- Canada

- /

- Metals and Mining

- /

- TSX:EDR

November 2024's Top Value Picks Trading Below Estimated Worth

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, investors are witnessing a surge in major benchmarks driven by expectations of faster earnings growth and lower corporate taxes. Amidst this optimism, identifying stocks trading below their estimated worth becomes crucial for those looking to capitalize on potential undervaluation opportunities. In such an environment, a good stock is often characterized by strong fundamentals that suggest it is priced lower than its intrinsic value, offering potential for appreciation as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$122.86 | US$245.13 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.14 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| TBC Bank Group (LSE:TBCG) | £31.35 | £62.68 | 50% |

| Afya (NasdaqGS:AFYA) | US$16.16 | US$32.25 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.06 | 49.8% |

| XPEL (NasdaqCM:XPEL) | US$45.46 | US$90.91 | 50% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.39 | MX$38.77 | 50% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Salcef Group (BIT:SCF)

Overview: Salcef Group S.p.A. designs, constructs, and maintains railway infrastructure and civil works worldwide with a market cap of €1.58 billion.

Operations: The company's revenue is primarily generated from Heavy Construction, amounting to €912.02 million.

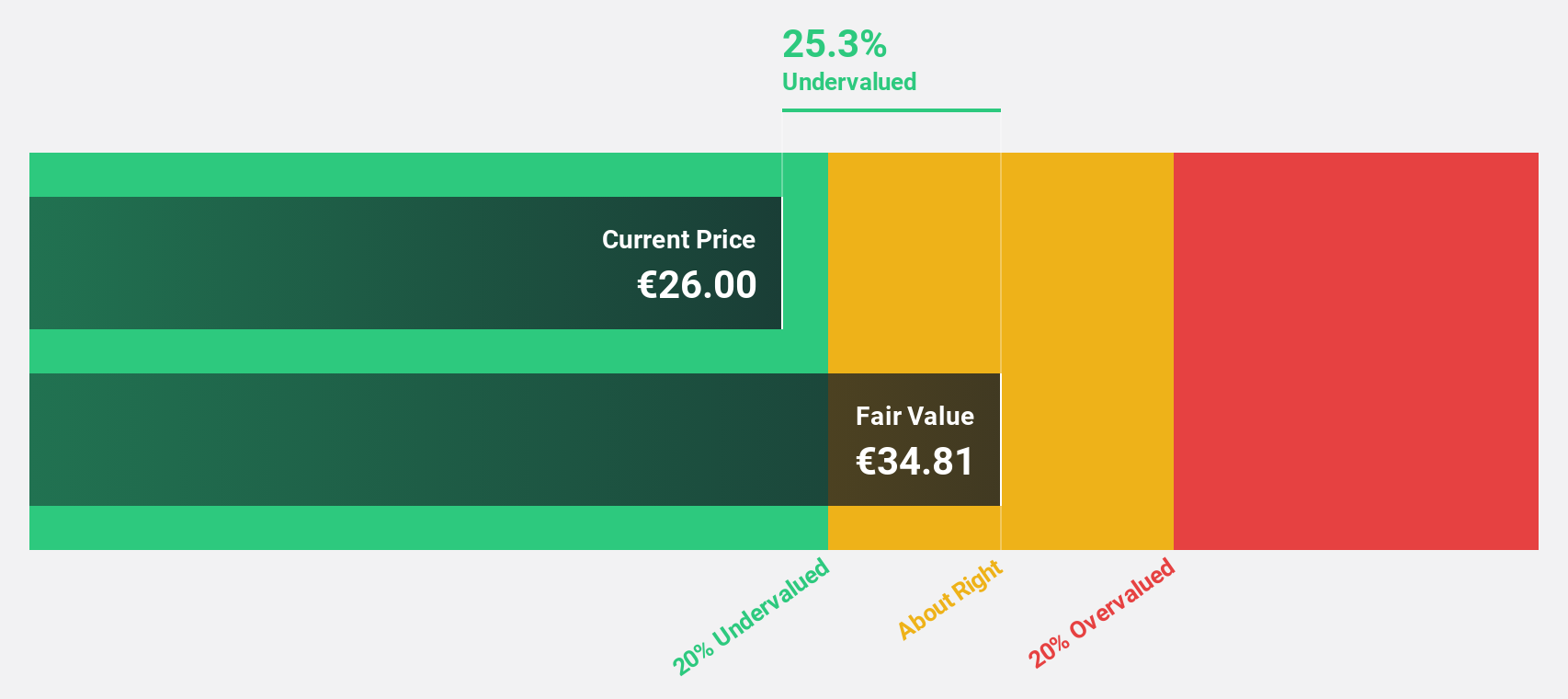

Estimated Discount To Fair Value: 25.4%

Salcef Group is trading at €26, below its estimated fair value of €34.83, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 21.4% annually, outpacing the Italian market's 7.1%. However, the dividend yield of 2.12% isn't well covered by free cash flows. Revenue growth is expected at 11.6% per year, surpassing the local market's rate but not reaching high-growth thresholds above 20%.

- Insights from our recent growth report point to a promising forecast for Salcef Group's business outlook.

- Dive into the specifics of Salcef Group here with our thorough financial health report.

Endeavour Silver (TSX:EDR)

Overview: Endeavour Silver Corp. is a silver mining company involved in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Chile and the United States with a market cap of CA$1.55 billion.

Operations: The company's revenue segments include Bolanitos, generating $65.19 million, and Guanaceví, contributing $160.74 million.

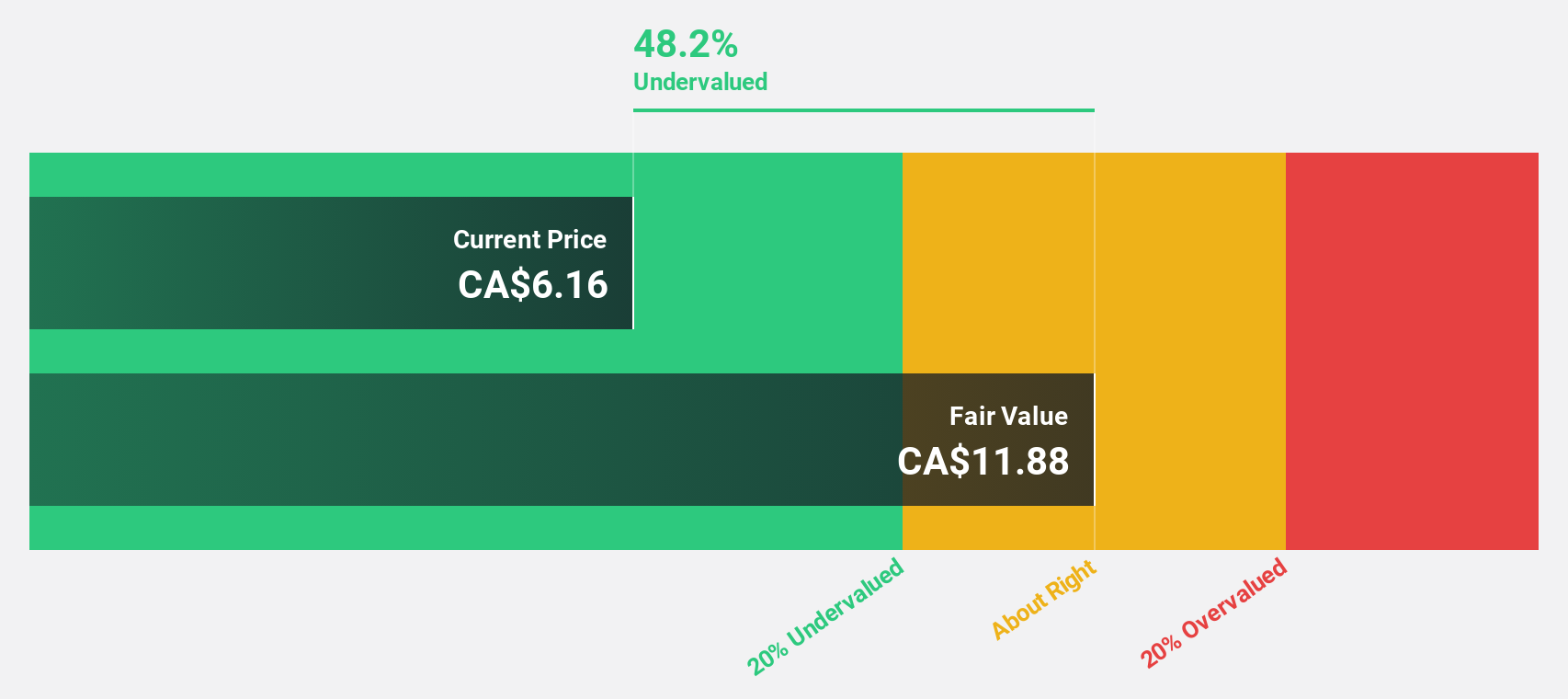

Estimated Discount To Fair Value: 20.7%

Endeavour Silver is trading at CA$6.71, more than 20% below its estimated fair value of CA$8.46, highlighting potential undervaluation based on cash flows. Revenue is forecast to grow at 20.5% annually, outpacing the Canadian market's 7.1%. Despite recent operational challenges and a net loss of US$17.3 million in Q3, the company expects profitability within three years and has ongoing exploration initiatives that could enhance future production capabilities.

- The analysis detailed in our Endeavour Silver growth report hints at robust future financial performance.

- Navigate through the intricacies of Endeavour Silver with our comprehensive financial health report here.

Logan Energy (TSXV:LGN)

Overview: Logan Energy Corp. is involved in the exploration, development, and production of crude oil and natural gas properties, with a market cap of CA$400.52 million.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, amounting to CA$90.27 million.

Estimated Discount To Fair Value: 36.4%

Logan Energy, trading at CA$0.79, is considered undervalued with an estimated fair value of CA$1.24. The company reported significant revenue growth, reaching CAD 29.01 million in Q3 2024 compared to CAD 15.46 million a year ago, and turned a net income of CAD 6.28 million from a loss last year. Despite past shareholder dilution, Logan's revenue is forecast to grow by 46.8% annually, surpassing the Canadian market average significantly.

- Our comprehensive growth report raises the possibility that Logan Energy is poised for substantial financial growth.

- Click here to discover the nuances of Logan Energy with our detailed financial health report.

Summing It All Up

- Embark on your investment journey to our 900 Undervalued Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives