- Malaysia

- /

- Real Estate

- /

- KLSE:LBS

Exploring Three Dividend Stocks In June 2024

Reviewed by Simply Wall St

As of June 2024, global markets present a mixed landscape with U.S. services showing resilience and manufacturing sectors under pressure, reflecting a complex economic environment. Amid these conditions, dividend stocks continue to attract attention for their potential to offer investors steady income streams in a fluctuating market. In this context, understanding the fundamentals that underpin strong dividend stocks—such as stable earnings, solid management, and a history of payout consistency—is crucial for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.28% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 8.01% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.65% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.59% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.55% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.74% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.47% | ★★★★★★ |

| Innotech (TSE:9880) | 4.06% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

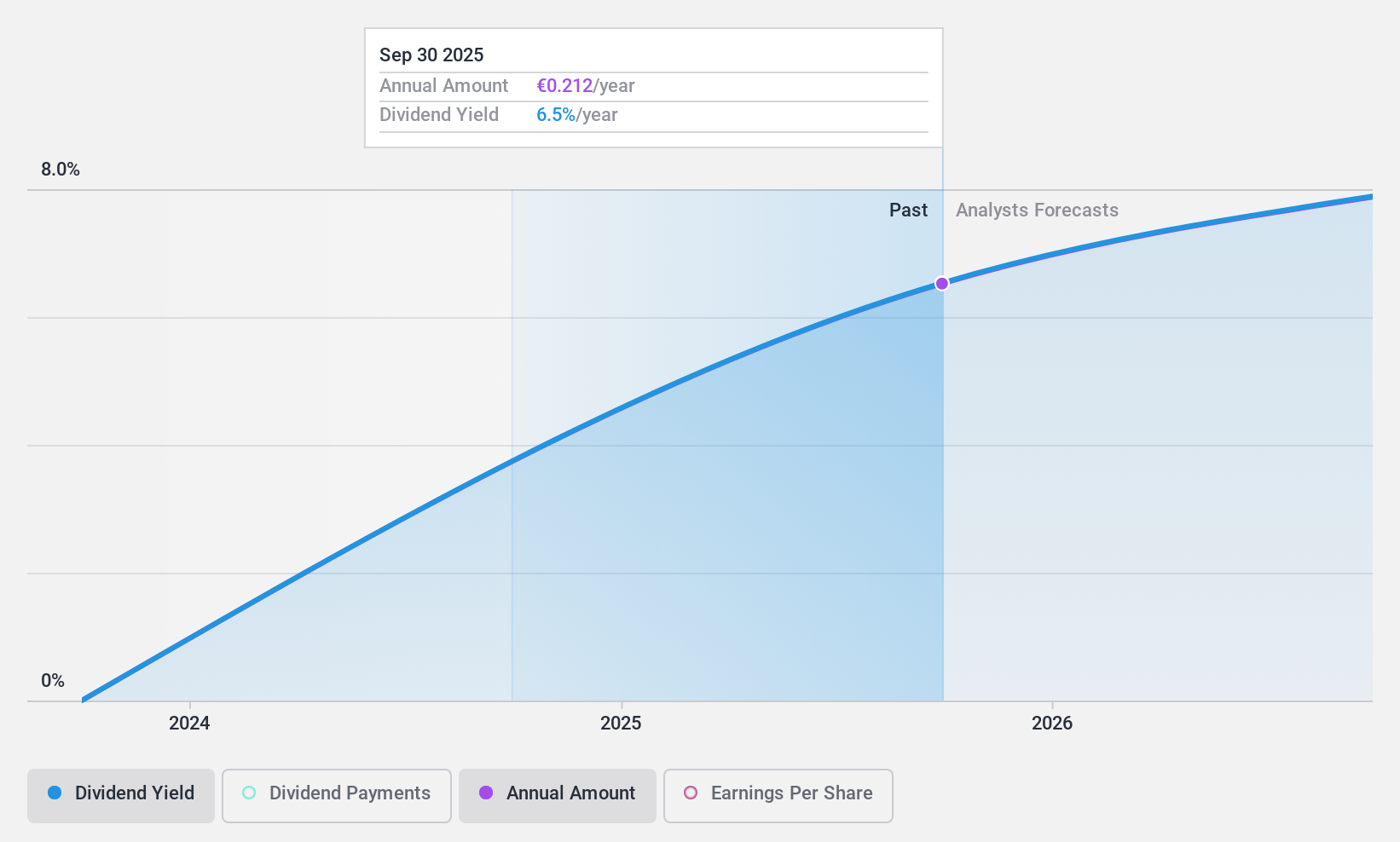

Abitare In (BIT:ABT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abitare In S.p.A. operates in real estate development with a market capitalization of approximately €137.35 million.

Operations: Abitare In S.p.A. generates its revenue primarily from residential and commercial home building activities, totaling €228.58 million.

Dividend Yield: 7.2%

Abitare In (ABT) recently initiated dividend payouts, making its dividend history brief and uncertain in terms of reliability and growth. However, the dividends are well-supported with a payout ratio of 40.9% and a cash payout ratio of 9.1%, suggesting sustainability from both earnings and cash flow perspectives. Despite this positive aspect, ABT's high level of debt could pose risks to future dividend stability. Additionally, significant insider selling over the past three months may raise concerns about its near-term prospects.

- Click to explore a detailed breakdown of our findings in Abitare In's dividend report.

- In light of our recent valuation report, it seems possible that Abitare In is trading behind its estimated value.

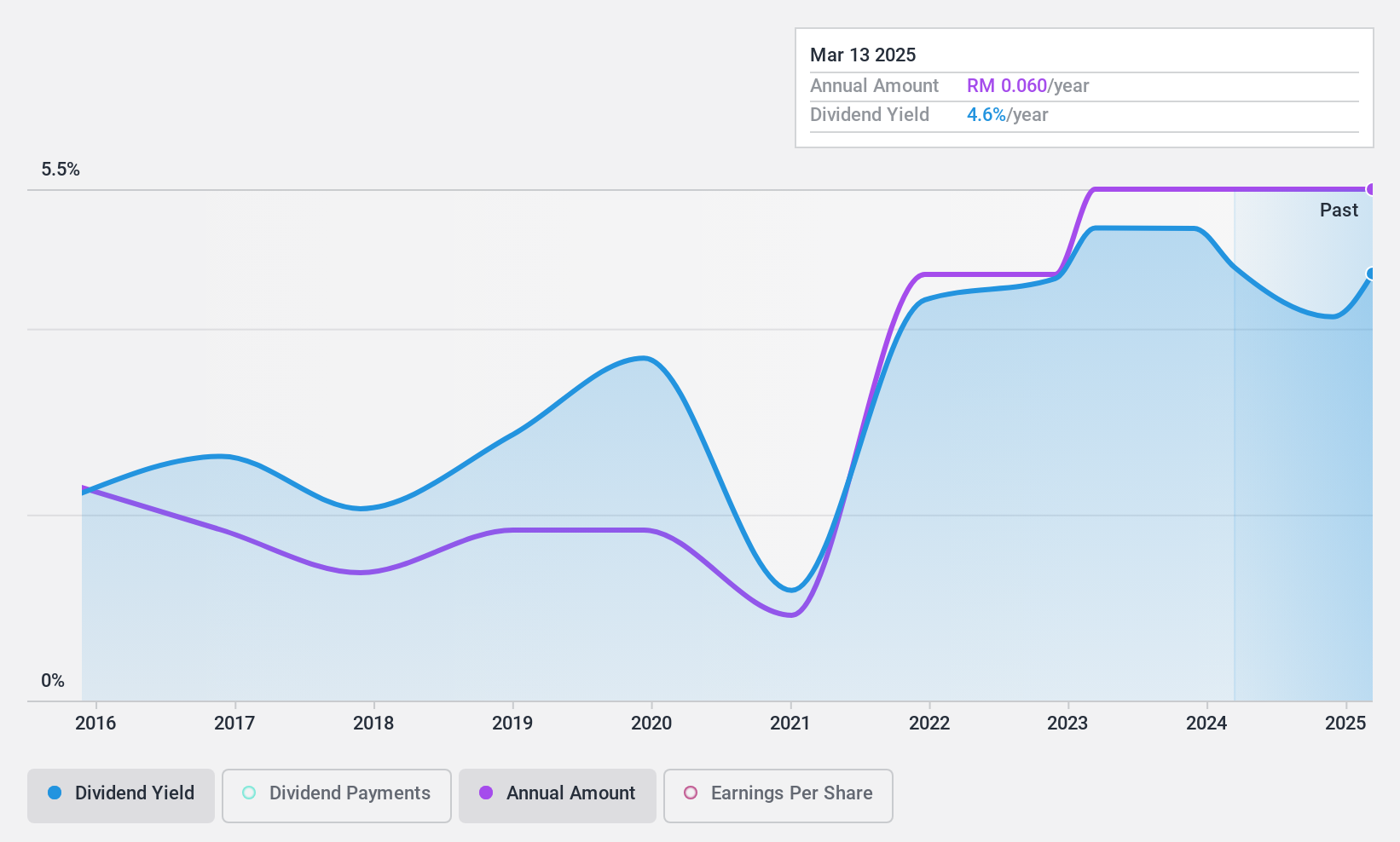

Harbour-Link Group Berhad (KLSE:HARBOUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Harbour-Link Group Berhad, an investment holding company, engages in shipping, marine services, logistics, engineering, and construction across Malaysia, Hong Kong, China, Singapore, and Brunei with a market capitalization of approximately MYR 685.55 million.

Operations: Harbour-Link Group Berhad generates revenue primarily through its Shipping and Marine segment (MYR 587.07 million), Integrated Logistics (MYR 332.66 million), Investment Holding (MYR 85.09 million), Engineering (MYR 39.78 million), and Property Development (MYR 9.09 million).

Dividend Yield: 3.3%

Harbour-Link Group Berhad has experienced a decrease in net profit margin from 17.4% to 8.7% over the past year, indicating reduced profitability. Despite this, the company maintains a low price-to-earnings ratio of 8.8x, below the Malaysian market average of 17.2x, suggesting potential value. Dividend reliability remains a concern due to historical volatility and an overall unstable track record over the past decade. However, dividends are reasonably covered by both earnings (28.9%) and cash flows (41.8%), supporting current payout levels despite a dividend yield (3.3%) that is lower than top market performers.

- Delve into the full analysis dividend report here for a deeper understanding of Harbour-Link Group Berhad.

- Our valuation report here indicates Harbour-Link Group Berhad may be overvalued.

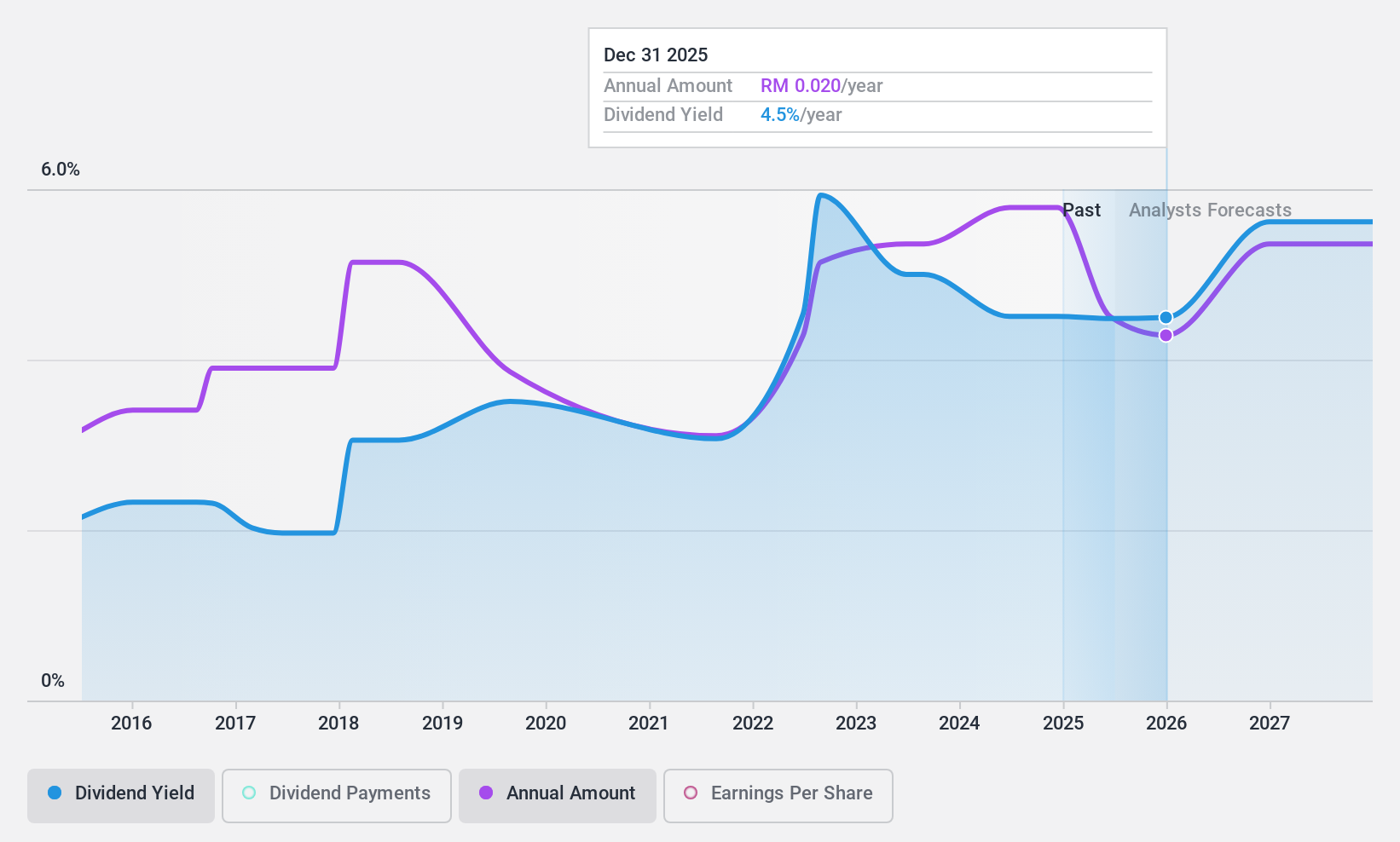

LBS Bina Group Berhad (KLSE:LBS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBS Bina Group Berhad is a Malaysian investment holding company that operates in property development, construction, hospitality, retail, and tourism sectors primarily in Malaysia and China, with a market capitalization of approximately MYR 1.08 billion.

Operations: LBS Bina Group Berhad generates revenue through various segments, with property development being the most significant at MYR 1.71 billion, followed by construction and trading at MYR 818.17 million, management and investment at MYR 151.89 million, motor racing circuit at MYR 23.35 million, and hotel operations contributing MYR 10.28 million.

Dividend Yield: 3.5%

LBS Bina Group Berhad trades at 64.3% below its estimated fair value and has shown a 20.1% annual earnings growth over the past five years, with forecasts predicting further growth of 6.8% annually. Despite this, dividend reliability is questionable due to volatility and an unstable track record over the past decade. Recent increases in dividends, including a final single-tier dividend announced for FY 2023, indicate some positive movement, but with a current yield of 3.46%, it remains low compared to top Malaysian dividend payers at 4.38%. Dividends are well-covered by both earnings (34.8% payout ratio) and cash flows (10.2% cash payout ratio).

- Click here to discover the nuances of LBS Bina Group Berhad with our detailed analytical dividend report.

- Our expertly prepared valuation report LBS Bina Group Berhad implies its share price may be lower than expected.

Make It Happen

- Explore the 1947 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:LBS

LBS Bina Group Berhad

An investment holding company, primarily engages in property development business in Malaysia and Saudi Arabia.

Good value with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion