Despite BIFIRE S.p.A.'s (BIT:FIRE) recent earnings report having lackluster headline numbers, the market responded positively. We think that shareholders might be missing some concerning factors that our analysis found.

Check out our latest analysis for BIFIRE

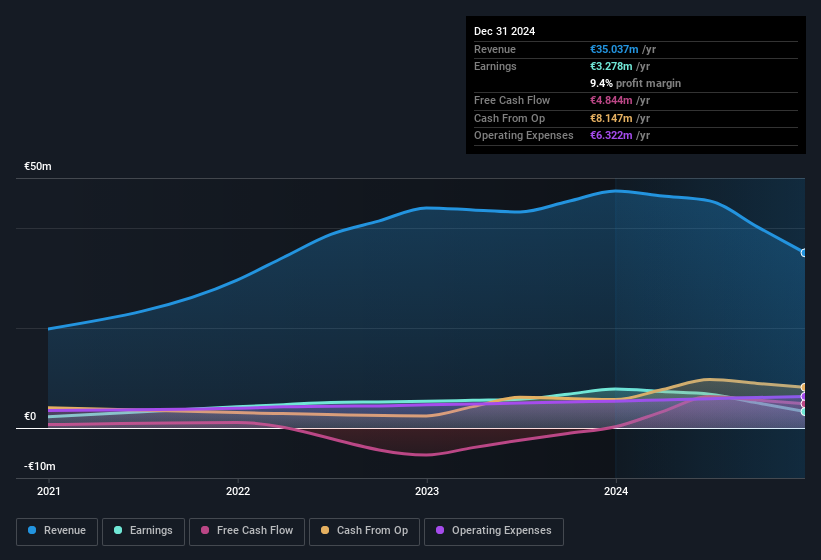

The Power Of Non-Operating Revenue

Companies will classify their revenue streams as either operating revenue or other revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that BIFIRE saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from €1.92m last year to €2.86m this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On BIFIRE's Profit Performance

As discussed above, BIFIRE's sharp increase in non-operating revenue boosted its profit over the last year, and if that non-operating revenue is not repeated, then the trailing twelve months profit probably isn't as good as it seems. Because of this, we think that it may be that BIFIRE's statutory profits are better than its underlying earnings power. The good news is that, its earnings per share increased by 20% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. While conducting our analysis, we found that BIFIRE has 3 warning signs and it would be unwise to ignore them.

Today we've zoomed in on a single data point to better understand the nature of BIFIRE's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BIFIRE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:FIRE

BIFIRE

Manufactures and sells products for thermal insulation and fire protection in Italy and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)