- Italy

- /

- Construction

- /

- BIT:NXT

Next Geosolutions Europe Among 2 Other Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its longest streak of weekly gains since August 2012, driven by encouraging company results and resilience in defense stocks, investors are increasingly on the lookout for promising opportunities amid mixed inflation data and economic contractions in major economies like Germany and France. In this climate of cautious optimism, identifying stocks with strong fundamentals becomes crucial for navigating market uncertainties; companies that demonstrate robust financial health and strategic positioning can offer potential stability and growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

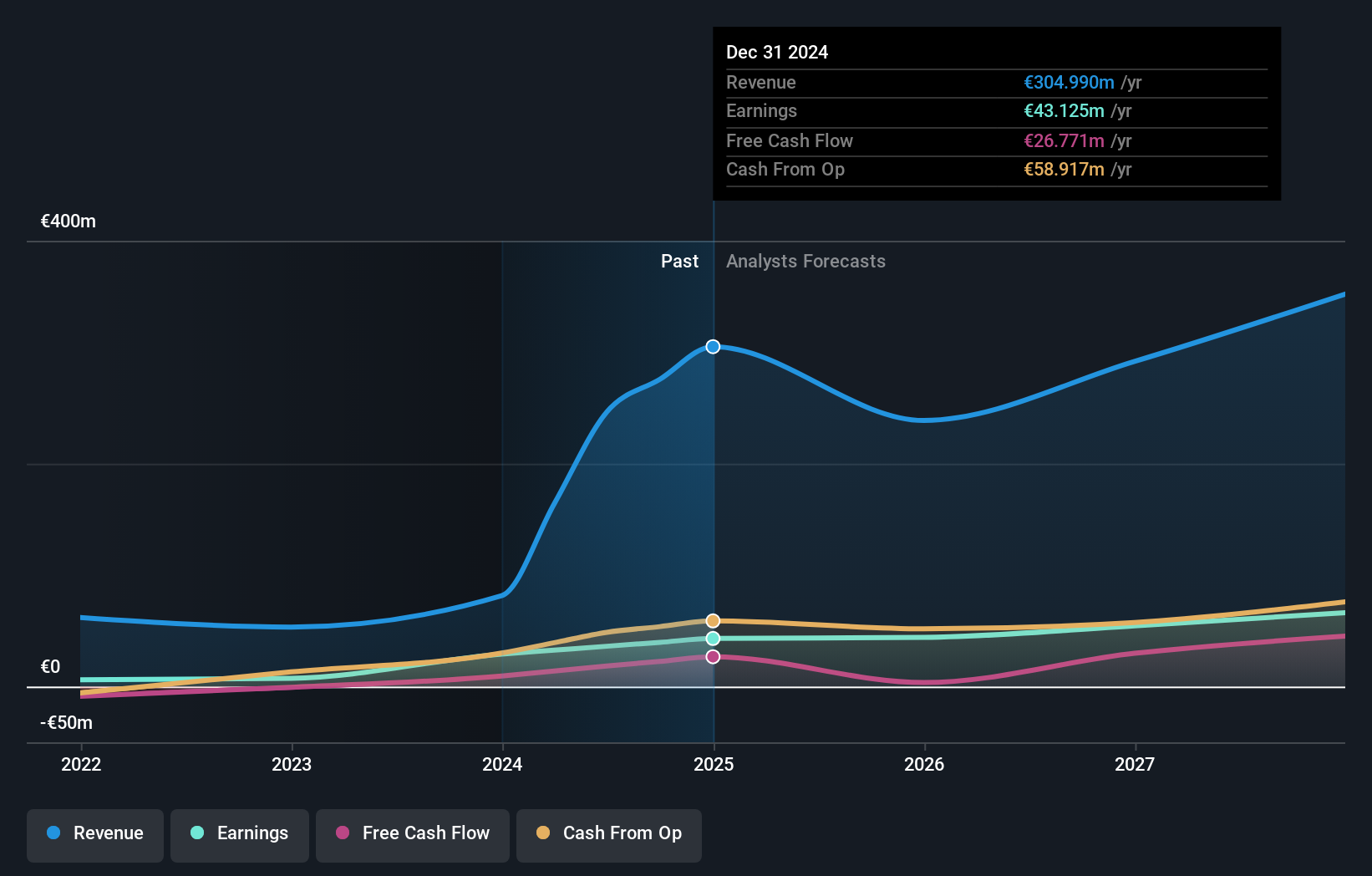

Overview: Next Geosolutions Europe SpA offers geoscience and engineering services to the energy, infrastructure, and utilities sectors with a market capitalization of €428.16 million.

Operations: The company generates revenue primarily from its engineering services, totaling €246.37 million.

Next Geosolutions Europe, a small player in its field, has shown impressive growth with earnings surging 98.9% over the past year, outpacing the Construction industry's 39.5%. Its net profit margin dipped to 14.7% from last year's 27%, yet it remains profitable and trades at an attractive 59.1% below estimated fair value. The company enjoys robust financial health with interest payments well-covered by EBIT at a ratio of 28.8 times and more cash than total debt on its books, suggesting strong operational efficiency and potential for future expansion in its sector.

- Unlock comprehensive insights into our analysis of Next Geosolutions Europe stock in this health report.

Understand Next Geosolutions Europe's track record by examining our Past report.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative is a French financial institution offering a range of banking products and services, with a market capitalization of approximately €1.01 billion.

Operations: The institution generates revenue primarily through its retail banking segment, which accounts for €623.64 million.

Caisse Régionale de Crédit Agricole Mutuel Nord de France, with total assets of €38.9 billion and equity of €5.5 billion, stands out due to its strong financial health. It boasts an appropriate level of bad loans at 1.5% and a sufficient allowance for these at 102%. Total deposits amount to €31.7 billion against loans totaling €28.3 billion, reflecting solid customer trust and low-risk funding sources comprising 95% of liabilities. Moreover, earnings have surged by 31.6%, outpacing the industry average growth rate of 6.2%. Trading at a discount to its estimated fair value by 30.7%, this company presents intriguing potential for investors seeking undervalued opportunities in Europe’s banking sector.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

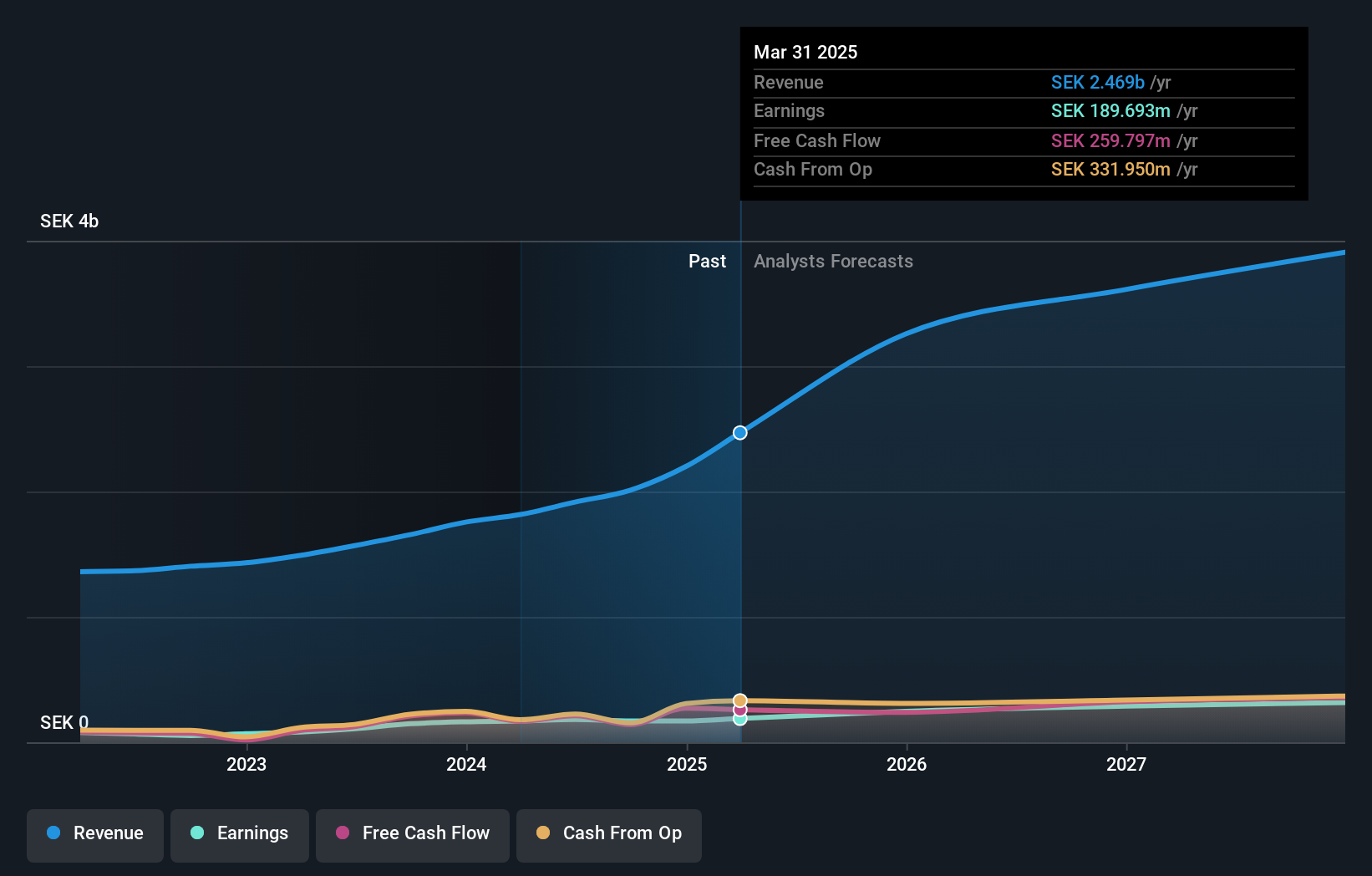

Overview: Zinzino AB (publ) is a direct sales company offering dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK4.88 billion.

Operations: The company generates revenue primarily from its Zinzino segment, including VMA Life, amounting to SEK2.11 billion. It also reports a smaller contribution from Faun at SEK182.15 million.

Zinzino, a nimble player in the retail distributors sector, has been making waves with its impressive financial performance. Over the past year, earnings growth of 3.3% outpaced the industry average of -12.1%, highlighting its competitive edge. The company reported full-year sales of SEK 2.10 billion compared to SEK 1.68 billion last year, while net income rose to SEK 169 million from SEK 164 million previously. With no debt on its books, Zinzino enjoys a solid position and is trading at an attractive valuation—47% below estimated fair value—despite significant insider selling recently observed over three months ago.

- Get an in-depth perspective on Zinzino's performance by reading our health report here.

Gain insights into Zinzino's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 356 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next Geosolutions Europe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NXT

Next Geosolutions Europe

Provides geoscience and engineering services for energy, infrastructure, and utilities sectors.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives