- Italy

- /

- Capital Markets

- /

- BIT:AZM

Is Azimut Holding’s 58% Rally Justified After Sustainable Investing Expansion?

Reviewed by Bailey Pemberton

- Wondering if Azimut Holding stock is actually a good deal or just riding a hot streak? You are in the right place to find out how its current price stacks up against its real worth.

- Azimut has been on a strong run, jumping 4.8% over the last week, 43.8% year-to-date, and delivering an impressive 58.1% return over the past year. These kinds of numbers naturally spark questions about its valuation and future potential.

- Recent headlines have spotlighted Azimut’s bold moves in expanding its presence in international markets, with particular attention on new ventures in sustainable investment products. This extra attention and fresh strategic shifts have definitely contributed to recent price moves and investor buzz.

- Looking at the numbers, Azimut’s valuation checks add up to a score of 3 out of 6, suggesting it might be undervalued in some areas but not others. We will walk through those methods in a moment and, stick around, because there is an even smarter approach to understanding value that could change your view of this stock entirely.

Approach 1: Azimut Holding Excess Returns Analysis

The Excess Returns model is a valuation approach that calculates a stock’s worth based on how much value the company generates above the required cost of equity. In simple terms, it judges Azimut Holding on its ability to earn more from its investments than it costs to fund them, taking into account projected profitability and growth in equity.

For Azimut Holding, the key numbers are:

- Book Value: €13.44 per share

- Stable EPS: €3.83 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: €2.27 per share

- Excess Return: €1.56 per share

- Average Return on Equity: 22.82%

- Stable Book Value: €16.79 per share (Source: Weighted future Book Value estimates from 4 analysts.)

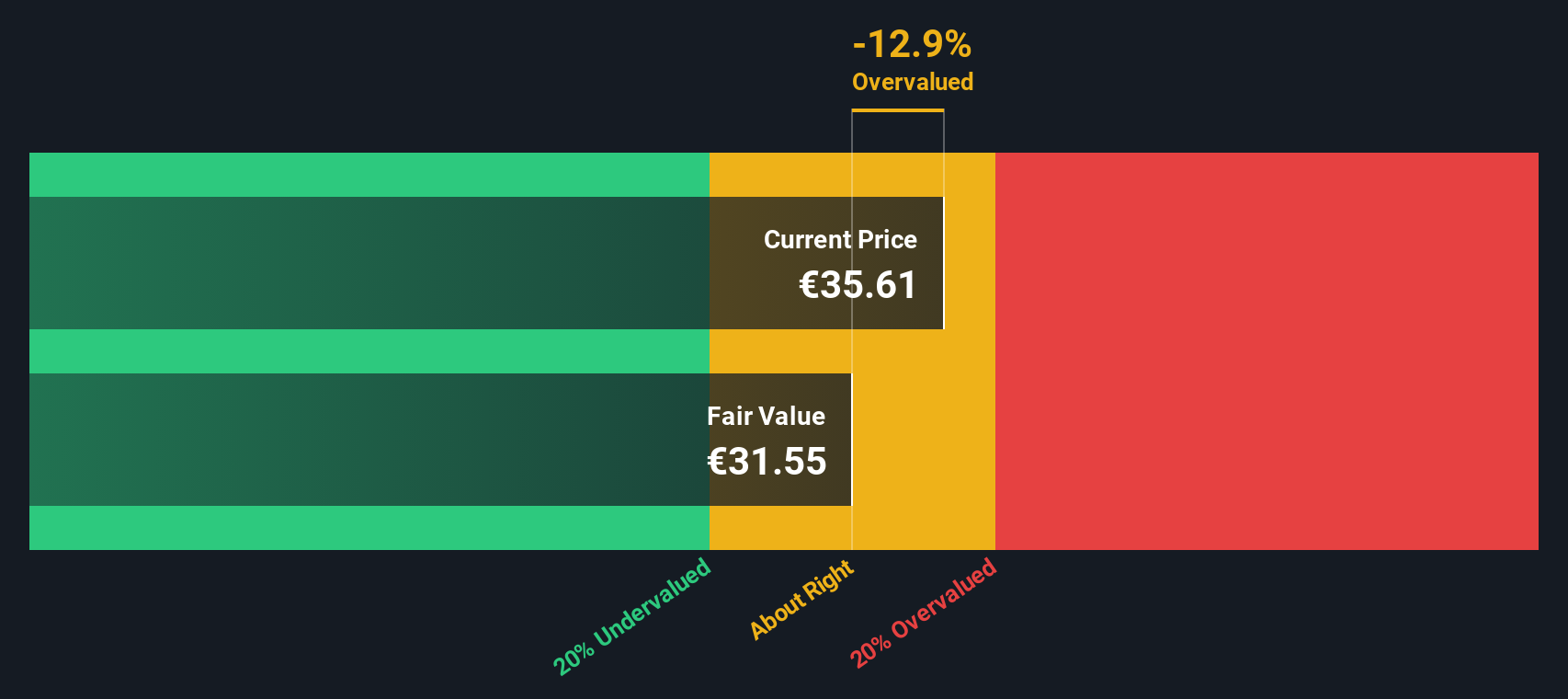

By estimating how long and how well Azimut Holding will keep generating income above its costs, this model arrives at an intrinsic value of €31.67 per share. Compared to Azimut’s current stock price, this implies the shares are roughly 9.6% overvalued. This is a small enough margin that it could easily swing either way with changes in the market or analyst forecasts.

Result: ABOUT RIGHT

Azimut Holding is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Azimut Holding Price vs Earnings

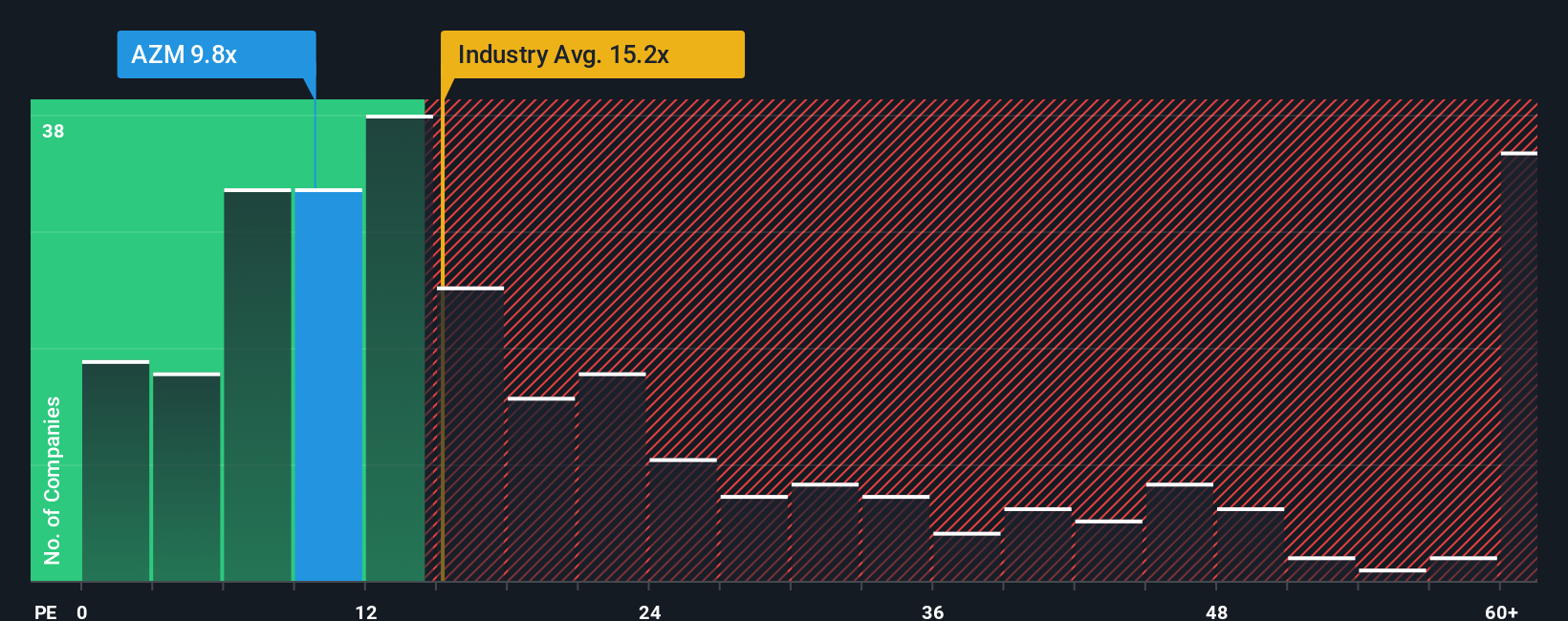

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Azimut Holding because it directly compares a company’s current share price to its per-share earnings. This makes it a quick way for investors to gauge how the market values each Euro of earnings. In general, a higher PE ratio can signal expectations of stronger future growth, while a lower ratio may reflect higher perceived risks or slower growth prospects.

Azimut Holding currently trades at a PE ratio of 9.6x. For context, this is well below the Capital Markets industry average PE of 17.9x and is also much lower than the average for its direct peers at 22.1x. This low multiple suggests the market might not be pricing in as much growth or may see more risk in Azimut Holding compared to others in the sector.

To get a more tailored perspective, Simply Wall St has created a "Fair Ratio" for Azimut Holding, which adjusts for specifics like its earnings growth, profit margins, risk profile, industry, and market capitalization. This approach offers a more meaningful comparison than just using industry or peer averages because it reflects what the multiple should reasonably be given the company’s unique outlook and fundamentals.

For Azimut Holding, the Fair Ratio is 15.8x, notably higher than its current PE of 9.6x. This gap suggests the stock may be undervalued relative to the level you would expect based on its growth and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Azimut Holding Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple tool that lets you connect your story, your personal perspective about Azimut Holding’s future, to financial forecasts and ultimately to a fair value for the stock.

Instead of seeing just a single number or analyst target, Narratives help you clarify what you think will actually drive Azimut’s performance, such as expansion, earnings growth, or risks that may affect its long-term outlook. With Narratives, you explain your reasoning, provide your own fair value assumptions, and shape your expectations about future revenue, earnings, and profit margins.

Narratives are available to everyone on Simply Wall St’s Community page, and are already being used by millions of investors. You just select or write your Narrative, and the platform automatically connects your scenario to a dynamic fair value. As new information or earnings releases come in, your Narrative will update automatically so your decision-making is always based on the latest data.

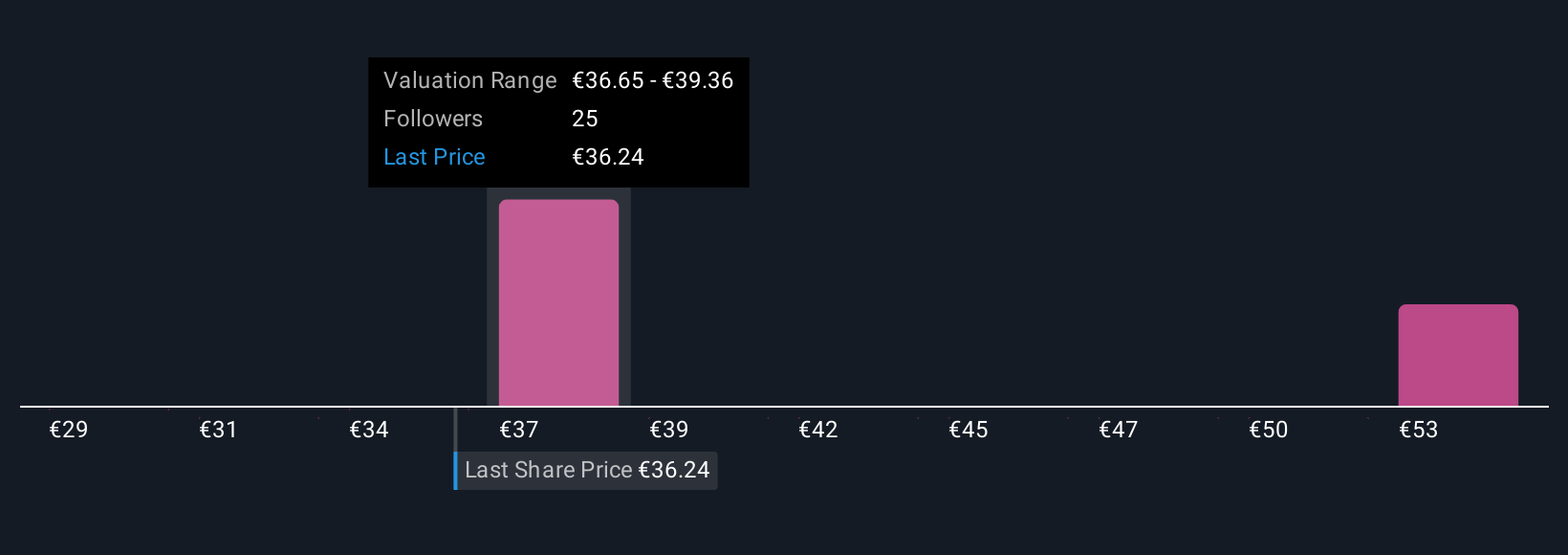

For example, some investors see Azimut Holding’s digital transformation and geographic diversification leading to a fair value as high as €36.34 per share, while others, more cautious about regulatory and demographic risks, estimate its value closer to €25.90. Narratives make it easy to compare these competing perspectives against the current share price, helping you decide whether now is the right time to buy or sell.

Do you think there's more to the story for Azimut Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AZM

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success