- Italy

- /

- Oil and Gas

- /

- BIT:DIS

What d'Amico International Shipping S.A.'s (BIT:DIS) P/S Is Not Telling You

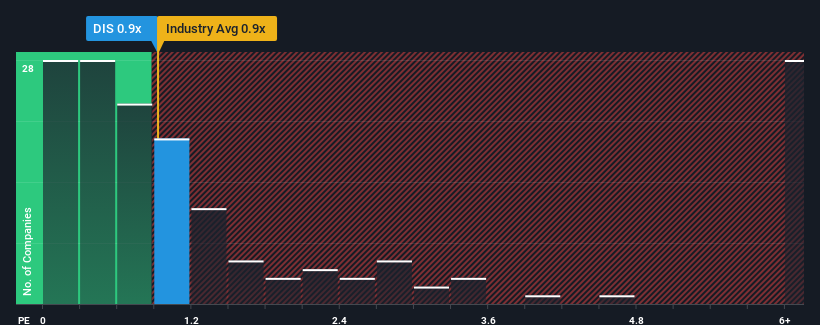

It's not a stretch to say that d'Amico International Shipping S.A.'s (BIT:DIS) price-to-sales (or "P/S") ratio of 0.9x seems quite "middle-of-the-road" for Oil and Gas companies in Italy, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for d'Amico International Shipping

How d'Amico International Shipping Has Been Performing

Recent times have been advantageous for d'Amico International Shipping as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think d'Amico International Shipping's future stacks up against the industry? In that case, our free report is a great place to start.How Is d'Amico International Shipping's Revenue Growth Trending?

d'Amico International Shipping's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 118% last year. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 31% as estimated by the dual analysts watching the company. That's not great when the rest of the industry is expected to grow by 13%.

With this in consideration, we think it doesn't make sense that d'Amico International Shipping's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From d'Amico International Shipping's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that d'Amico International Shipping currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

And what about other risks? Every company has them, and we've spotted 3 warning signs for d'Amico International Shipping (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of d'Amico International Shipping's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success