Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Longino & Cardenal S.p.A. (BIT:LON) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Longino & Cardenal

How Much Debt Does Longino & Cardenal Carry?

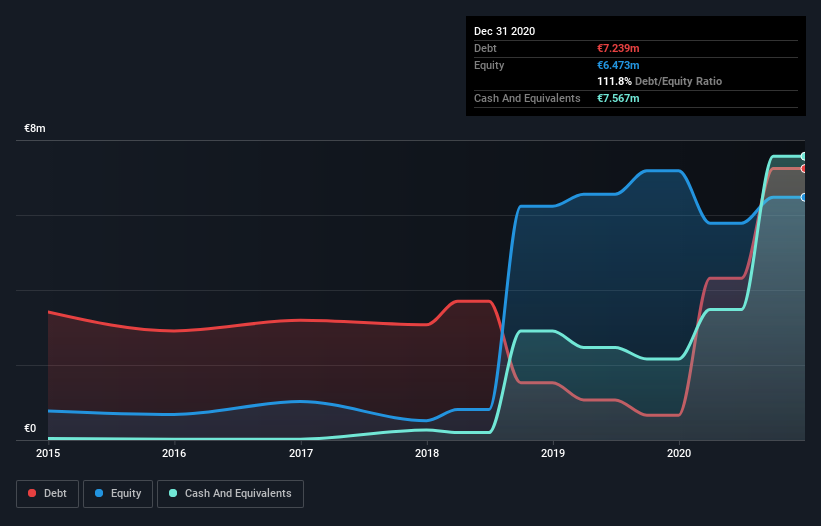

As you can see below, at the end of December 2020, Longino & Cardenal had €7.24m of debt, up from €662.3k a year ago. Click the image for more detail. But it also has €7.57m in cash to offset that, meaning it has €328.0k net cash.

A Look At Longino & Cardenal's Liabilities

The latest balance sheet data shows that Longino & Cardenal had liabilities of €6.51m due within a year, and liabilities of €5.77m falling due after that. Offsetting these obligations, it had cash of €7.57m as well as receivables valued at €5.42m due within 12 months. So it can boast €706.0k more liquid assets than total liabilities.

This surplus suggests that Longino & Cardenal has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Longino & Cardenal boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Longino & Cardenal's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Longino & Cardenal made a loss at the EBIT level, and saw its revenue drop to €20m, which is a fall of 42%. To be frank that doesn't bode well.

So How Risky Is Longino & Cardenal?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Longino & Cardenal lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of €1.6m and booked a €1.8m accounting loss. Given it only has net cash of €328.0k, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Longino & Cardenal has 4 warning signs (and 1 which is significant) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Longino & Cardenal, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:LON

Longino & Cardenal

Provides catering services to the hotel, restaurant, catering, and gastronomy sectors in Italy, rest of the European Union, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion