- Italy

- /

- Oil and Gas

- /

- BIT:DIS

Investors Aren't Buying d'Amico International Shipping S.A.'s (BIT:DIS) Earnings

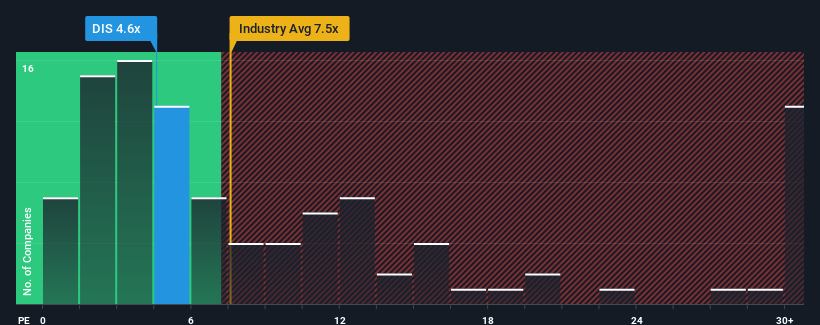

With a price-to-earnings (or "P/E") ratio of 4.6x d'Amico International Shipping S.A. (BIT:DIS) may be sending very bullish signals at the moment, given that almost half of all companies in Italy have P/E ratios greater than 15x and even P/E's higher than 25x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, d'Amico International Shipping's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for d'Amico International Shipping

Is There Any Growth For d'Amico International Shipping?

There's an inherent assumption that a company should far underperform the market for P/E ratios like d'Amico International Shipping's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Although pleasingly EPS has lifted 3,660% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 23% per year over the next three years. Meanwhile, the broader market is forecast to expand by 17% per year, which paints a poor picture.

In light of this, it's understandable that d'Amico International Shipping's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that d'Amico International Shipping maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for d'Amico International Shipping (1 is significant!) that you should be aware of.

You might be able to find a better investment than d'Amico International Shipping. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success