- Italy

- /

- Consumer Durables

- /

- BIT:PWS

European Value Stock Picks For Estimated Discount Opportunities

Reviewed by Simply Wall St

As European markets show signs of optimism following the easing of trade tensions between the U.S. and China, major indices like the STOXX Europe 600 and Germany's DAX have experienced notable gains. In this environment, identifying undervalued stocks becomes crucial for investors aiming to capitalize on potential discount opportunities, as these stocks may offer value relative to their intrinsic worth amidst improving economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.40 | SEK96.31 | 49.7% |

| ILPRA (BIT:ILP) | €4.58 | €8.75 | 47.7% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.935 | €3.71 | 47.9% |

| Lectra (ENXTPA:LSS) | €23.60 | €47.03 | 49.8% |

| adidas (XTRA:ADS) | €218.30 | €434.91 | 49.8% |

| Cavotec (OM:CCC) | SEK16.25 | SEK32.35 | 49.8% |

| dormakaba Holding (SWX:DOKA) | CHF735.00 | CHF1401.95 | 47.6% |

| Surgical Science Sweden (OM:SUS) | SEK142.80 | SEK274.02 | 47.9% |

| Northern Data (DB:NB2) | €25.02 | €49.50 | 49.5% |

| Arlandastad Group (OM:AGROUP) | SEK26.30 | SEK50.14 | 47.6% |

Here we highlight a subset of our preferred stocks from the screener.

Powersoft (BIT:PWS)

Overview: Powersoft S.p.A. designs, produces, and markets power amplifiers, loudspeaker components, and software for installed and live sound applications both in Italy and internationally, with a market cap of €221.96 million.

Operations: The company's revenue primarily comes from audio amplifiers for professional applications, generating €71.50 million.

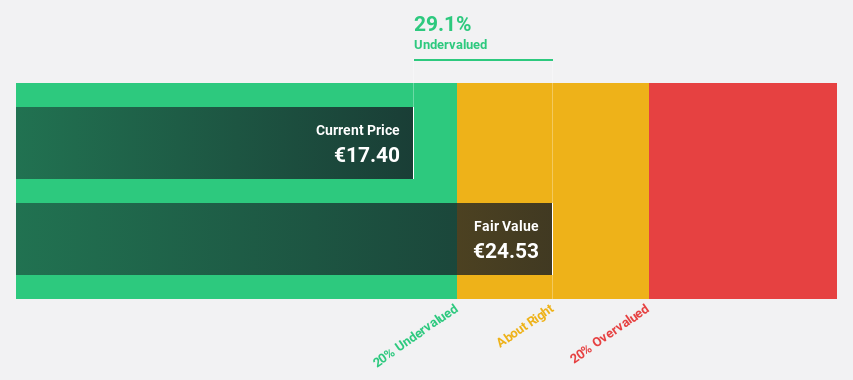

Estimated Discount To Fair Value: 27.8%

Powersoft is trading at 27.8% below its estimated fair value of €24.52, with a current price of €17.7, highlighting its potential undervaluation based on discounted cash flow analysis. Despite a dividend yield of 4.63% not being well-covered by free cash flows, the company's revenue and earnings are forecast to grow significantly faster than the Italian market at 23.8% and 18.9% per year respectively, suggesting strong future cash flow potential despite recent modest earnings growth.

- The analysis detailed in our Powersoft growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Powersoft's balance sheet health report.

STIF Société anonyme (ENXTPA:ALSTI)

Overview: STIF Société anonyme manufactures and sells components for the handling of bulk products in France, with a market cap of €269.61 million.

Operations: The company generates revenue of €63.70 million from its Machinery & Industrial Equipment segment.

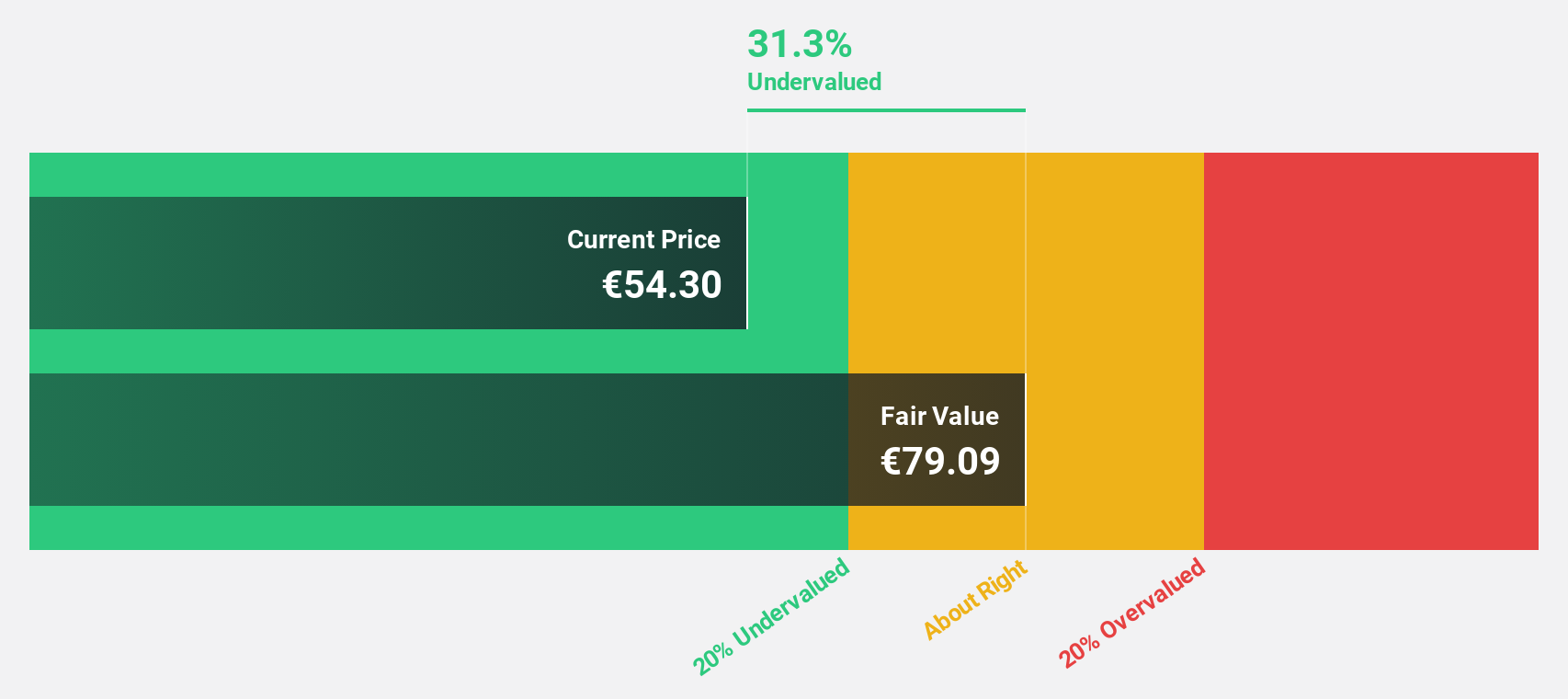

Estimated Discount To Fair Value: 33.9%

STIF Société anonyme trades at €52.5, significantly below its estimated fair value of €79.44, suggesting undervaluation based on discounted cash flow analysis. The company reported a substantial increase in sales to €61.2 million and net income to €9.7 million for 2024, reflecting strong past performance. Earnings are projected to grow annually by 16.1%, outpacing the French market's growth rate, despite recent share price volatility over the past three months.

- According our earnings growth report, there's an indication that STIF Société anonyme might be ready to expand.

- Take a closer look at STIF Société anonyme's balance sheet health here in our report.

Biotage (OM:BIOT)

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of SEK11.36 billion.

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated SEK1.96 billion.

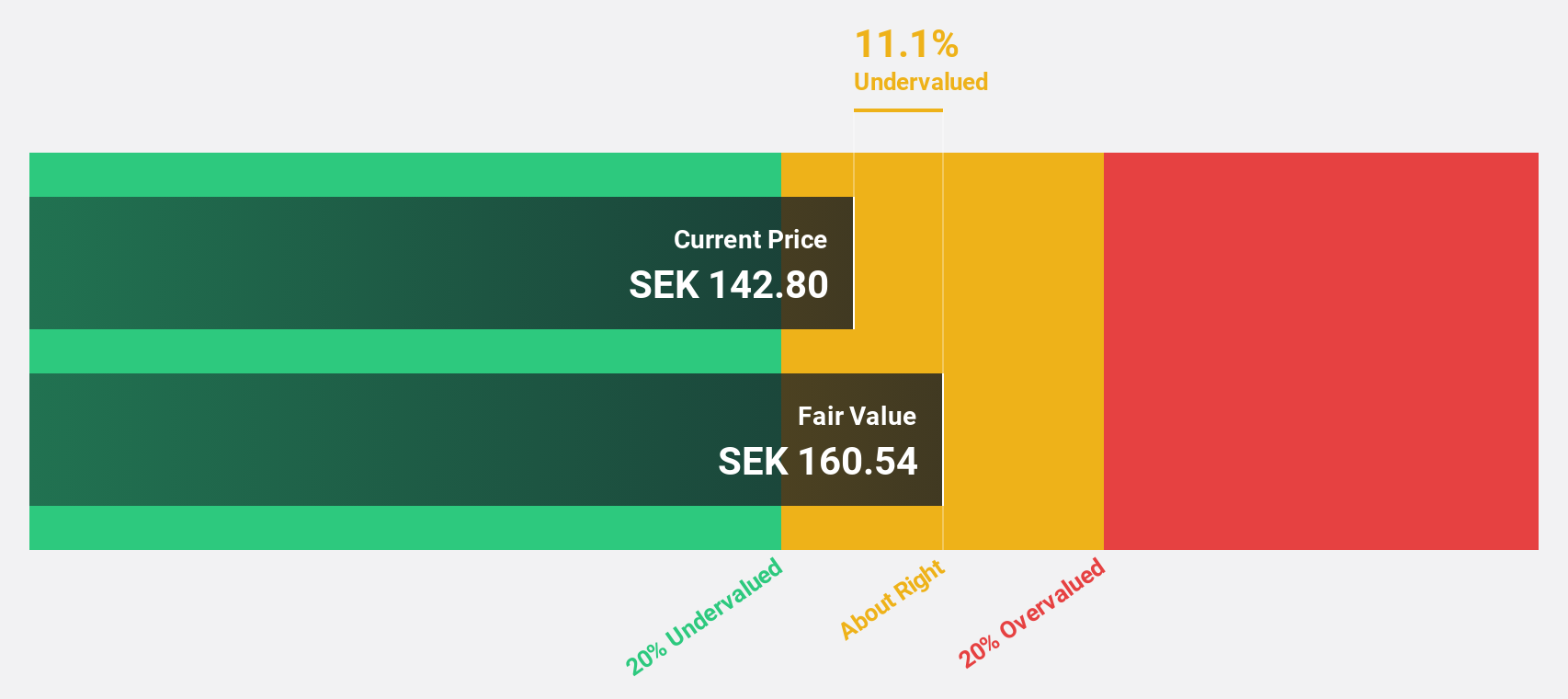

Estimated Discount To Fair Value: 19.8%

Biotage AB is currently trading at SEK 141.9, which is 19.8% below its estimated fair value of SEK 177, indicating potential undervaluation based on cash flows. Despite recent earnings challenges with a net income drop to SEK 4 million for Q1 2025 from SEK 33 million a year ago, the company's revenue and earnings are forecasted to grow faster than the Swedish market. The proposed acquisition by KKR could further impact valuation considerations.

- Our comprehensive growth report raises the possibility that Biotage is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Biotage.

Where To Now?

- Access the full spectrum of 179 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PWS

Powersoft

Engages in the design, production, and marketing of power amplifiers, loudspeaker components, and software in Italy and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives