- Sweden

- /

- Construction

- /

- OM:SWEC B

February 2025 Value Stocks With Estimated Discounts For Savvy Investors

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, investors are keeping a close eye on the performance of major indices. Despite recent volatility, particularly in the technology sector due to competitive pressures from new AI developments, there remain opportunities for those seeking value in undervalued stocks. In this environment, identifying stocks that offer intrinsic value at discounted prices can be key for investors aiming to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$527.62 | 49.9% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.70 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.358 | £0.71 | 49.7% |

| GlobalData (AIM:DATA) | £1.78 | £3.55 | 49.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$12.14 | HK$24.15 | 49.7% |

| Bufab (OM:BUFAB) | SEK467.40 | SEK928.96 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| Prodways Group (ENXTPA:PWG) | €0.576 | €1.15 | 49.8% |

| South32 (ASX:S32) | A$3.36 | A$6.70 | 49.8% |

| Gold Royalty (NYSEAM:GROY) | US$1.32 | US$2.63 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

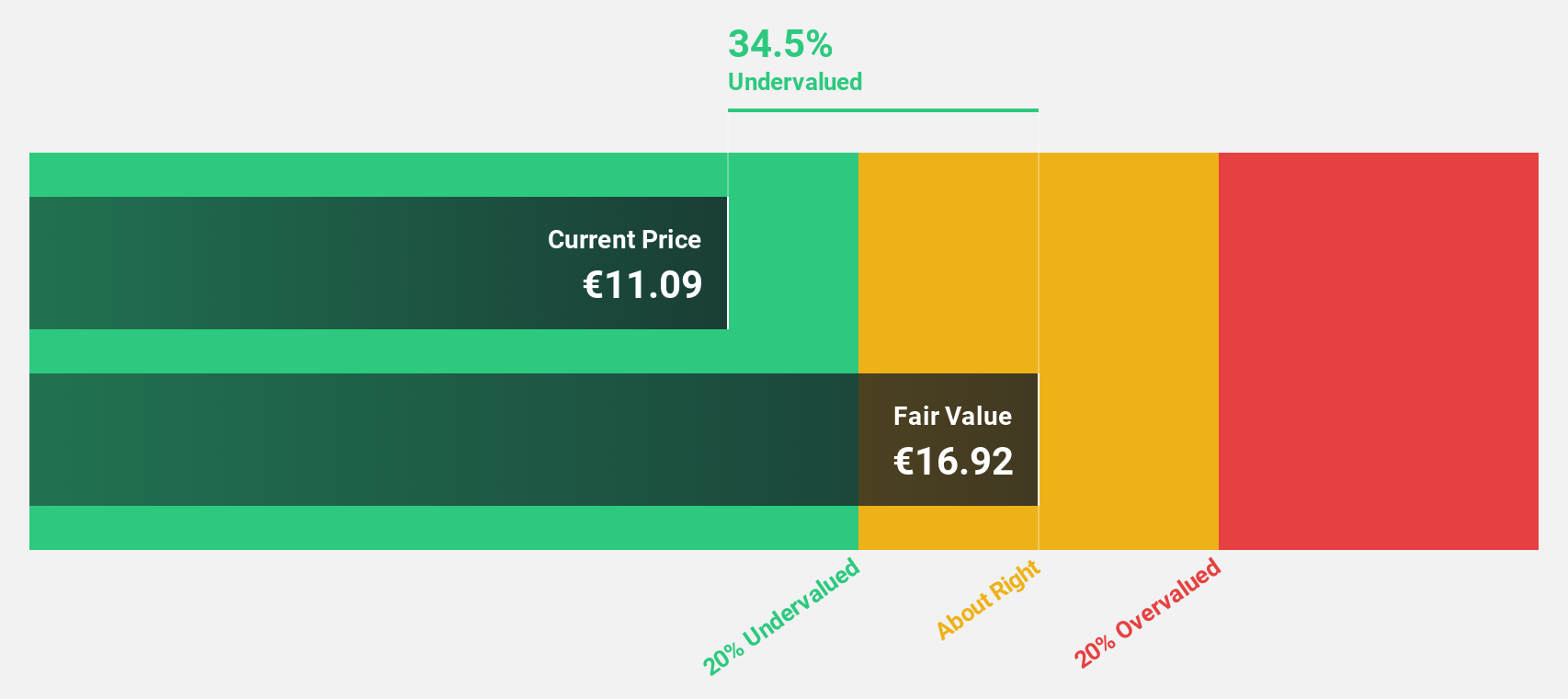

Maire (BIT:MAIRE)

Overview: Maire S.p.A. develops and implements solutions for the energy transition, with a market cap of €3.11 billion.

Operations: The company's revenue segments consist of Integrated E&C Solutions generating €4.98 billion and Sustainable Technology Solutions contributing €321.47 million.

Estimated Discount To Fair Value: 30.9%

Maire is trading at €9.52, significantly below its estimated fair value of €13.77, indicating it could be undervalued based on cash flows. Despite an unstable dividend track record, Maire's earnings are forecast to grow 14.3% annually, outpacing the Italian market's 6.8%. Revenue growth is projected at 10.9% per year, higher than the local market average of 4.2%. Recent presentations at key conferences underscore its active engagement with investors and stakeholders.

- Our expertly prepared growth report on Maire implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Maire.

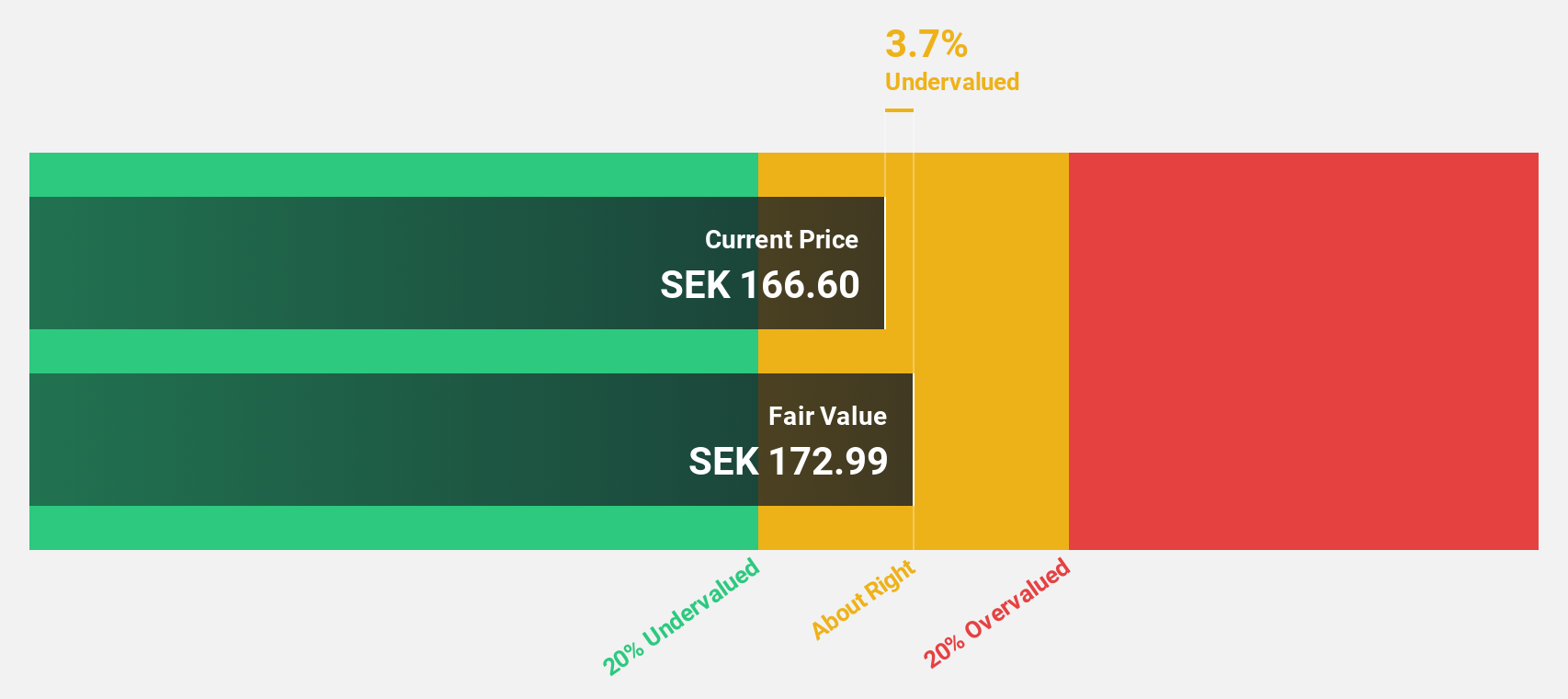

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) is a global provider of architecture and engineering consultancy services with a market cap of SEK62.47 billion.

Operations: Sweco's revenue segments include SEK8.88 billion from Sweden, SEK3.99 billion from Belgium, SEK3.48 billion from Norway, SEK3.62 billion from Finland, SEK3.38 billion from Denmark, SEK3.28 billion from the Netherlands, SEK2.78 billion from Germany & Central Europe, and SEK1.48 billion from the UK.

Estimated Discount To Fair Value: 23.6%

Sweco, trading at SEK173.7, is priced below its fair value estimate of SEK227.38 by over 23%, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at 16.2% annually, surpassing the Swedish market's growth rate of 13.4%. Recent strategic agreements with Danish and Norwegian partners bolster Sweco's position in renewable energy and infrastructure projects, potentially enhancing future revenue streams despite an unstable dividend history.

- Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

- Take a closer look at Sweco's balance sheet health here in our report.

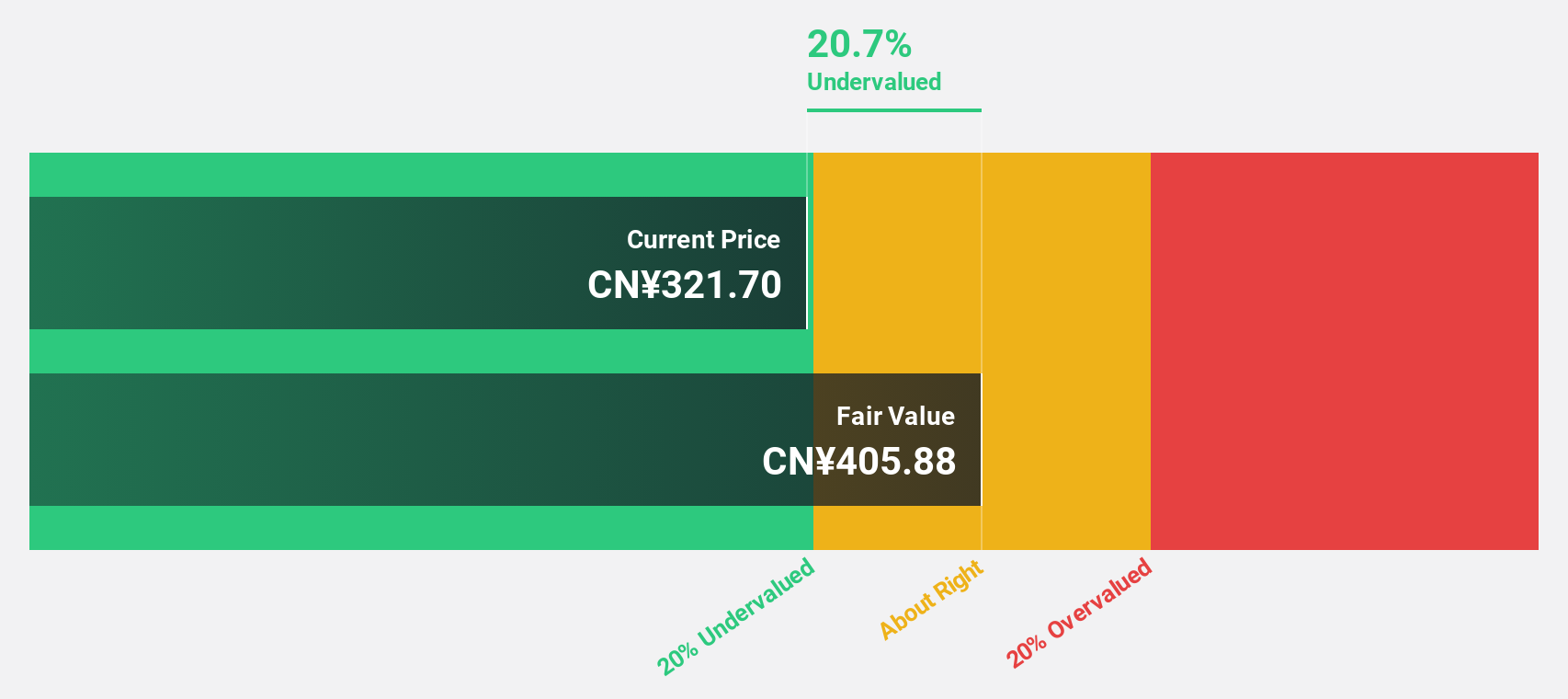

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. is involved in the research, development, production, and sales of beverages in China with a market cap of CN¥126.44 billion.

Operations: The company generates revenue of CN¥15.18 billion from its production, sales, and wholesale of beverages and pre-packaged foods in China.

Estimated Discount To Fair Value: 25.2%

Eastroc Beverage is trading at CN¥243.15, significantly below its estimated fair value of CN¥325.2, suggesting undervaluation based on cash flows. Earnings are expected to grow significantly over the next three years, with a forecasted annual growth rate of 25.1%, outpacing the Chinese market's average. Revenue growth is projected at 23.1% annually, exceeding both market expectations and the company's past performance despite an unstable dividend history.

- The growth report we've compiled suggests that Eastroc Beverage(Group)'s future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Eastroc Beverage(Group)'s balance sheet health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 916 more companies for you to explore.Click here to unveil our expertly curated list of 919 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWEC B

Sweco

Provides architecture and engineering consultancy services worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives