- Italy

- /

- Food and Staples Retail

- /

- BIT:TALEA

Talea Group S.p.A. (BIT:TALEA) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

The Talea Group S.p.A. (BIT:TALEA) share price has fared very poorly over the last month, falling by a substantial 27%. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

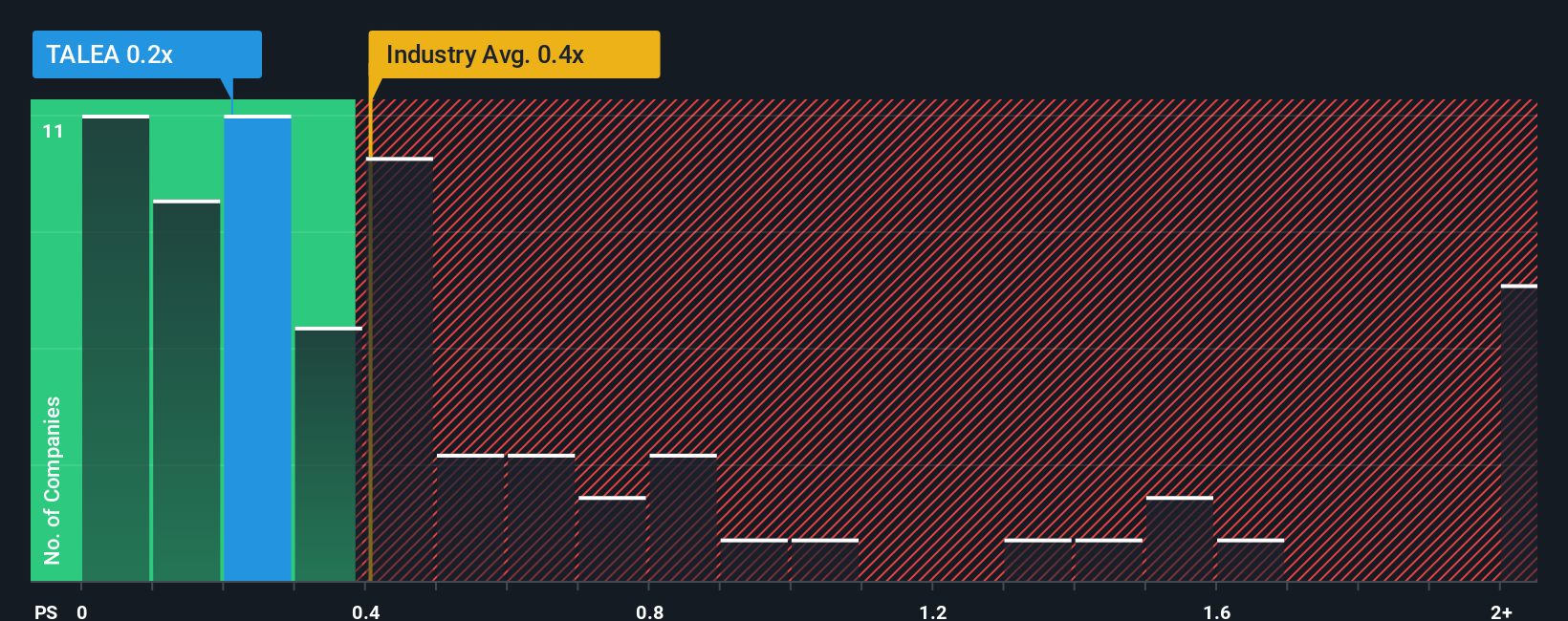

Although its price has dipped substantially, it's still not a stretch to say that Talea Group's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Italy, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Talea Group

How Talea Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Talea Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Talea Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Talea Group's Revenue Growth Trending?

In order to justify its P/S ratio, Talea Group would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 6.8% each year over the next three years. That's shaping up to be similar to the 6.5% per year growth forecast for the broader industry.

In light of this, it's understandable that Talea Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Following Talea Group's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Talea Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 3 warning signs for Talea Group (1 doesn't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Talea Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TALEA

Talea Group

Operates as an e-retailer of health, wellness, and beauty products in Italy.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.