- Italy

- /

- Diversified Financial

- /

- BIT:BFF

Banca Farmafactoring (BIT:BFF) Shareholders Have Enjoyed A 34% Share Price Gain

Diversification is a key tool for dealing with stock price volatility. Of course, in an ideal world, all your stocks would beat the market. One such company is Banca Farmafactoring S.p.A. (BIT:BFF), which saw its share price increase 34% in the last year, slightly above the market return of around 29% (not including dividends). However, the longer term returns haven't been so impressive, with the stock up just 4.2% in the last three years.

View our latest analysis for Banca Farmafactoring

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

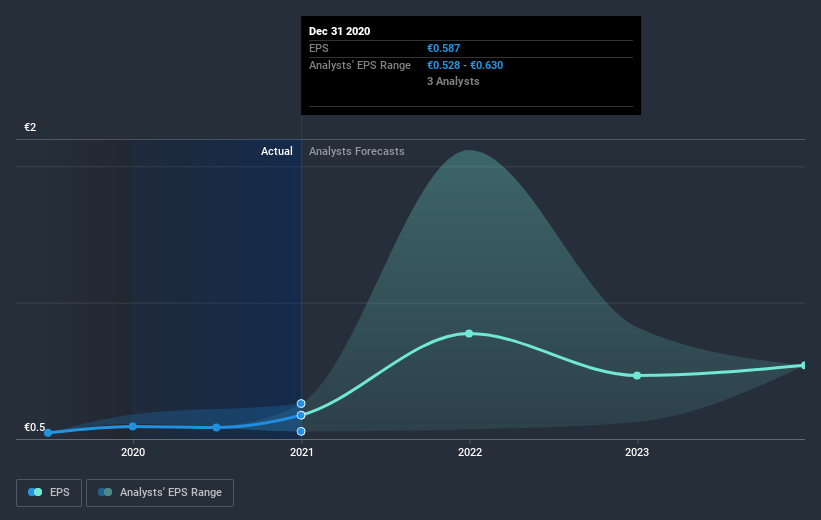

Banca Farmafactoring was able to grow EPS by 3.7% in the last twelve months. The share price gain of 34% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Banca Farmafactoring's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Banca Farmafactoring shareholders have gained 34% over twelve months (even including dividends). This isn't far from the market return of 33%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return of 8% over the last three years, implying that the company is doing better recently. We're certainly happy to see the uptick and we hope the underlying business goes on to justify the improved valuation. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Banca Farmafactoring (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

Of course Banca Farmafactoring may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

When trading Banca Farmafactoring or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026