If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Although, when we looked at Pattern (BIT:PTR), it didn't seem to tick all of these boxes.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Pattern is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = €5.3m ÷ (€46m - €13m) (Based on the trailing twelve months to June 2020).

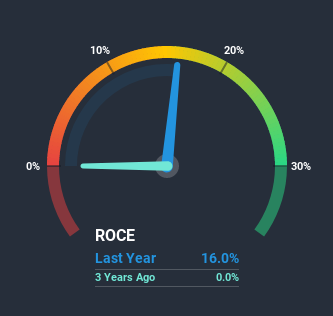

Therefore, Pattern has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Luxury industry average of 7.4% it's much better.

See our latest analysis for Pattern

Above you can see how the current ROCE for Pattern compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Pattern here for free.

How Are Returns Trending?

On the surface, the trend of ROCE at Pattern doesn't inspire confidence. To be more specific, ROCE has fallen from 45% over the last two years. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a side note, Pattern has done well to pay down its current liabilities to 28% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.Our Take On Pattern's ROCE

While returns have fallen for Pattern in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. However, total returns to shareholders over the last year have been flat, which could indicate these growth trends potentially aren't accounted for yet by investors. So we think it'd be worthwhile to look further into this stock given the trends look encouraging.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 3 warning signs for Pattern (of which 2 are significant!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Pattern or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:PTR

Pattern

Engages in the engineering and production of luxury goods in Italy, rest of the European Union, and internationally.

Good value with imperfect balance sheet.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Hims & Hers Health - Valuation

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026