One thing we could say about the covering analyst on Innovatec S.p.A. (BIT:INC) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business. The stock price has risen 7.7% to €0.99 over the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

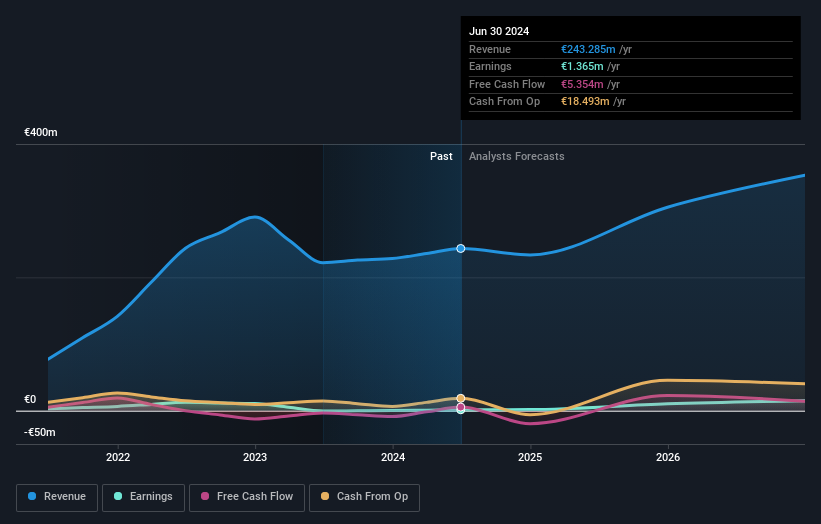

After the downgrade, the consensus from Innovatec's one analyst is for revenues of €234m in 2024, which would reflect a noticeable 4.0% decline in sales compared to the last year of performance. Statutory earnings per share are presumed to shoot up 20% to €0.017. Prior to this update, the analyst had been forecasting revenues of €288m and earnings per share (EPS) of €0.10 in 2024. Indeed, we can see that the analyst is a lot more bearish about Innovatec's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Innovatec

It'll come as no surprise then, to learn that the analyst has cut their price target 22% to €1.40.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 4.0% by the end of 2024. This indicates a significant reduction from annual growth of 39% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 8.4% per year. It's pretty clear that Innovatec's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After such a stark change in sentiment from the analyst, we'd understand if readers now felt a bit wary of Innovatec.

In light of the downgrade, our automated discounted cash flow valuation tool suggests that Innovatec could now be moderately overvalued. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:INC

Innovatec

Provides technologies, processes, products, and services in the areas of energy efficiency and renewables in Italy.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success