- Italy

- /

- Electrical

- /

- BIT:INC

Are Innovatec's (BIT:INC) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Innovatec (BIT:INC).

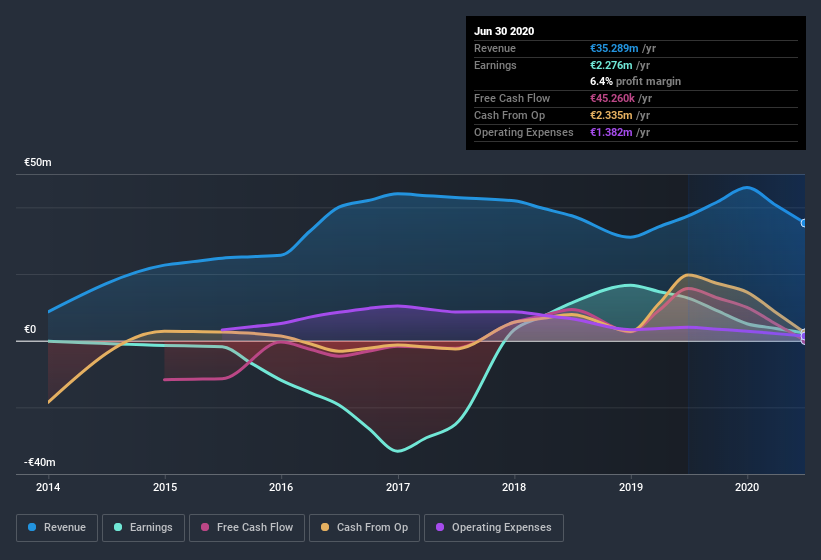

We like the fact that Innovatec made a profit of €2.28m on its revenue of €35.3m, in the last year. Even though revenue is down over the last three years, you can see in the chart below that the company has moved from loss-making to profitable.

View our latest analysis for Innovatec

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, today we'll take a look at Innovatec's cashflow, share issues and unusual items with a view to better understanding the nature of its statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Innovatec.

A Closer Look At Innovatec's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to June 2020, Innovatec recorded an accrual ratio of 0.25. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. To wit, it produced free cash flow of €45k during the period, falling well short of its reported profit of €2.28m. Innovatec's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits. Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively. The good news for shareholders is that Innovatec's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Innovatec issued 27% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Innovatec's EPS by clicking here.

How Is Dilution Impacting Innovatec's Earnings Per Share? (EPS)

Innovatec was losing money three years ago. Even looking at the last year, profit was still down 82%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 86% in the same period. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Innovatec's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

Finally, we should also talk about the €1.5m in unusual items that weighed on profit over the year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. In the twelve months to June 2020, Innovatec had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Innovatec's Profit Performance

Summing up, Innovatec's unusual items suggest that its statutory earnings were temporarily depressed, and its accrual ratio indicates a lack of free cash flow relative to profit. And the dilution means that per-share results are weaker than the bottom line might imply. Based on these factors, we think that Innovatec's statutory profits probably make it seem better than it is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For instance, we've identified 5 warning signs for Innovatec (1 is significant) you should be familiar with.

Our examination of Innovatec has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Innovatec or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:INC

Innovatec

Provides technologies, processes, products, and services in the areas of energy efficiency and renewables in Italy.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026