- Italy

- /

- Consumer Durables

- /

- BIT:SAB

Analysts Have Made A Financial Statement On Sabaf S.p.A.'s (BIT:SAB) Interim Report

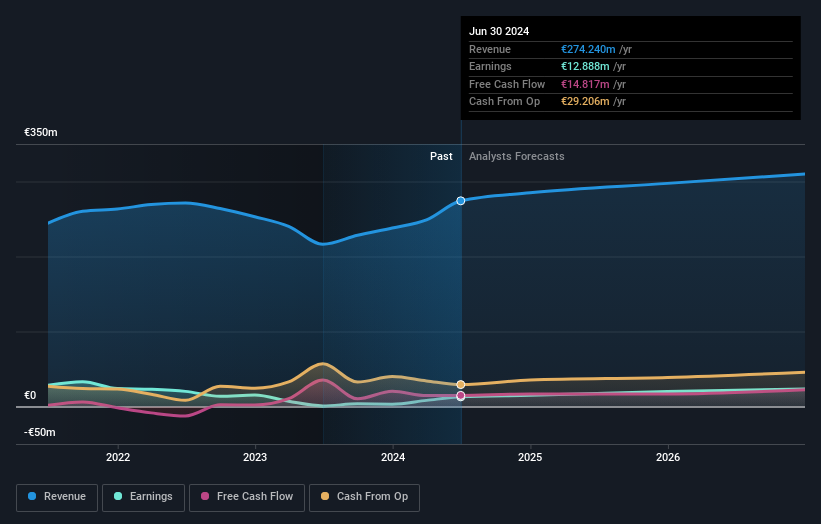

It's been a good week for Sabaf S.p.A. (BIT:SAB) shareholders, because the company has just released its latest half-year results, and the shares gained 3.3% to €18.60. Results overall were respectable, with statutory earnings of €0.26 per share roughly in line with what the analysts had forecast. Revenues of €143m came in 2.7% ahead of analyst predictions. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Sabaf

Taking into account the latest results, the consensus forecast from Sabaf's dual analysts is for revenues of €285.0m in 2024. This reflects an okay 3.9% improvement in revenue compared to the last 12 months. Per-share earnings are expected to expand 14% to €1.18. In the lead-up to this report, the analysts had been modelling revenues of €272.9m and earnings per share (EPS) of €1.17 in 2024. So it looks like there's been no major change in sentiment following the latest results, although the analysts have made a small lift in to revenue forecasts.

Even though revenue forecasts increased, there was no change to the consensus price target of €22.50, suggesting the analysts are focused on earnings as the driver of value creation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Sabaf's revenue growth is expected to slow, with the forecast 8.0% annualised growth rate until the end of 2024 being well below the historical 11% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 7.5% annually. So it's pretty clear that, while Sabaf's revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. They also upgraded their revenue forecasts, although the latest estimates suggest that Sabaf will grow in line with the overall industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Sabaf going out as far as 2026, and you can see them free on our platform here.

Before you take the next step you should know about the 2 warning signs for Sabaf that we have uncovered.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:SAB

Sabaf

Manufactures and sells components for household gas cooking appliances in Europe, Turkey, North America, South America, Africa, the Middle East, Asia, and Oceania.

Slight risk with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026