The European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 3.44% as easing tariff concerns have bolstered investor confidence, while economic growth in the eurozone accelerated to 0.4% in the first quarter. Amid this positive backdrop, identifying promising small-cap stocks that can capitalize on these favorable conditions requires a keen eye for companies with strong fundamentals and potential for growth in an evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

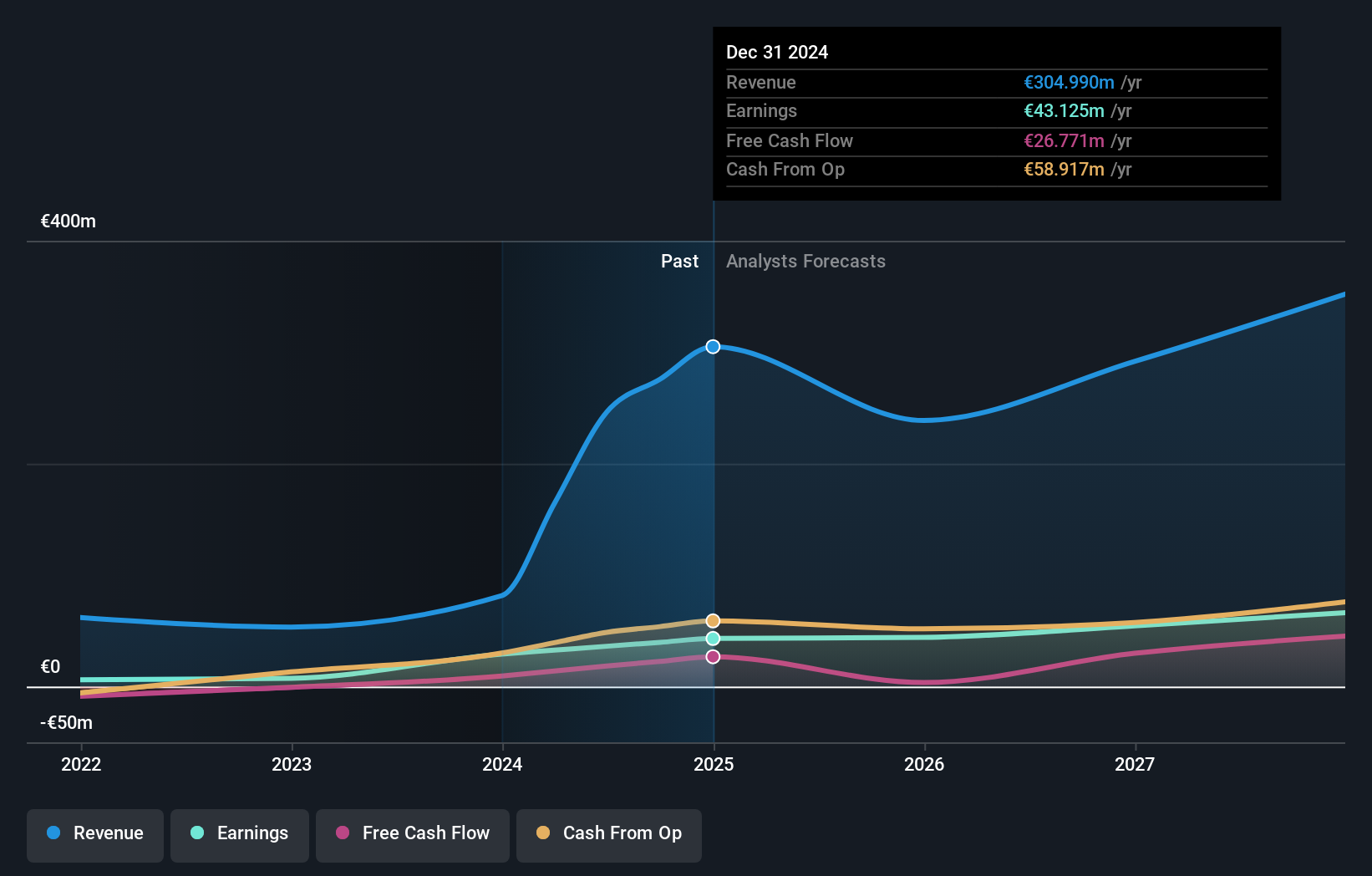

Overview: Next Geosolutions Europe SpA offers geoscience and engineering services for the energy, infrastructure, and utilities sectors with a market capitalization of €386.88 million.

Operations: Next Geosolutions Europe SpA generates revenue primarily from its engineering services, totaling €304.99 million.

Next Geosolutions Europe, a promising name in the sector, has demonstrated significant growth with earnings surging 47.8% over the past year, outpacing the Construction industry's 18%. The company reported sales of €301.8 million for 2024, a substantial increase from €79.9 million in the previous year. Despite net profit margins dipping to 14.1% from last year's 35.8%, NXT remains attractive as it trades at nearly 57.8% below its estimated fair value and maintains strong interest coverage with EBIT covering interest payments by over 92 times, highlighting robust financial health and potential for future expansion.

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK4.79 billion.

Operations: Pexip generates revenue primarily through its video conferencing platform and digital infrastructure services, operating across various global regions. The company has a market cap of NOK4.79 billion.

Pexip Holding, a tech firm with promising prospects, has demonstrated robust financial health, becoming profitable in the last year. The company reported sales of NOK 347.95 million for Q1 2025, up from NOK 291.98 million a year ago, with net income rising to NOK 66.37 million from NOK 45.41 million. Pexip's debt-to-equity ratio impressively dropped from 1.2% to just 0.1% over five years, showcasing effective debt management strategies and ensuring more cash than total debt on hand—an attractive feature for investors eyeing stability and growth potential in the evolving software industry landscape.

- Navigate through the intricacies of Pexip Holding with our comprehensive health report here.

Understand Pexip Holding's track record by examining our Past report.

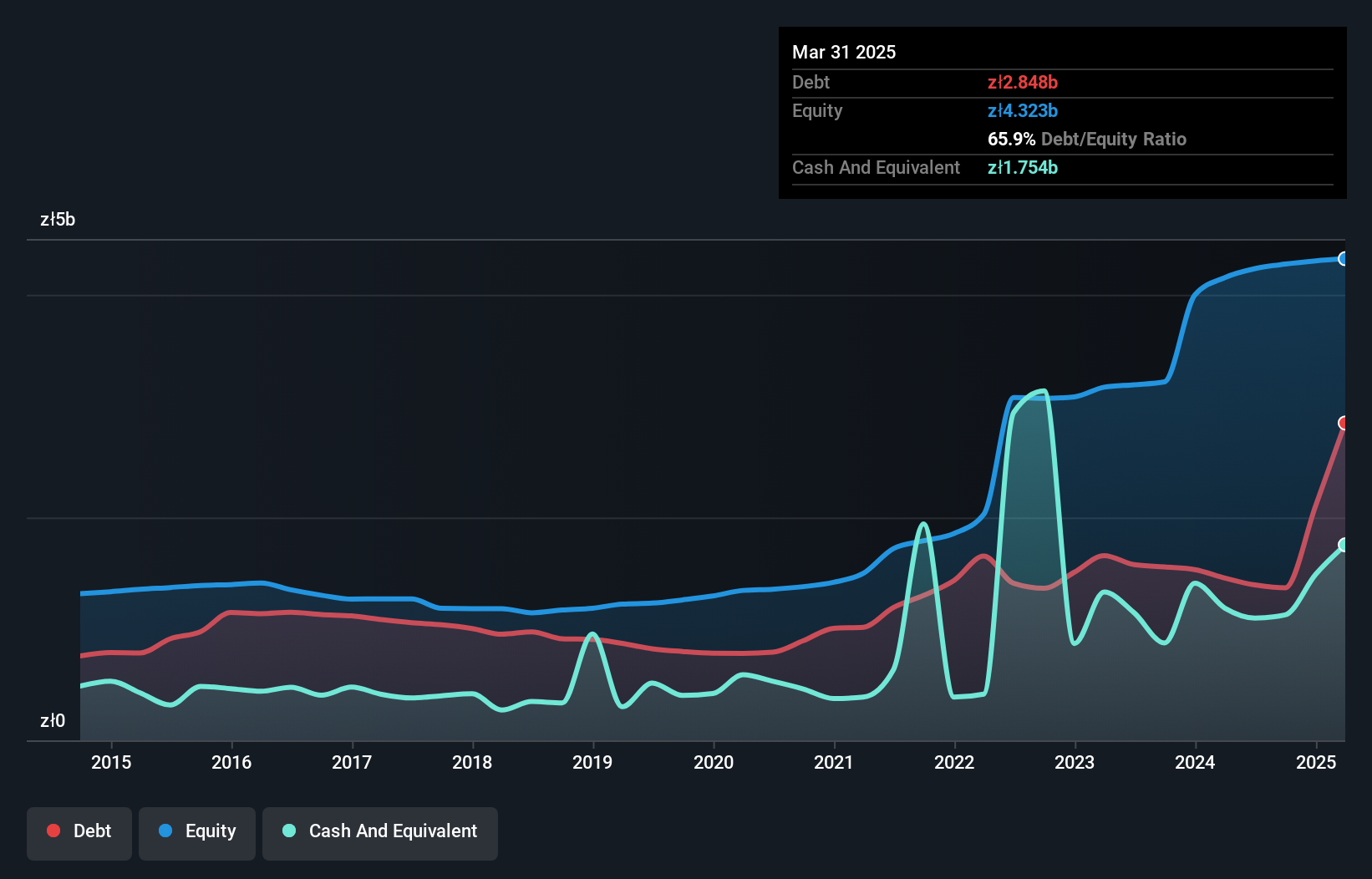

Polenergia (WSE:PEP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Polenergia S.A. operates in the generation, distribution, trading, and sale of electricity both in Poland and internationally, with a market capitalization of PLN5.16 billion.

Operations: Polenergia generates revenue primarily from Trading and Sales, which contributes PLN3.14 billion, and onshore wind farms generating PLN768.81 million. The company also earns from gas and clean fuel at PLN147.65 million and distribution and eMobility at PLN207.89 million.

Polenergia, a notable player in the renewable energy sector, reported sales of PLN 4.31 billion for 2024, down from PLN 5.60 billion the previous year. Despite this dip in sales, net income rose to PLN 301.17 million from PLN 263.59 million, with basic earnings per share improving slightly to PLN 3.9. The company is trading at a significant discount to its estimated fair value and boasts a satisfactory net debt-to-equity ratio of 14%. With interest payments well-covered by EBIT at an impressive multiple of 8x and high-quality earnings reported, Polenergia presents an intriguing investment opportunity despite anticipated future earnings challenges.

- Click here to discover the nuances of Polenergia with our detailed analytical health report.

Gain insights into Polenergia's historical performance by reviewing our past performance report.

Next Steps

- Dive into all 328 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives