Moncler (BIT:MONC): Reassessing Valuation After Luxury Sector Rally on LVMH Results and Stronger China Demand

Reviewed by Kshitija Bhandaru

Moncler (BIT:MONC) saw its shares react as investors grew more optimistic about the luxury sector, following LVMH’s upbeat third-quarter results and signs that shoppers in China are showing renewed interest.

See our latest analysis for Moncler.

Moncler’s share price has climbed over 5% in the past week as enthusiasm for luxury stocks returns, influenced by LVMH’s strong results and growing optimism around Chinese consumer demand. Despite recent momentum, Moncler's one-year total shareholder return remains slightly negative, while its longer-term record still stands out.

If resurgent luxury demand has you curious about other market opportunities, now is a sensible time to broaden your perspective and discover fast growing stocks with high insider ownership

But with Moncler’s shares rallying on a wave of sector optimism, investors have to ask whether the company is still trading at an attractive valuation or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 6.9% Undervalued

Moncler's most widely followed narrative puts fair value at €56.37, noticeably above the last closing price of €52.46. This suggests the market may be missing some crucial growth and margin dynamics driving analyst optimism.

Moncler's continued brand elevation efforts (for example, high-profile collaborations, new category launches such as footwear, and increased activity in the U.S. via targeted campaigns and celebrity partnerships) are expected to reinforce brand desirability and pricing power. These factors may support above-market revenue growth and potential gross margin expansion.

Want to know what sets this forecast apart? A big part of the equation includes ambitious growth assumptions and a future profit multiple higher than global sector norms. Wondering how confident analysts really are and what bold projections could justify the premium? Click through to uncover the core numbers and arguments powering this valuation call.

Result: Fair Value of €56.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing store traffic and overreliance on outerwear could threaten Moncler’s forecast if international demand does not rebound as expected.

Find out about the key risks to this Moncler narrative.

Another View: What Does the SWS DCF Model Say?

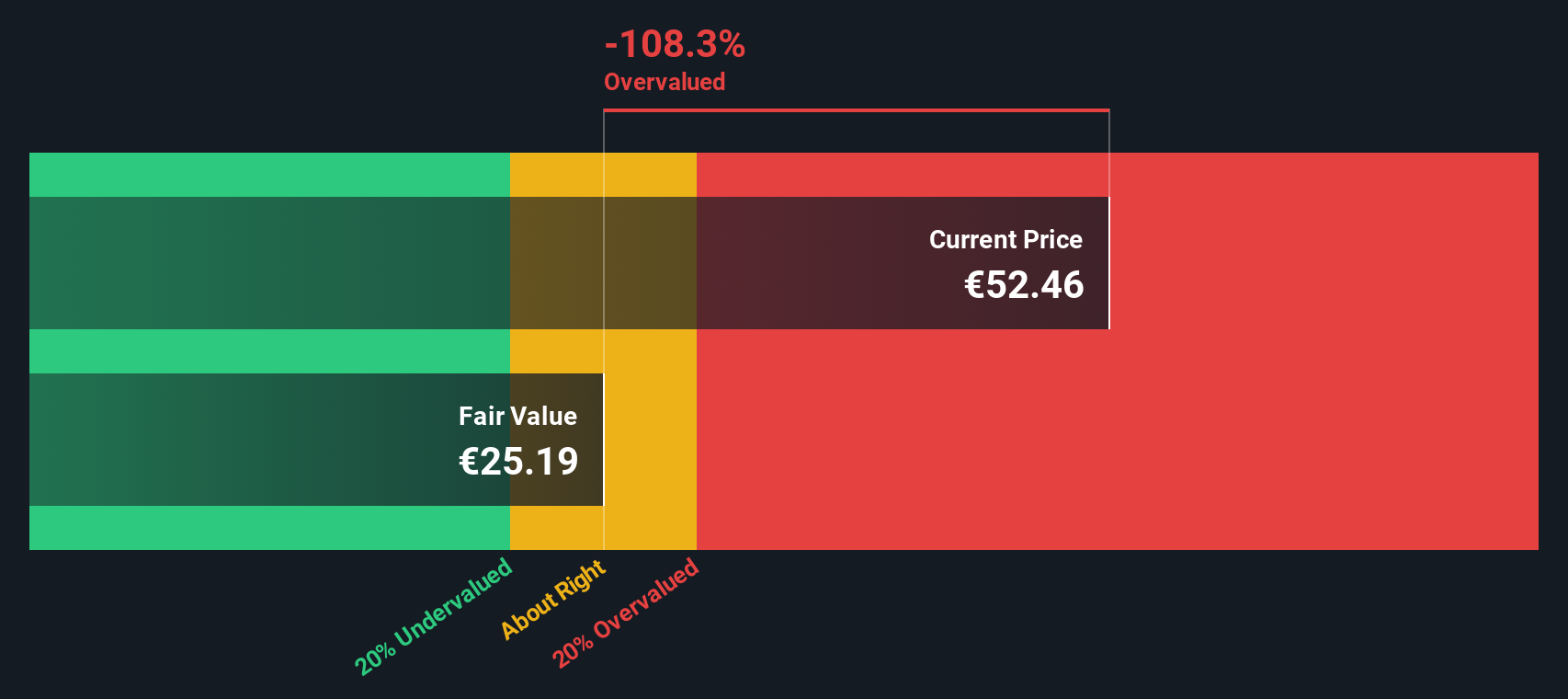

While the narrative and analyst targets point to upside, our DCF model offers a different perspective. According to the SWS DCF model, Moncler is actually trading well above its estimated fair value of €25.19. This suggests the stock may be overvalued if those cash flow forecasts prove too optimistic. Can both views be right, or is the market missing something crucial?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Moncler for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Moncler Narrative

If you’d rather trust your own process, it’s easy to dive into Moncler’s fundamentals and construct your own view of fair value in just a few minutes. Do it your way

A great starting point for your Moncler research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let smart opportunities slip by while you focus on a single stock. Make sharper moves and stay ahead with the powerful tools below:

- Boost your potential returns by targeting value with these 878 undervalued stocks based on cash flows. Here, strong fundamentals and attractive pricing come together in exceptional candidates.

- Unlock next-level trends in medicine, automation, and diagnostics with these 33 healthcare AI stocks, connecting you to trailblazers at the frontier of healthcare and AI.

- Get ahead of the curve in digital innovation by checking these 79 cryptocurrency and blockchain stocks, featuring companies powering breakthroughs in virtual assets and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MONC

Moncler

Produces and distributes clothing for men, women and children, footwear, glasses, and other accessories under the Moncler and Stone Island brands in Italy, rest of Europe, Asia, the Middle East, Africa, and the Americas.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives