Three Stocks That Could Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to experience fluctuations, with U.S. stocks reaching record highs amid optimism for softer tariffs and AI-related investments, investors are increasingly focused on identifying opportunities that may be trading below their intrinsic value. In such a climate, finding stocks that are potentially undervalued can be particularly appealing, as they offer the possibility of capitalizing on market inefficiencies while navigating the evolving economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.77 | 49.8% |

| GlobalData (AIM:DATA) | £1.78 | £3.56 | 49.9% |

| Fudo Tetra (TSE:1813) | ¥2192.00 | ¥4357.83 | 49.7% |

| J Trust (TSE:8508) | ¥520.00 | ¥1039.92 | 50% |

| Bufab (OM:BUFAB) | SEK464.20 | SEK926.28 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.83 | CN¥27.64 | 50% |

| IDP Education (ASX:IEL) | A$13.17 | A$26.31 | 49.9% |

| Allied Blenders and Distillers (NSEI:ABDL) | ₹394.40 | ₹787.12 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.83 | CA$3.64 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.24 | NZ$6.15 | 47.3% |

Here's a peek at a few of the choices from the screener.

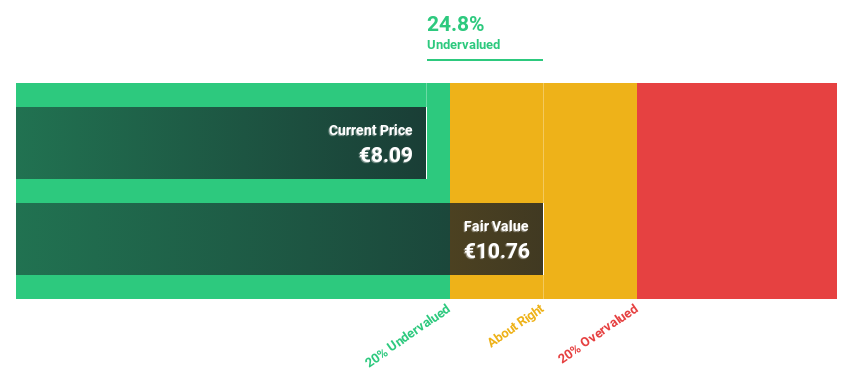

Salvatore Ferragamo (BIT:SFER)

Overview: Salvatore Ferragamo S.p.A. is a luxury goods company that designs, produces, and sells products for men and women across Europe, North America, Japan, the Asia Pacific, and Central and South America with a market cap of approximately €1.17 billion.

Operations: The company's revenue primarily comes from its footwear segment, which generated €1.08 billion.

Estimated Discount To Fair Value: 35.3%

Salvatore Ferragamo is trading at €7.28, significantly below its estimated fair value of €11.24, highlighting its undervaluation based on discounted cash flow analysis. Despite recent volatility and a decline in profit margins to 0.9%, earnings are expected to grow substantially at 38.1% annually, surpassing the Italian market's growth rate of 6.7%. However, future return on equity remains low at a forecasted 4.8% in three years.

- According our earnings growth report, there's an indication that Salvatore Ferragamo might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Salvatore Ferragamo.

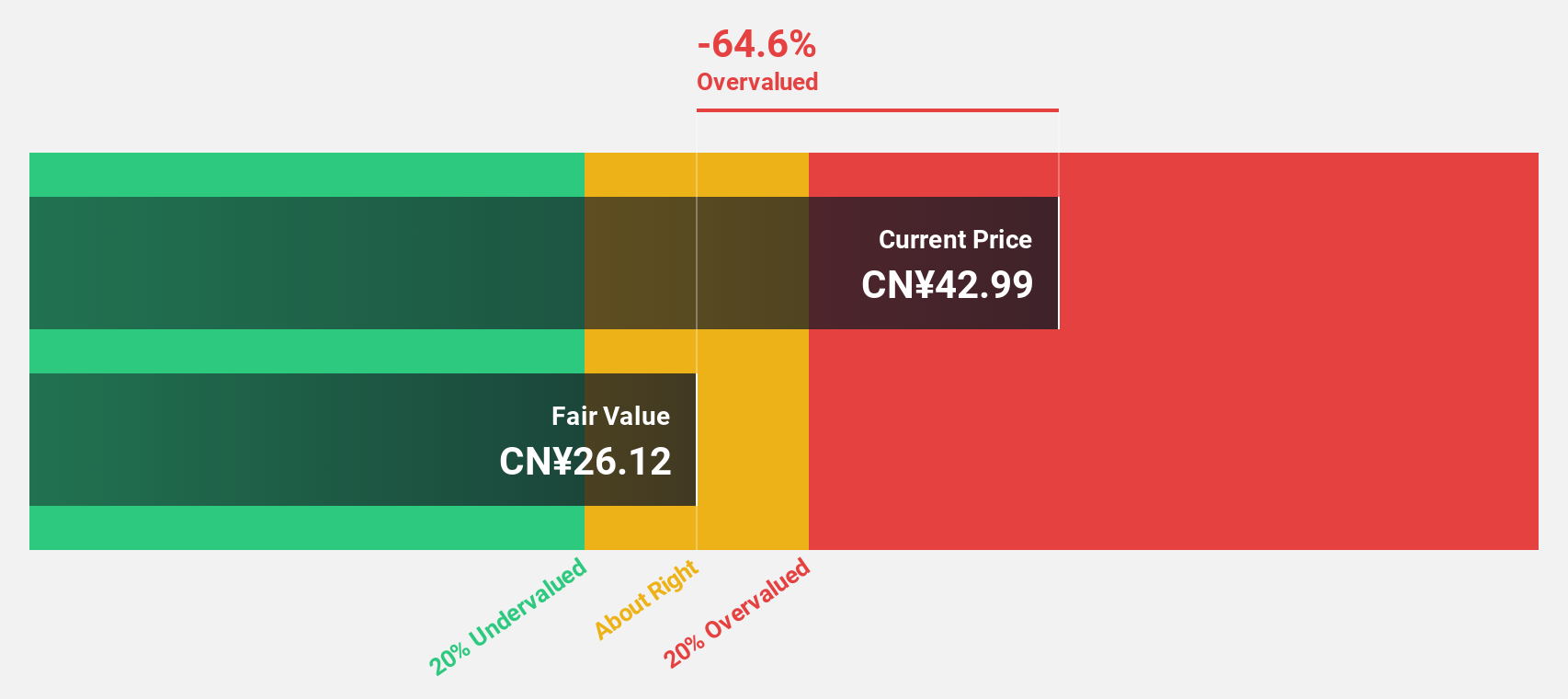

Haisco Pharmaceutical Group (SZSE:002653)

Overview: Haisco Pharmaceutical Group Co., Ltd. engages in the research, development, manufacturing, and sale of pharmaceuticals in China with a market cap of CN¥35.37 billion.

Operations: The company's revenue is primarily derived from its activities in researching, developing, manufacturing, and selling pharmaceuticals within China.

Estimated Discount To Fair Value: 42.7%

Haisco Pharmaceutical Group, trading at CN¥31.89, is undervalued with an estimated fair value of CN¥55.7. Earnings are projected to grow significantly at 35.7% annually, outpacing the Chinese market's 25% growth rate, while revenue is expected to increase by 23% per year. Despite a low future return on equity forecast of 16.1%, its current valuation and growth prospects make it an attractive consideration for cash flow-focused investors. Recent dividend affirmations reflect stable profit distribution plans.

- Upon reviewing our latest growth report, Haisco Pharmaceutical Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Haisco Pharmaceutical Group's balance sheet health report.

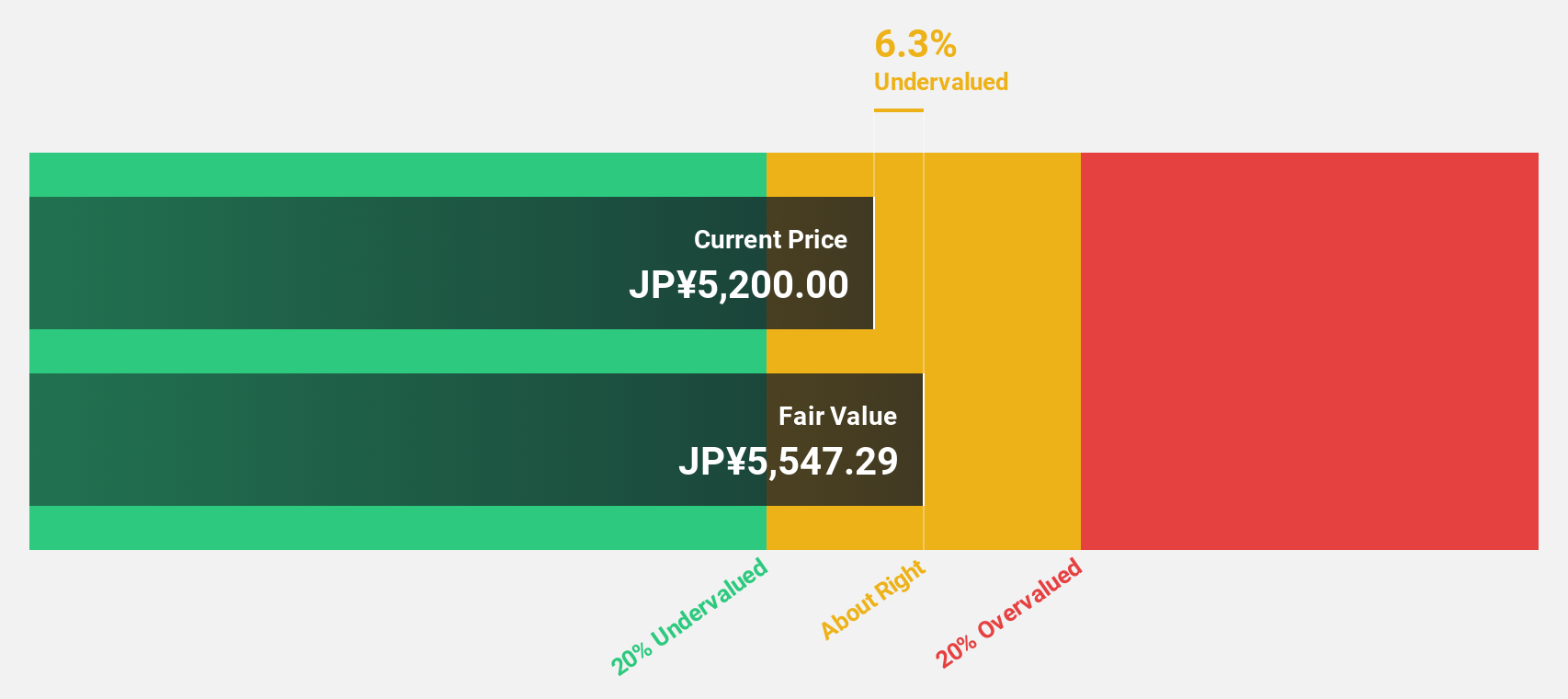

DTS (TSE:9682)

Overview: DTS Corporation offers systems integration services in Japan and has a market cap of ¥175.43 billion.

Operations: The company's revenue segments include Platform & Services at ¥29.38 billion, Business & Solutions at ¥49.81 billion, and Technology & Solutions at ¥42.66 billion.

Estimated Discount To Fair Value: 11.7%

DTS is trading at ¥4,245, below its estimated fair value of ¥4,809.31. Revenue growth is forecast at 6.7% annually, surpassing the JP market's 4.3%. Earnings are expected to grow faster than the market at 12.3% per year but not significantly high. Recent share buybacks totaling ¥5,999.83 million aim to enhance shareholder returns and capital efficiency. The stock's undervaluation and growth potential offer a compelling case for cash flow-focused investors despite an unstable dividend history.

- Our expertly prepared growth report on DTS implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of DTS with our comprehensive financial health report here.

Summing It All Up

- Unlock our comprehensive list of 904 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9682

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion