- Italy

- /

- Construction

- /

- BIT:TFIN

What TREVI - Finanziaria Industriale S.p.A.'s (BIT:TFIN) 32% Share Price Gain Is Not Telling You

TREVI - Finanziaria Industriale S.p.A. (BIT:TFIN) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

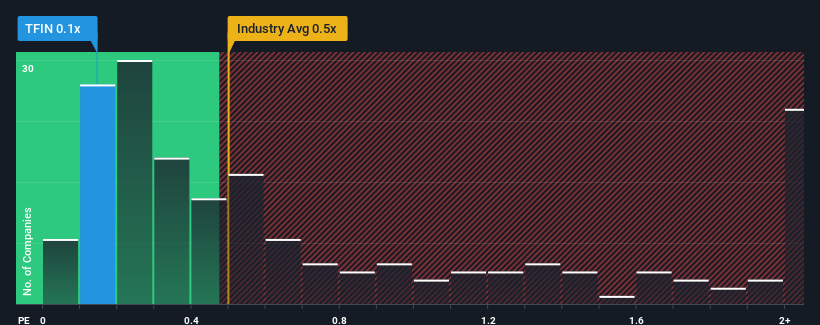

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about TREVI - Finanziaria Industriale's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Italy is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 3 warning signs about TREVI - Finanziaria Industriale. View them for free.See our latest analysis for TREVI - Finanziaria Industriale

How Has TREVI - Finanziaria Industriale Performed Recently?

TREVI - Finanziaria Industriale could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TREVI - Finanziaria Industriale.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, TREVI - Finanziaria Industriale would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 2.8% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially lower than the 13% per year growth forecast for the broader industry.

In light of this, it's curious that TREVI - Finanziaria Industriale's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does TREVI - Finanziaria Industriale's P/S Mean For Investors?

TREVI - Finanziaria Industriale's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that TREVI - Finanziaria Industriale's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 3 warning signs for TREVI - Finanziaria Industriale (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TREVI - Finanziaria Industriale might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TFIN

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives