Danieli & C. Officine Meccaniche S.p.A.'s (BIT:DAN) biggest owners are individual investors who got richer after stock soared 3.7% last week

Every investor in Danieli & C. Officine Meccaniche S.p.A. (BIT:DAN) should be aware of the most powerful shareholder groups. We can see that individual investors own the lion's share in the company with 34% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, individual investors collectively scored the highest last week as the company hit €1.3b market cap following a 3.7% gain in the stock.

In the chart below, we zoom in on the different ownership groups of Danieli & C. Officine Meccaniche.

See our latest analysis for Danieli & C. Officine Meccaniche

What Does The Institutional Ownership Tell Us About Danieli & C. Officine Meccaniche?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

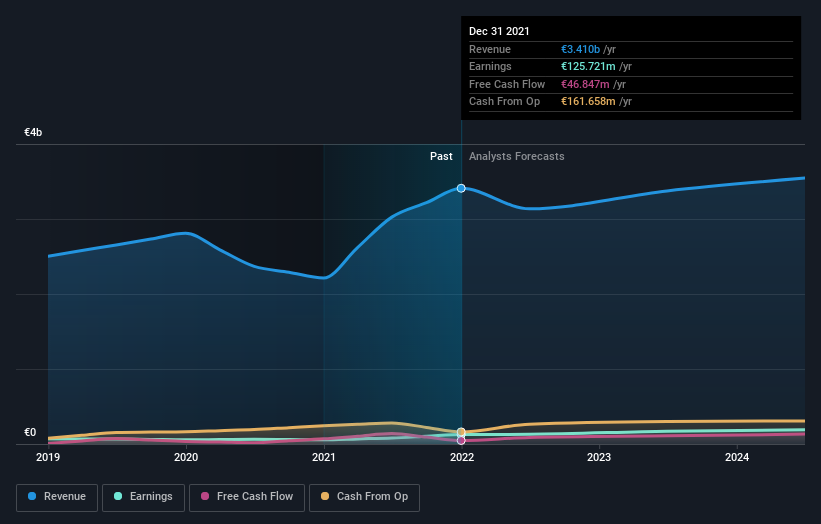

As you can see, institutional investors have a fair amount of stake in Danieli & C. Officine Meccaniche. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Danieli & C. Officine Meccaniche's earnings history below. Of course, the future is what really matters.

Danieli & C. Officine Meccaniche is not owned by hedge funds. Our data shows that Sind International S.R.L. is the largest shareholder with 34% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 4.2% and 3.4%, of the shares outstanding, respectively.

On further inspection, we found that more than half the company's shares are owned by the top 8 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Danieli & C. Officine Meccaniche

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data cannot confirm that board members are holding shares personally. Given we are not picking up on insider ownership, we may have missing data. Therefore, it would be interesting to assess the CEO compensation and tenure, here.

General Public Ownership

The general public-- including retail investors -- own 34% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 34%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Danieli & C. Officine Meccaniche better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Danieli & C. Officine Meccaniche .

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DAN

Danieli & C. Officine Meccaniche

Designs, builds, and sells plants for the iron and steel industry in Europe, Russia, the Middle East, the Americas, and South East Asia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026