- Italy

- /

- Construction

- /

- BIT:SCF

Analysts Are Betting On Salcef Group S.p.A. (BIT:SCF) With A Big Upgrade This Week

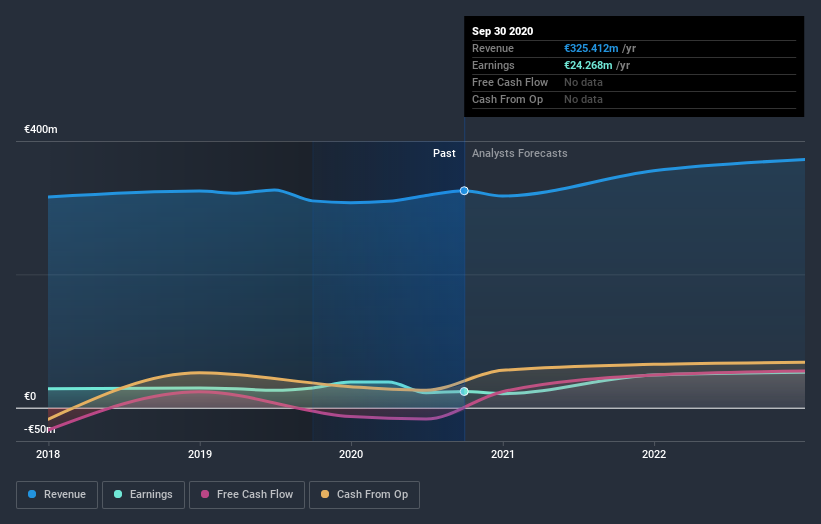

Shareholders in Salcef Group S.p.A. (BIT:SCF) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts have sharply increased their revenue numbers, with a view that Salcef Group will make substantially more sales than they'd previously expected.

Following the upgrade, the current consensus from Salcef Group's dual analysts is for revenues of €373m in 2021 which - if met - would reflect a solid 14% increase on its sales over the past 12 months. Statutory earnings per share are presumed to leap 110% to €1.19. Previously, the analysts had been modelling revenues of €338m and earnings per share (EPS) of €1.14 in 2021. The forecasts seem more optimistic now, with a solid increase in revenue and a small increase to earnings per share estimates.

View our latest analysis for Salcef Group

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of €13.95, suggesting that the forecast performance does not have a long term impact on the company's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Salcef Group at €13.80 per share, while the most bearish prices it at €13.40. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Salcef Group is an easy business to forecast or the underlying assumptions are obvious.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Salcef Group's rate of growth is expected to accelerate meaningfully, with the forecast 14% revenue growth noticeably faster than its historical growth of 8.5% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Salcef Group is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for next year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Salcef Group.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

You can also see our analysis of Salcef Group's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

When trading Salcef Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:SCF

Salcef Group

Designs, constructs, and maintains railway infrastructure and civil works worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion