- Italy

- /

- Oil and Gas

- /

- BIT:DIS

Need To Know: Analysts Are Much More Bullish On d'Amico International Shipping S.A. (BIT:DIS) Revenues

d'Amico International Shipping S.A. (BIT:DIS) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. d'Amico International Shipping has also found favour with investors, with the stock up an impressive 10% to €0.14 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

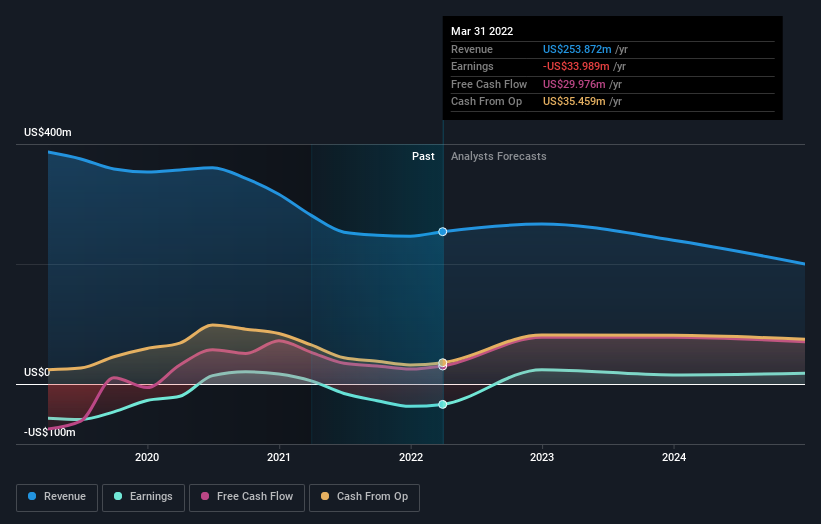

Following the upgrade, the most recent consensus for d'Amico International Shipping from its three analysts is for revenues of US$267m in 2022 which, if met, would be a credible 5.0% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.01 per share this year. Before this latest update, the analysts had been forecasting revenues of US$232m and earnings per share (EPS) of US$0.01 in 2022. It seems analyst sentiment has certainly become more bullish on revenues, even though they haven't changed their view on earnings per share.

See our latest analysis for d'Amico International Shipping

The consensus price target increased 13% to US$0.16, with an improved revenue forecast carrying the promise of a more valuable business, in time. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on d'Amico International Shipping, with the most bullish analyst valuing it at US$0.21 and the most bearish at US$0.11 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that d'Amico International Shipping's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 6.7% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 8.3% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to decline 1.8% per year. So although d'Amico International Shipping is expected to return to growth, it's also expected to grow revenues during a time when the wider industry is estimated to see revenue decline.

The Bottom Line

The most obvious conclusion from this consensus update is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. On the plus side, they also lifted their revenue estimates, and the company is expected to perform better than the wider market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at d'Amico International Shipping.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for d'Amico International Shipping going out to 2024, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives