Here's Why Salvatore Ferragamo (BIT:SFER) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Salvatore Ferragamo S.p.A. (BIT:SFER) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Salvatore Ferragamo

How Much Debt Does Salvatore Ferragamo Carry?

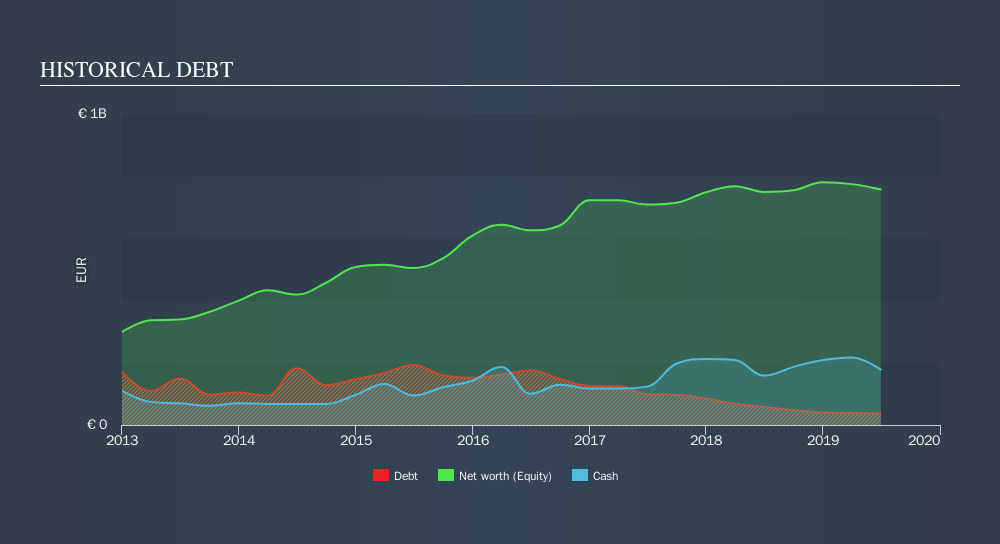

You can click the graphic below for the historical numbers, but it shows that Salvatore Ferragamo had €37.3m of debt in June 2019, down from €57.9m, one year before. However, its balance sheet shows it holds €178.2m in cash, so it actually has €140.9m net cash.

How Healthy Is Salvatore Ferragamo's Balance Sheet?

The latest balance sheet data shows that Salvatore Ferragamo had liabilities of €419.6m due within a year, and liabilities of €625.9m falling due after that. Offsetting this, it had €178.2m in cash and €193.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €673.9m.

While this might seem like a lot, it is not so bad since Salvatore Ferragamo has a market capitalization of €2.74b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Salvatore Ferragamo also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, Salvatore Ferragamo saw its EBIT drop by 5.1% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Salvatore Ferragamo can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Salvatore Ferragamo has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Salvatore Ferragamo generated free cash flow amounting to a very robust 86% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Summing up

Although Salvatore Ferragamo's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €140.9m. And it impressed us with free cash flow of €162m, being 86% of its EBIT. So we are not troubled with Salvatore Ferragamo's debt use. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Salvatore Ferragamo's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:SFER

Salvatore Ferragamo

Through its subsidiaries, creates, produces, and sells luxury goods for men and women in Europe, North America, Japan, the Asia Pacific, and Central and South America.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives