- Italy

- /

- Electrical

- /

- BIT:INC

Announcing: Innovatec (BIT:INC) Stock Soared An Exciting 485% In The Last Three Years

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One such superstar is Innovatec S.p.A. (BIT:INC), which saw its share price soar 485% in three years. Also pleasing for shareholders was the 372% gain in the last three months.

Check out our latest analysis for Innovatec

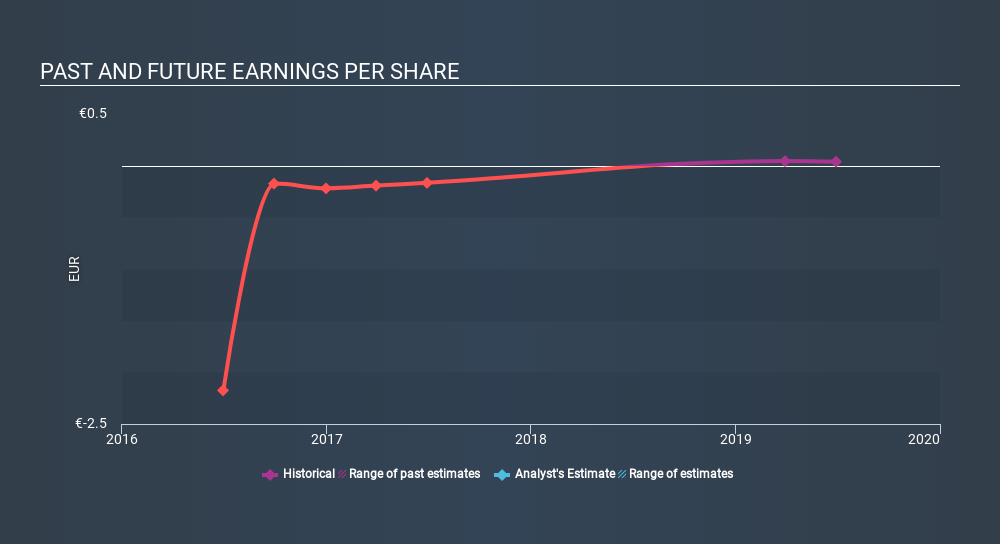

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Innovatec became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time.

It might be well worthwhile taking a look at our free report on Innovatec's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Innovatec's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Innovatec hasn't been paying dividends, but its TSR of 485% exceeds its share price return of 485%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Innovatec has rewarded shareholders with a total shareholder return of 420% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9.0% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:INC

Innovatec

Provides technologies, processes, products, and services in the areas of energy efficiency and renewables in Italy.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion