- Italy

- /

- Commercial Services

- /

- BIT:ABP

Earnings Not Telling The Story For Azienda Bresciana Petroli Nocivelli S.p.A. (BIT:ABP) After Shares Rise 26%

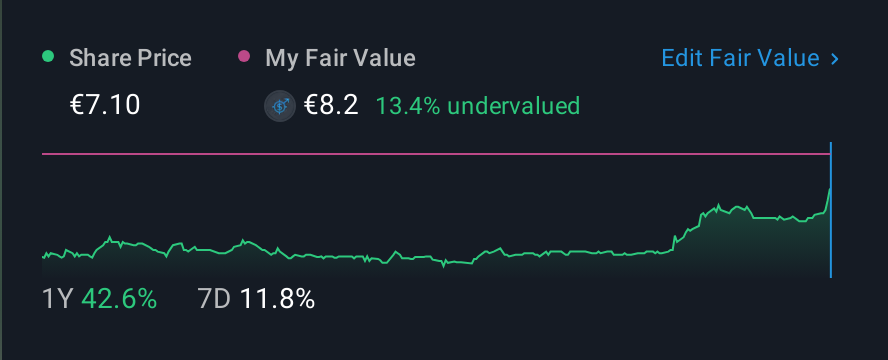

Azienda Bresciana Petroli Nocivelli S.p.A. (BIT:ABP) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

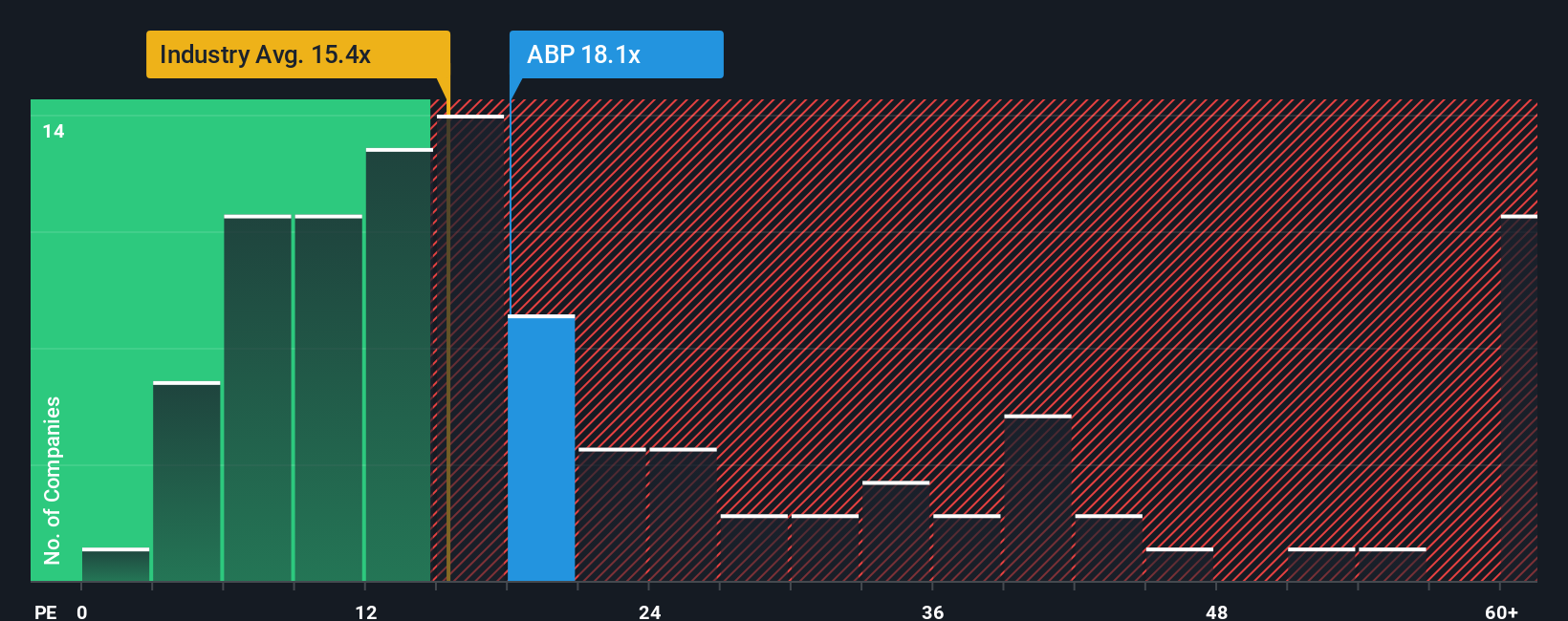

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Azienda Bresciana Petroli Nocivelli's P/E ratio of 18.1x, since the median price-to-earnings (or "P/E") ratio in Italy is also close to 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Azienda Bresciana Petroli Nocivelli's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Azienda Bresciana Petroli Nocivelli

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Azienda Bresciana Petroli Nocivelli's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.4%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 15% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 8.9% per annum as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 20% per year growth forecast for the broader market.

With this information, we find it interesting that Azienda Bresciana Petroli Nocivelli is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Azienda Bresciana Petroli Nocivelli appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Azienda Bresciana Petroli Nocivelli currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Azienda Bresciana Petroli Nocivelli that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ABP

Azienda Bresciana Petroli Nocivelli

Azienda Bresciana Petroli Nocivelli S.p.A.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives