- Taiwan

- /

- Electrical

- /

- TWSE:3665

Reway Group And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets experience fluctuations, with consumer confidence declining and major indices showing mixed results, investors are increasingly seeking opportunities in stocks that may be trading below their estimated value. In this environment, identifying undervalued stocks like Reway Group can be a strategic move for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7288.65 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Atlas Arteria (ASX:ALX) | A$4.75 | A$9.54 | 50.2% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.36 | CN¥9.03 | 51.7% |

| Merus Power Oyj (HLSE:MERUS) | €3.71 | €7.39 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.05 | US$129.48 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥62.31 | CN¥153.84 | 59.5% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.88 | 49.7% |

Let's dive into some prime choices out of the screener.

Reway Group (BIT:RWY)

Overview: Reway Group S.p.A. operates in Italy through its subsidiaries, focusing on infrastructure preservation and restoration, with a market cap of €241.02 million.

Operations: The company generates revenue from infrastructure preservation and restoration activities in Italy.

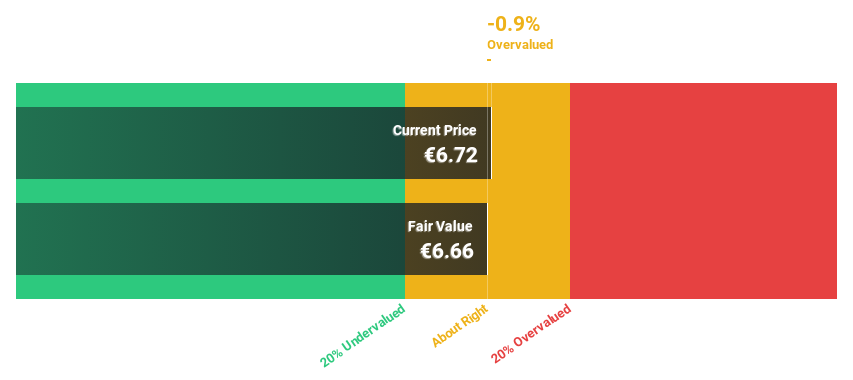

Estimated Discount To Fair Value: 12.1%

Reway Group is trading at €6.26, below its estimated fair value of €7.12, indicating potential undervaluation based on cash flows. Earnings are projected to grow 18.33% annually, outpacing the Italian market's 7%, while revenue is expected to rise by 12.1% per year. Despite strong growth forecasts and a high return on equity forecasted at 26.1% in three years, debt coverage by operating cash flow remains a concern among analysts who expect price appreciation of 24.1%.

- In light of our recent growth report, it seems possible that Reway Group's financial performance will exceed current levels.

- Take a closer look at Reway Group's balance sheet health here in our report.

KeePer Technical Laboratory (TSE:6036)

Overview: KeePer Technical Laboratory Co., Ltd. is a Japanese company that develops, manufactures, and sells car coatings, car washing chemicals and equipment, with a market cap of ¥129.91 billion.

Operations: KeePer Technical Laboratory Co., Ltd. generates revenue through the development, manufacturing, and sale of car coatings, as well as car washing chemicals and equipment in Japan.

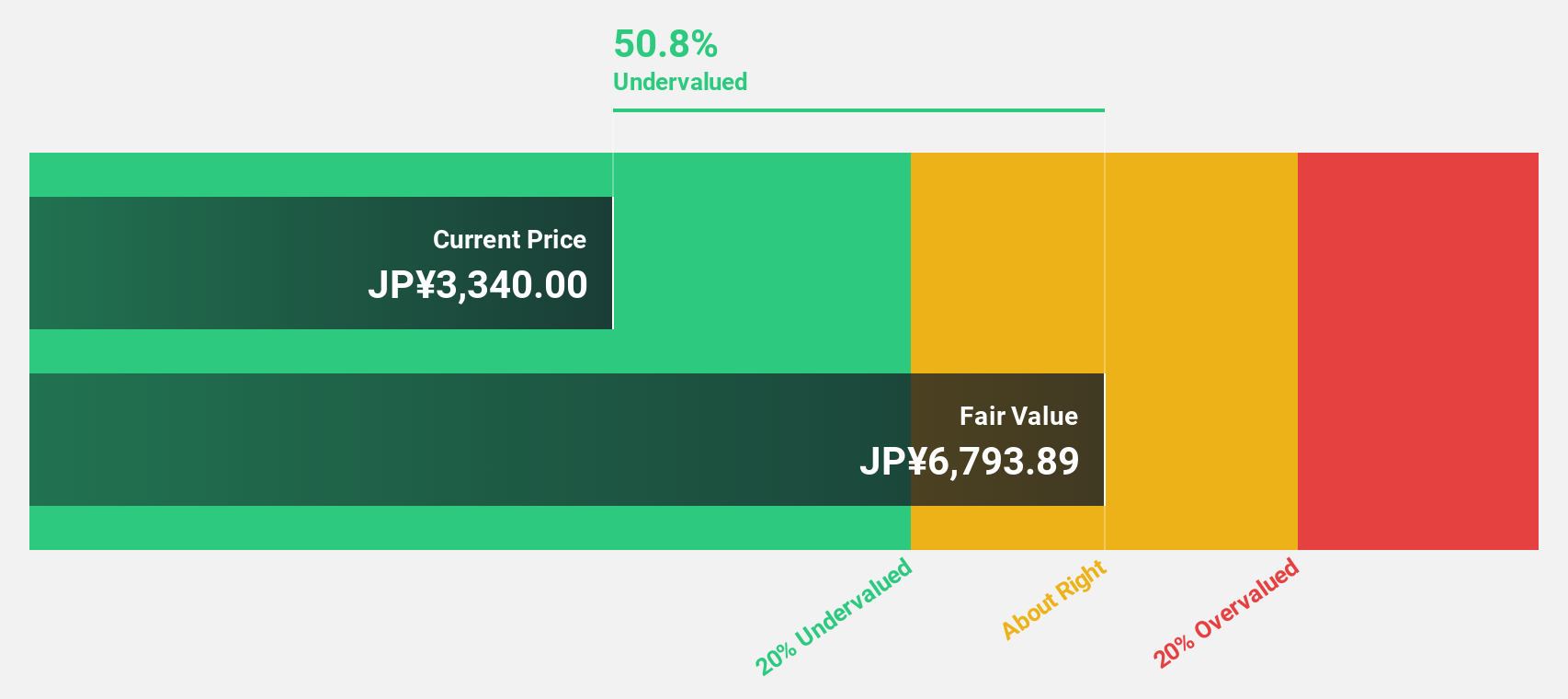

Estimated Discount To Fair Value: 38.6%

KeePer Technical Laboratory is trading at ¥4,760, significantly below its estimated fair value of ¥7,753.74. This suggests potential undervaluation based on cash flows. Earnings are projected to grow at 17.6% annually, surpassing the Japanese market's 7.9%, with revenue expected to increase by 14.9% per year. Despite high share price volatility recently, the company has been expanding its store network and reported strong sales figures for October and November 2024, enhancing growth prospects.

- The analysis detailed in our KeePer Technical Laboratory growth report hints at robust future financial performance.

- Dive into the specifics of KeePer Technical Laboratory here with our thorough financial health report.

Bizlink Holding (TWSE:3665)

Overview: Bizlink Holding Inc. is engaged in the research, design, development, manufacture, and sale of interconnect products for cable harnesses across various international markets including the United States, China, Germany, Malaysia, Taiwan, and Italy; it has a market cap of NT$110.40 billion.

Operations: The company's revenue segments include NT$49.83 billion from the Computer Transmission Department, NT$9.22 billion from the Home Electric Appliance Division, and NT$25.58 billion from the Industrial Application Department.

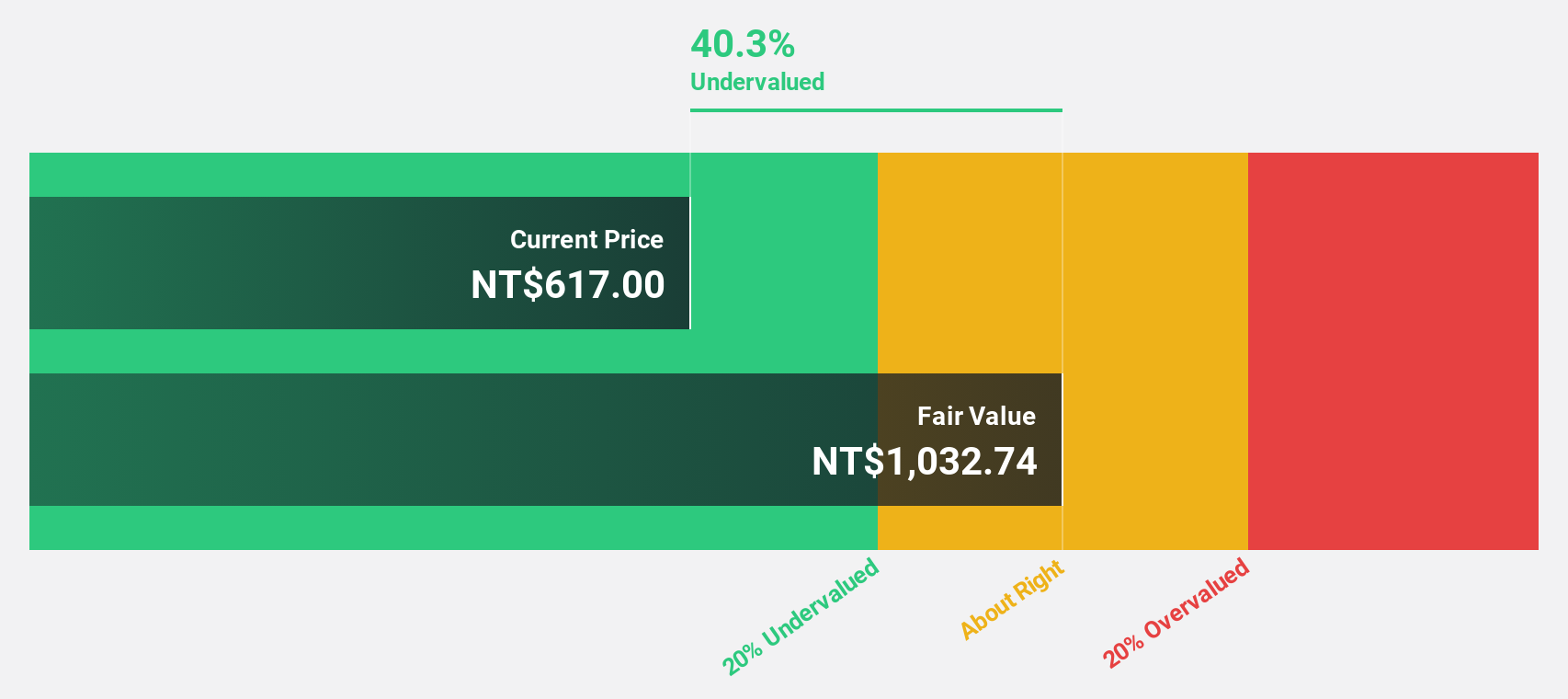

Estimated Discount To Fair Value: 9.9%

Bizlink Holding is trading at NT$612, slightly below its estimated fair value of NT$678.92, indicating potential undervaluation based on cash flows. Despite recent shareholder dilution and high share price volatility, earnings grew 22.6% last year and are forecast to increase by 36.26% annually over the next three years, outpacing the Taiwanese market's growth rate of 19%. Recent sales figures also show steady improvement with a notable rise in net income.

- Our comprehensive growth report raises the possibility that Bizlink Holding is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Bizlink Holding's balance sheet health report.

Make It Happen

- Access the full spectrum of 886 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bizlink Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3665

Bizlink Holding

Researches, designs, develops, manufactures, and sells interconnect products for cable harnesses in the United States, China, Germany, Malaysia, Taiwan, Italy, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives