Downgrade: Here's How Analysts See OVS S.p.A. (BIT:OVS) Performing In The Near Term

Market forces rained on the parade of OVS S.p.A. (BIT:OVS) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon. Bidders are definitely seeing a different story, with the stock price of €1.64 reflecting a 24% rise in the past week. It will be interesting to see if the downgrade has an impact on buying demand for the company's shares.

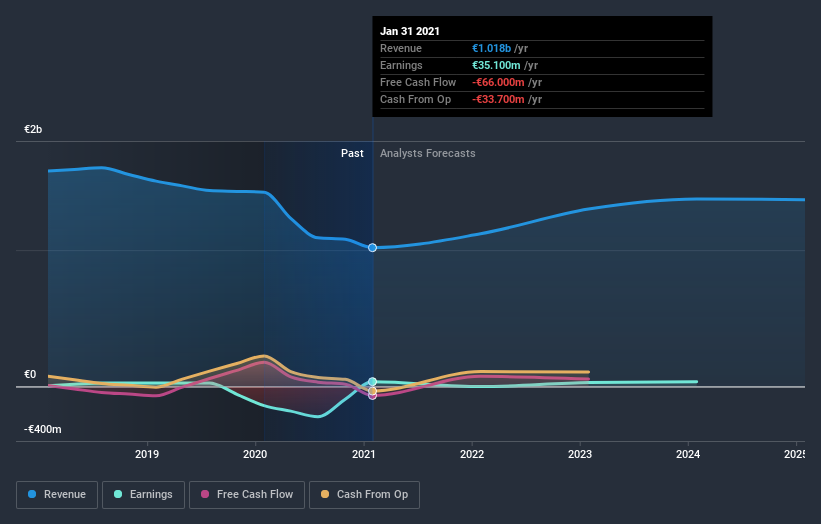

After this downgrade, OVS' four analysts are now forecasting revenues of €1.1b in 2022. This would be a solid 10% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 98% to €0.024. Prior to this update, the analysts had been forecasting revenues of €1.2b and earnings per share (EPS) of €0.068 in 2022. There looks to have been a major change in sentiment regarding OVS' prospects, with a measurable cut to revenues and the analysts now forecasting a loss instead of a profit.

View our latest analysis for OVS

Analysts lifted their price target 38% to €1.78, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic OVS analyst has a price target of €2.20 per share, while the most pessimistic values it at €1.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that OVS is forecast to grow faster in the future than it has in the past, with revenues expected to display 10% annualised growth until the end of 2022. If achieved, this would be a much better result than the 3.8% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 12% annually for the foreseeable future. Although OVS' revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing to take away is that analysts are expecting OVS to become unprofitable this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The rising price target is a puzzle, but still - with a serious cut to this year's outlook, we wouldn't be surprised if investors were a bit wary of OVS.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for OVS going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade OVS, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:OVS

Moderate growth potential with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026