- Finland

- /

- Basic Materials

- /

- HLSE:BETOLAR

3 Promising European Penny Stocks With Over €20M Market Cap

Reviewed by Simply Wall St

As the European market navigates a period of mixed returns, with indices like the STOXX Europe 600 Index remaining relatively flat, investors are keenly observing sectors that might offer growth potential. Penny stocks, though often considered a throwback to earlier trading days, still hold promise for those seeking affordable entry points into potentially lucrative investments. These smaller or newer companies can offer significant growth opportunities when backed by solid financials; here we explore three such stocks that stand out for their financial strength and potential in today’s market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.45 | €45.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.51 | RON17.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.84 | €59.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.80 | €17.95M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.48 | PLN12.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.53 | SEK2.42B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.62 | SEK220.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.10 | €289.94M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €33.05M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 324 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pattern (BIT:PTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pattern S.p.A. operates as a luxury engineering and production hub in Italy with a market cap of €62.73 million.

Operations: Pattern S.p.A. has not reported any specific revenue segments.

Market Cap: €62.73M

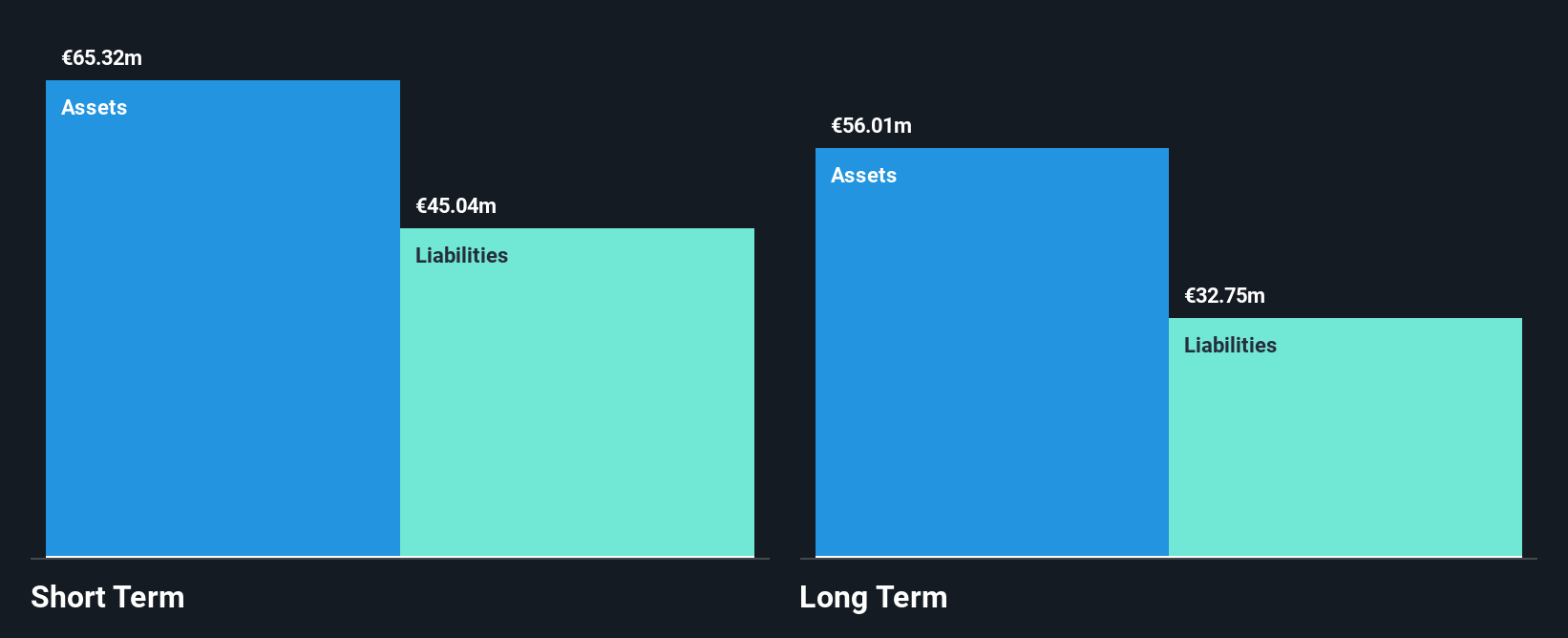

Pattern S.p.A. presents a mixed picture for investors interested in penny stocks. Trading at 12.4% below its estimated fair value, it offers potential upside, although recent earnings growth has been negative at -98.3%, contrasting sharply with its five-year average of 37.8% annual growth. The company’s financial health is supported by short-term assets exceeding both short and long-term liabilities, but interest coverage remains weak at 1.3x EBIT. Despite high-quality past earnings and satisfactory debt levels with a net debt to equity ratio of 11.8%, the stock's volatility and low return on equity (0.8%) may concern risk-averse investors.

- Unlock comprehensive insights into our analysis of Pattern stock in this financial health report.

- Examine Pattern's earnings growth report to understand how analysts expect it to perform.

Betolar Oyj (HLSE:BETOLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Betolar Oyj is a materials technology company that develops solutions for utilizing industrial sidestreams to create low-carbon, cement-free products for industries such as mining, metals, and construction across Europe, the Middle East, Africa, the Asia Pacific, and the Americas; it has a market cap of €25.88 million.

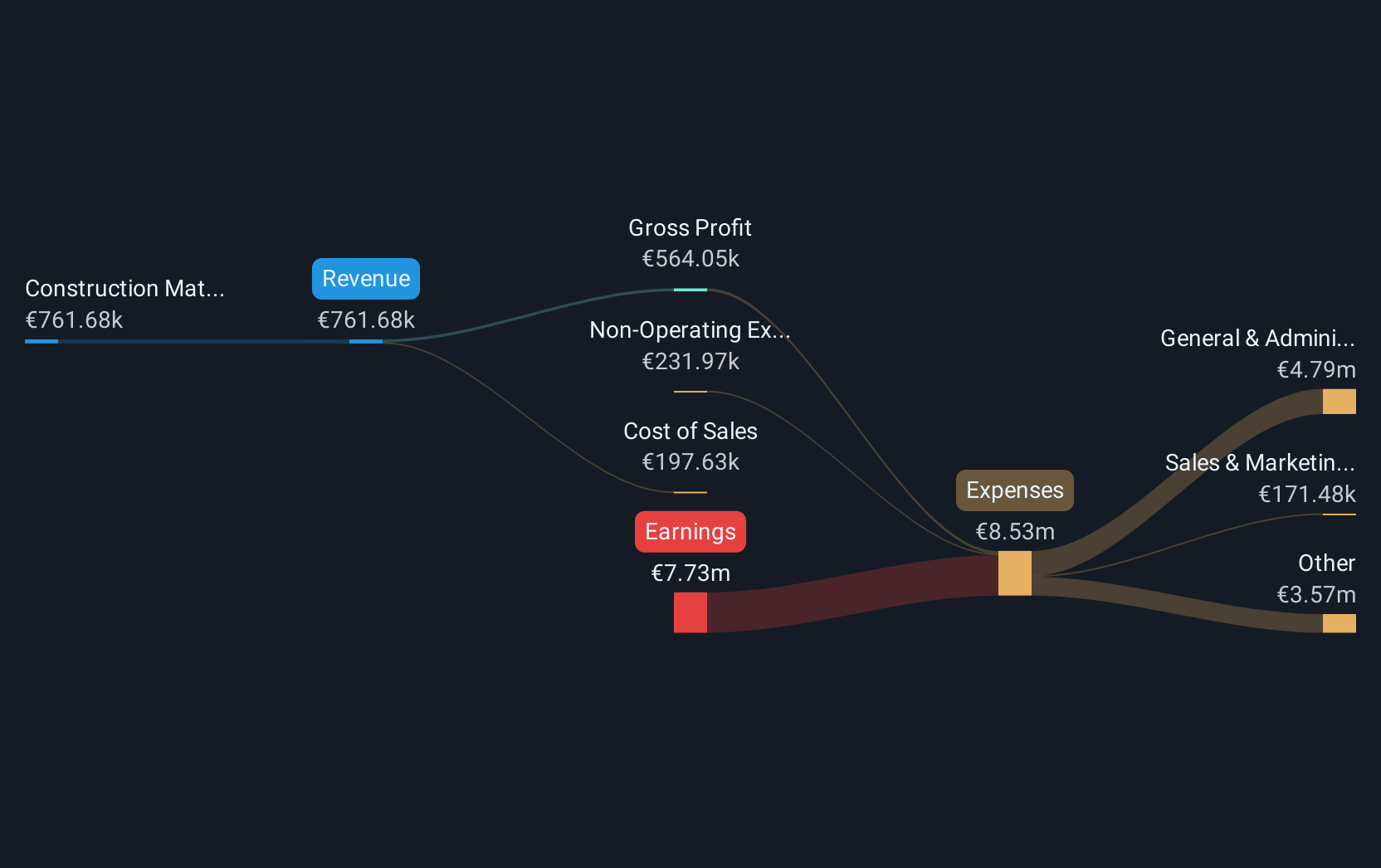

Operations: The company's revenue is derived entirely from its Construction Materials segment, amounting to €0.76 million.

Market Cap: €25.88M

Betolar Oyj, a materials technology firm, is navigating the penny stock landscape with its innovative green cement solutions. Despite being pre-revenue with €0.76 million in sales from its Construction Materials segment, Betolar's strategic collaborations are noteworthy. Its partnership with Anglo American aims to leverage metal extraction technology for sustainable mining practices in Finland, while a new venture into Canada targets carbon-neutral rockfill solutions. Financially, Betolar maintains more cash than debt and has sufficient short-term assets to cover liabilities; however, it remains unprofitable and highly volatile with significant challenges ahead in achieving profitability within three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Betolar Oyj.

- Gain insights into Betolar Oyj's future direction by reviewing our growth report.

SolTech Energy Sweden (OM:SOLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SolTech Energy Sweden AB (publ) develops, sells, and installs energy and solar cell solutions in Sweden and China, with a market cap of SEK298.95 million.

Operations: SolTech Energy Sweden AB (publ) does not report distinct revenue segments.

Market Cap: SEK298.95M

SolTech Energy Sweden AB, operating in the energy and solar cell sector, has shown financial resilience despite challenges typical of penny stocks. With a market cap of SEK298.95 million, SolTech's short-term assets (SEK838 million) exceed its short- and long-term liabilities, indicating solid liquidity. The company has reduced its debt to equity ratio significantly over five years to a satisfactory 23.3%. However, it remains unprofitable with increasing losses and negative return on equity (-42.54%). Recent amendments to the articles of association suggest potential future capital expansion as the company navigates its growth trajectory amidst volatility.

- Get an in-depth perspective on SolTech Energy Sweden's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into SolTech Energy Sweden's track record.

Next Steps

- Click through to start exploring the rest of the 321 European Penny Stocks now.

- Looking For Alternative Opportunities? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betolar Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BETOLAR

Betolar Oyj

A materials technology company, provides solutions to use industrial sidestreams to produce low-carbon and cement-free products for the mining, metals, construction sectors in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet slight.

Market Insights

Community Narratives