- Germany

- /

- Auto Components

- /

- XTRA:SFQ

European Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As European markets experience a boost, with the STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns and stronger-than-expected economic growth in the eurozone, investors are increasingly looking towards dividend stocks as a stable income source amidst fluctuating market conditions. In this environment, selecting stocks with consistent dividend payouts and solid financial health can be a prudent strategy for those seeking to balance potential risks and returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.71% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.31% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.41% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.01% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.50% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.23% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.09% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.31% | ★★★★★★ |

| Bank Handlowy w Warszawie (WSE:BHW) | 9.55% | ★★★★★☆ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

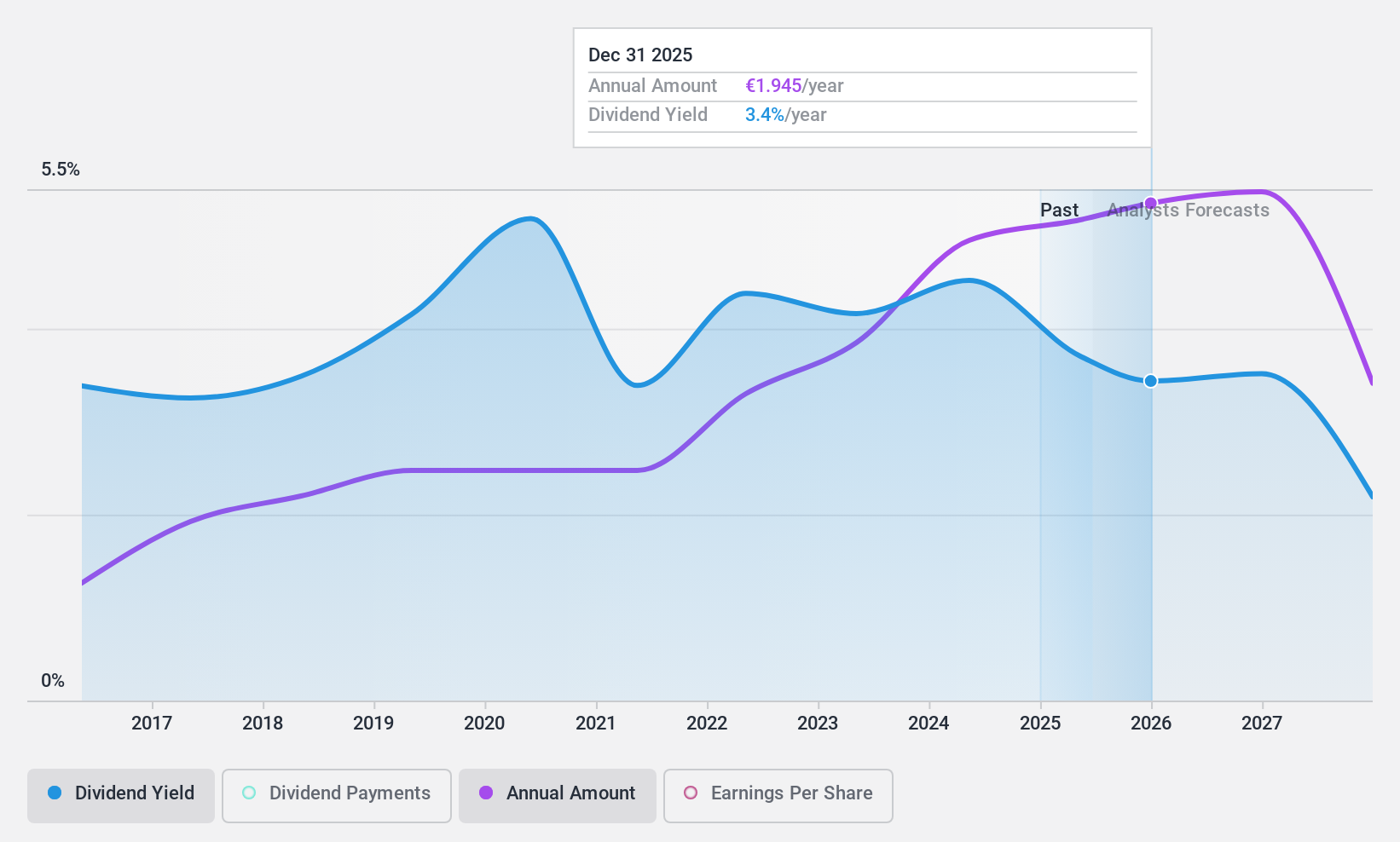

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and tools in Italy, Europe, and internationally with a market cap of €860.93 million.

Operations: Cembre S.p.A. generates revenue primarily from its Electric Connectors and Related Tools segment, amounting to €229.72 million.

Dividend Yield: 3.7%

Cembre's dividend payments have been stable and reliable over the past decade, with recent increases reflecting a commitment to shareholder returns. However, the current dividend yield of 3.67% is below Italy's top-tier payers and not well covered by free cash flows due to a high cash payout ratio of 190.2%. Despite earnings growth of 4.3% last year and a reasonable payout ratio of 74.2%, sustainability concerns remain due to limited coverage by earnings or cash flows.

- Get an in-depth perspective on Cembre's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Cembre shares in the market.

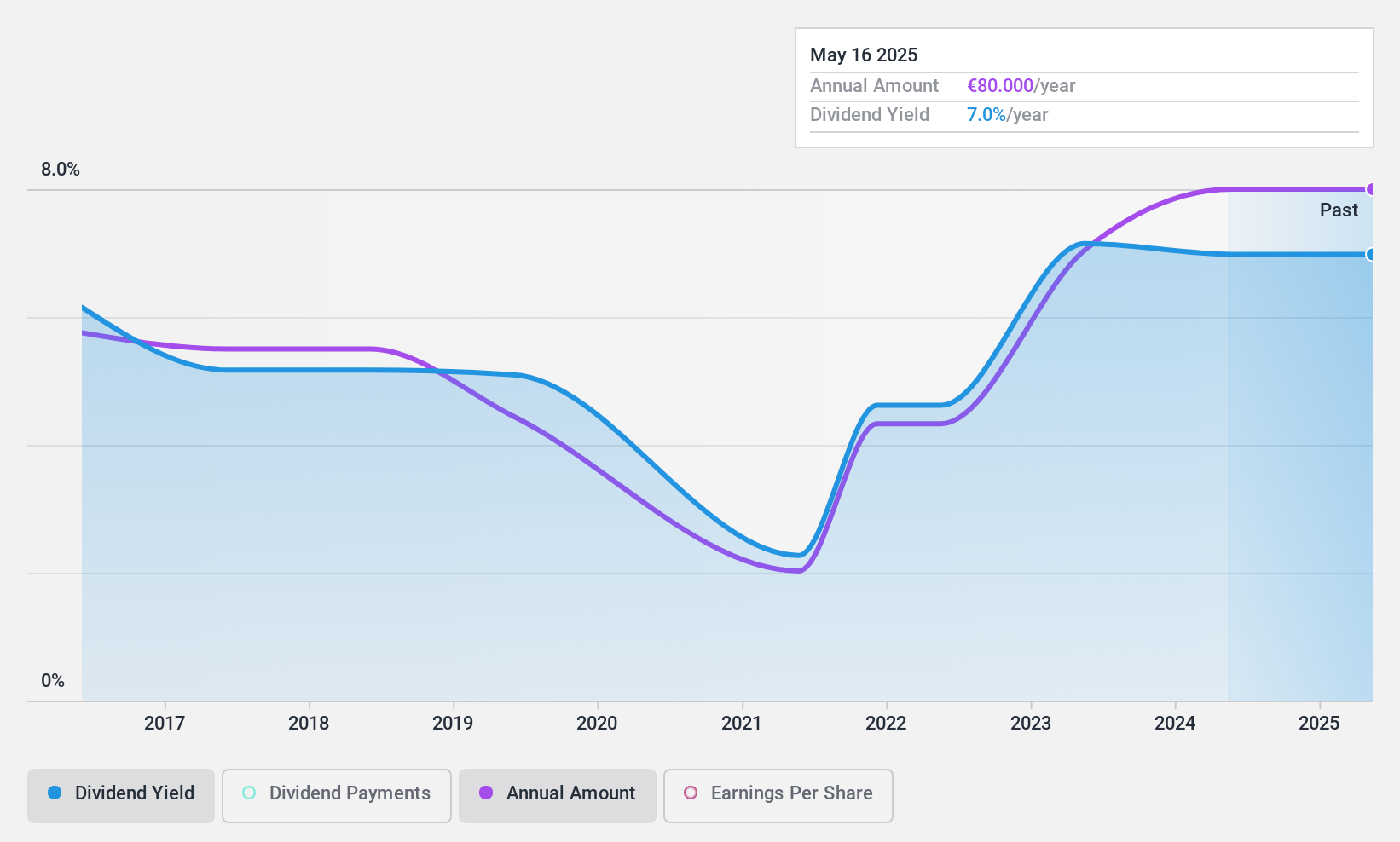

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, with a market cap of €716.25 million, provides banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally through its subsidiaries.

Operations: CFM Indosuez Wealth Management SA's revenue is derived from offering comprehensive banking and financial services to a diverse clientele, including private investors, businesses, institutions, and professionals across Monaco and international markets.

Dividend Yield: 6.4%

CFM Indosuez Wealth Management's recent dividend announcement of €78 per share marks a decrease, highlighting its volatility over the past decade. Despite being in the top 25% for dividend yield in France at 6.4%, its track record remains unstable and unreliable. The company has a reasonable payout ratio of 70.8%, suggesting dividends are covered by earnings, yet the low allowance for bad loans (34%) indicates potential financial vulnerabilities.

- Delve into the full analysis dividend report here for a deeper understanding of CFM Indosuez Wealth Management.

- Our expertly prepared valuation report CFM Indosuez Wealth Management implies its share price may be too high.

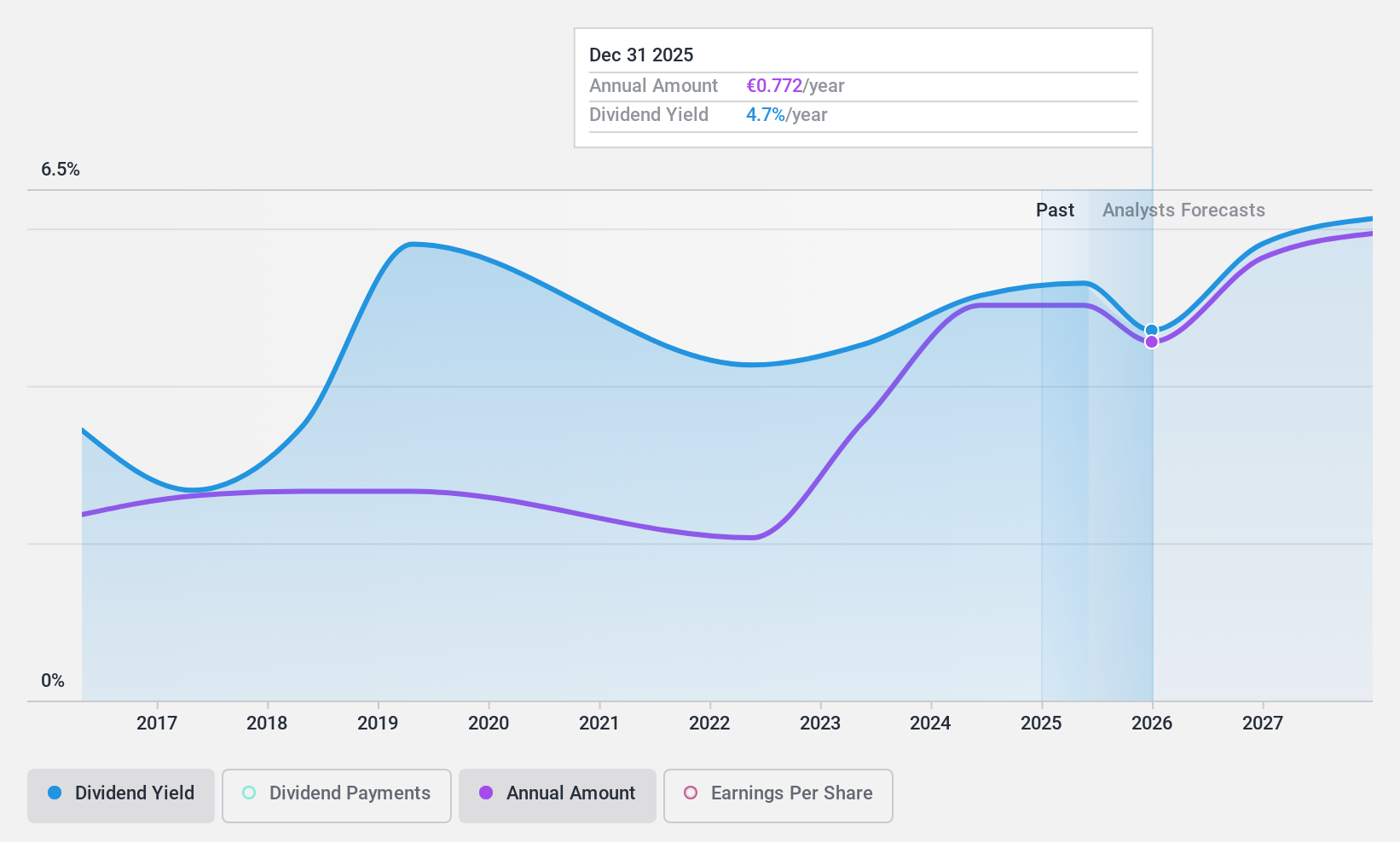

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market cap of €767.16 million.

Operations: SAF-Holland SE generates its revenue from three main segments: €747.34 million from the Americas, €246.65 million from Asia/Pacific (APAC)/China/India, and €882.76 million from Europe, The Middle East, and Africa (EMEA).

Dividend Yield: 5%

SAF-Holland's dividend of €0.85 per share, payable on May 23, 2025, is supported by a low payout ratio of 49.9% and cash payout ratio of 26.9%, indicating strong coverage by earnings and cash flows despite past volatility in payments. The dividend yield is among the top 25% in Germany at 5.03%. However, the company's high debt level and unstable dividend history may concern some investors seeking consistent income streams.

- Unlock comprehensive insights into our analysis of SAF-Holland stock in this dividend report.

- Upon reviewing our latest valuation report, SAF-Holland's share price might be too pessimistic.

Seize The Opportunity

- Reveal the 235 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SFQ

SAF-Holland

Manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives