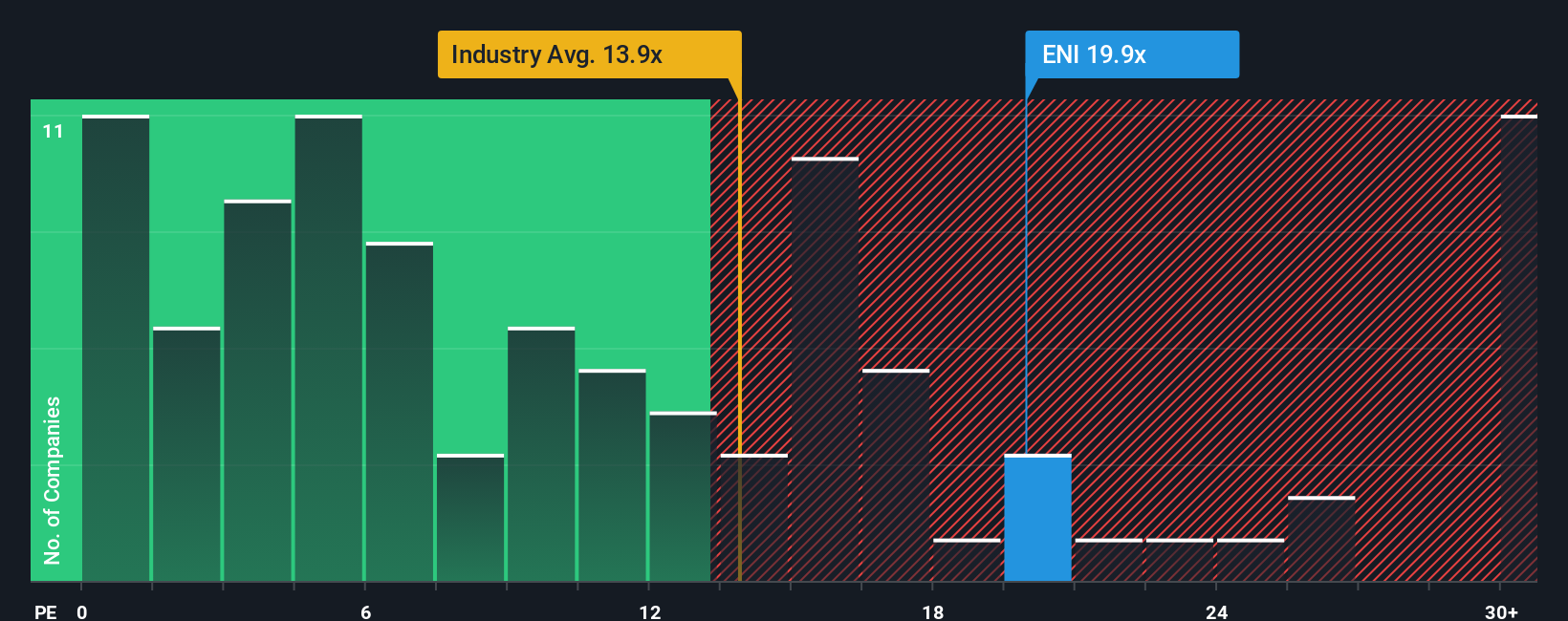

While the fair value models suggest Eni is undervalued, the current price-to-earnings ratio of 19.8x stands well above both the industry average of 13.8x and the peer average of 13.9x, as well as the fair ratio of 18.1x. This indicates that investors are currently paying a premium for Eni, which could increase valuation risk if future growth does not materialize as expected. Should you trust the optimism in the share price, or is some caution now warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If you’re keen to dig into Eni’s numbers and piece together a story that fits your own conclusions, you can get started in minutes, your way with Do it your way.

A great starting point for your Eni research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. These handpicked stock ideas could put you ahead of tomorrow’s biggest trends and income streams.

- Capitalize on potential high-yield returns by scanning these 3596 penny stocks with strong financials, which is packed with robust financials and promising growth markers.

- Boost your portfolio’s future focus when you uncover innovation at its best with these 24 AI penny stocks, driving the latest advances in artificial intelligence.

- Secure reliable income with these 18 dividend stocks with yields > 3%, featuring equities that consistently deliver strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives