For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Sabaf (BIT:SAB). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Sabaf

How Quickly Is Sabaf Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Sabaf's EPS has grown 17% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

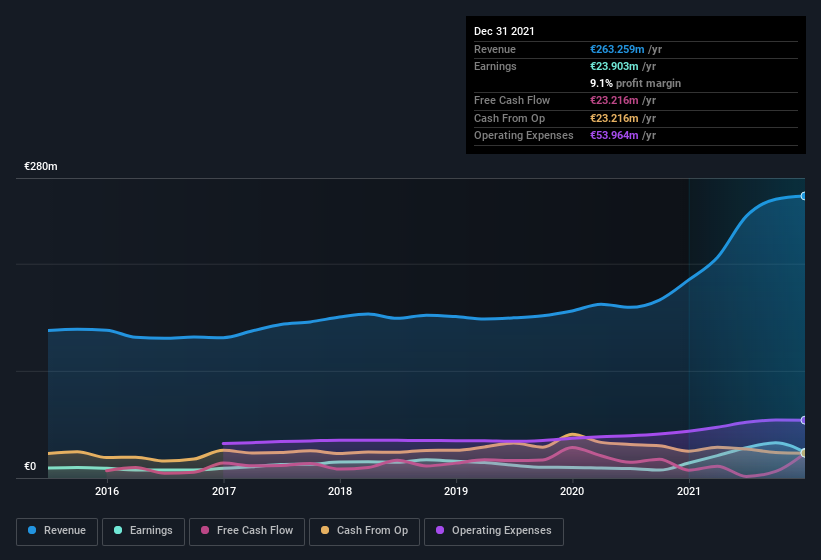

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Sabaf shareholders can take confidence from the fact that EBIT margins are up from 10% to 14%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Sabaf's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sabaf Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Like a sturdy phalanx Sabaf insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the CEO & Director, Pietro Iotti, paid €50k to buy shares at an average price of €22.59.

The good news, alongside the insider buying, for Sabaf bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at €78m, they have plenty of motivation to push the business to succeed. That holding amounts to 31% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does Sabaf Deserve A Spot On Your Watchlist?

You can't deny that Sabaf has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. We should say that we've discovered 2 warning signs for Sabaf that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Sabaf isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SAB

Sabaf

Manufactures and sells components for household gas cooking appliances in Europe, Turkey, North America, South America, Africa, the Middle East, Asia, and Oceania.

Slight risk with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026