- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni (BIT:ENI): Assessing the Oil Major’s Valuation After a Year of 13% Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Eni.

After a year that has seen some ups and downs, Eni’s recent share price movement hints at cooling short-term momentum. Its 1-year total shareholder return of 13.3% shows investors have still been rewarded for staying the course.

If you’re curious about where else investor interest is building, this could be an ideal time to broaden your outlook and discover fast growing stocks with high insider ownership

With Eni shares up strongly over the longer term but modestly below analyst price targets, the real question is whether the stock still offers value at current levels or if expectations for future growth are already built in.

Most Popular Narrative: 3.1% Undervalued

With Eni's fair value estimated at €15.35, just above the latest closing price of €14.88, the prevailing narrative sees modest upside potential. Analyst consensus frames the current price as slightly undervalued, with a tight margin signaling balanced market expectations.

Eni's strategic expansion in LNG, highlighted by leading floating LNG investments in Africa, the Eastern Mediterranean, and new ventures in Argentina and Southeast Asia, positions the company to capture rising global demand for diverse and secure natural gas supplies. This geographic and product diversification is expected to drive future revenue and stabilize earnings amid energy transition volatility.

Wondering what bold assumptions power this valuation? The big story centers on ambitious growth in future earnings and profit margins, plus a profit multiple that reflects changing energy dynamics. Unpack the full methodology and discover which forecasts could swing the number further in either direction.

Result: Fair Value of €15.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses in Eni's chemicals division and delayed renewable cash neutrality could challenge future growth and place current profit expectations at risk.

Find out about the key risks to this Eni narrative.

Another View: Multiples Raise Questions

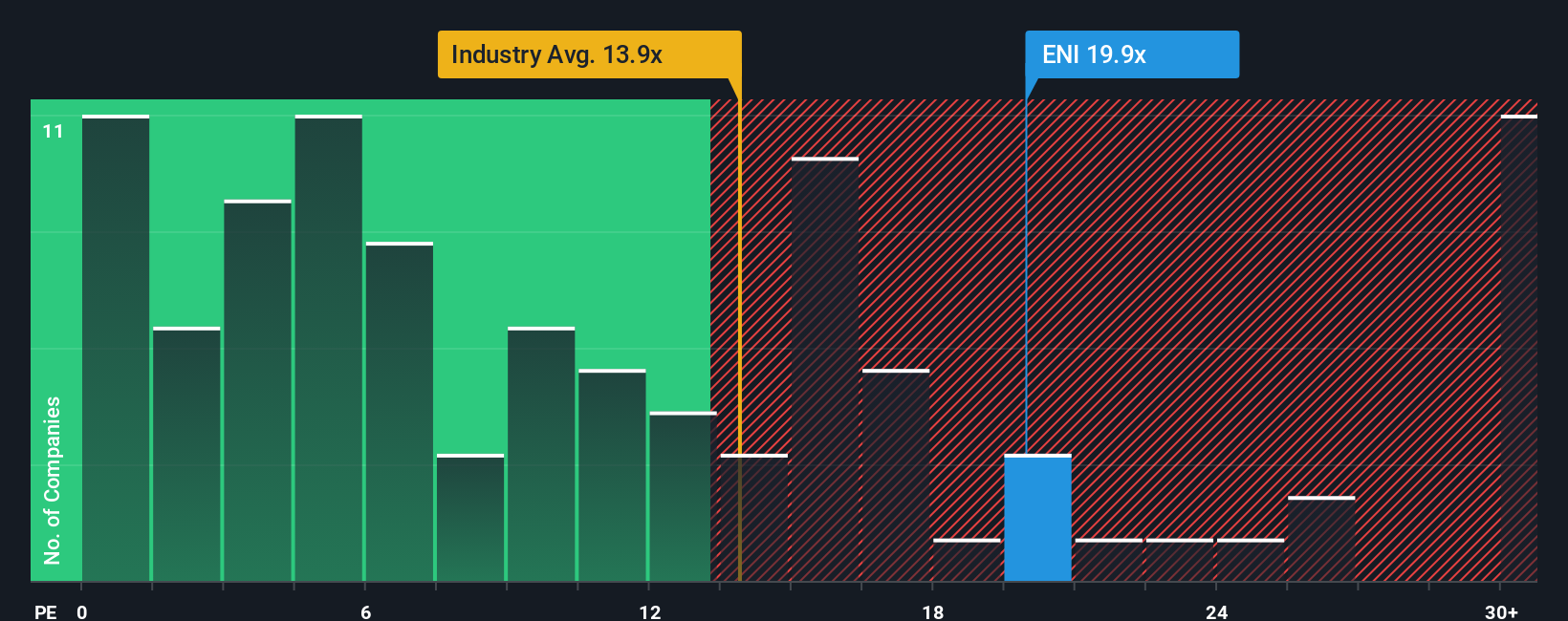

While the fair value estimate points to slight undervaluation, price-to-earnings ratios tell a different story. Eni trades at 19.8x earnings, a premium to both peers (14.6x) and the European sector (13.8x), and even above its fair ratio of 18.2x. Could this premium signal valuation risk on today’s price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If you see the story differently or want to review the numbers for yourself, you can quickly craft your own perspective in just minutes. Do it your way

A great starting point for your Eni research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities slip past you. Empower your portfolio with high-potential stocks and innovative themes you might not have considered yet.

- Uncover hidden gems with strong financials by checking out these 3568 penny stocks with strong financials that may be overlooked by bigger players.

- Lock in regular income, even in uncertain markets, by searching for top picks among these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Capitalize on the transformative power of next-gen health solutions with these 31 healthcare AI stocks making waves in AI-driven medical advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives