iGrandiViaggi S.p.A. (BIT:IGV) shareholders will doubtless be very grateful to see the share price up 49% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 54% in that time. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

See our latest analysis for iGrandiViaggi

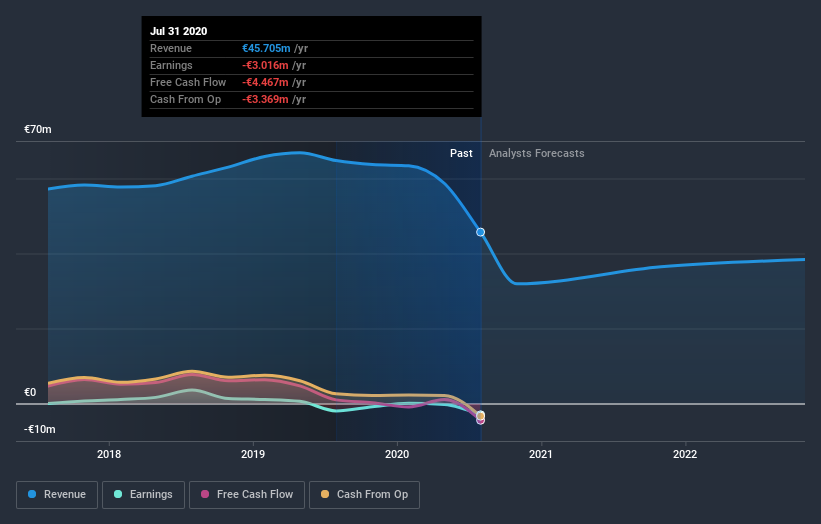

iGrandiViaggi wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, iGrandiViaggi's revenue dropped 0.5% per year. That is not a good result. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at iGrandiViaggi's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 5.3% in the twelve months, iGrandiViaggi shareholders did even worse, losing 28% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand iGrandiViaggi better, we need to consider many other factors. Even so, be aware that iGrandiViaggi is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you decide to trade iGrandiViaggi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:IGV

I Grandi Viaggi

Engages in the travel and tourism business in Italy, rest of Europe, and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success