- Italy

- /

- Electrical

- /

- BIT:CMB

Assessing Cembre (BIT:CMB) Valuation Following Strong Half-Year Earnings Growth

Reviewed by Simply Wall St

The latest earnings announcement from Cembre (BIT:CMB) has definitely caught the market’s attention. The company just reported half-year results showing increased sales, revenue, and net income compared to the same period last year, signaling steady growth and solid execution. For shareholders and prospective investors alike, strong earnings can often shift the risk-reward discussion. This serves as a reminder to revisit what the business is worth and how future growth might be reflected in the current price.

These results come as Cembre’s share price has shown upward momentum over the past year, delivering a 61% total return. That puts it well ahead of most sector peers, even as the past month has seen a slight pullback after earlier strong gains. The pattern mirrors the company’s consistent fundamentals, with revenue and net income both posting healthy annual growth, and the earnings report reinforces a long-term trend of compounding returns that is tough to ignore.

With a track record like this, the big question is whether Cembre’s valuation still offers room for upside, or if the market is already factoring in another chapter of growth. Is now the right time to buy, or is the best of the story already reflected in the price?

Price-to-Earnings of 20.7x: Is it justified?

Based on the current valuation, Cembre trades at a price-to-earnings (P/E) ratio of 20.7, which is slightly below the average for the European Electrical industry but higher than the estimated fair P/E of 13.4. This suggests the market is attaching a premium to Cembre’s recent growth performance and outlook.

The price-to-earnings ratio measures how much investors are willing to pay for each euro of earnings and is a standard benchmark for evaluating profitability versus share price in this sector. For industrial companies like Cembre, sustained earnings growth and consistent profitability often justify a higher multiple, especially compared to peers with weaker records.

However, Cembre’s elevated multiple implies investors expect continued strong results, despite forecasts for more moderate earnings growth ahead. This raises the question of whether optimism is running ahead of fundamentals, or if the company’s compounding performance track record supports this premium.

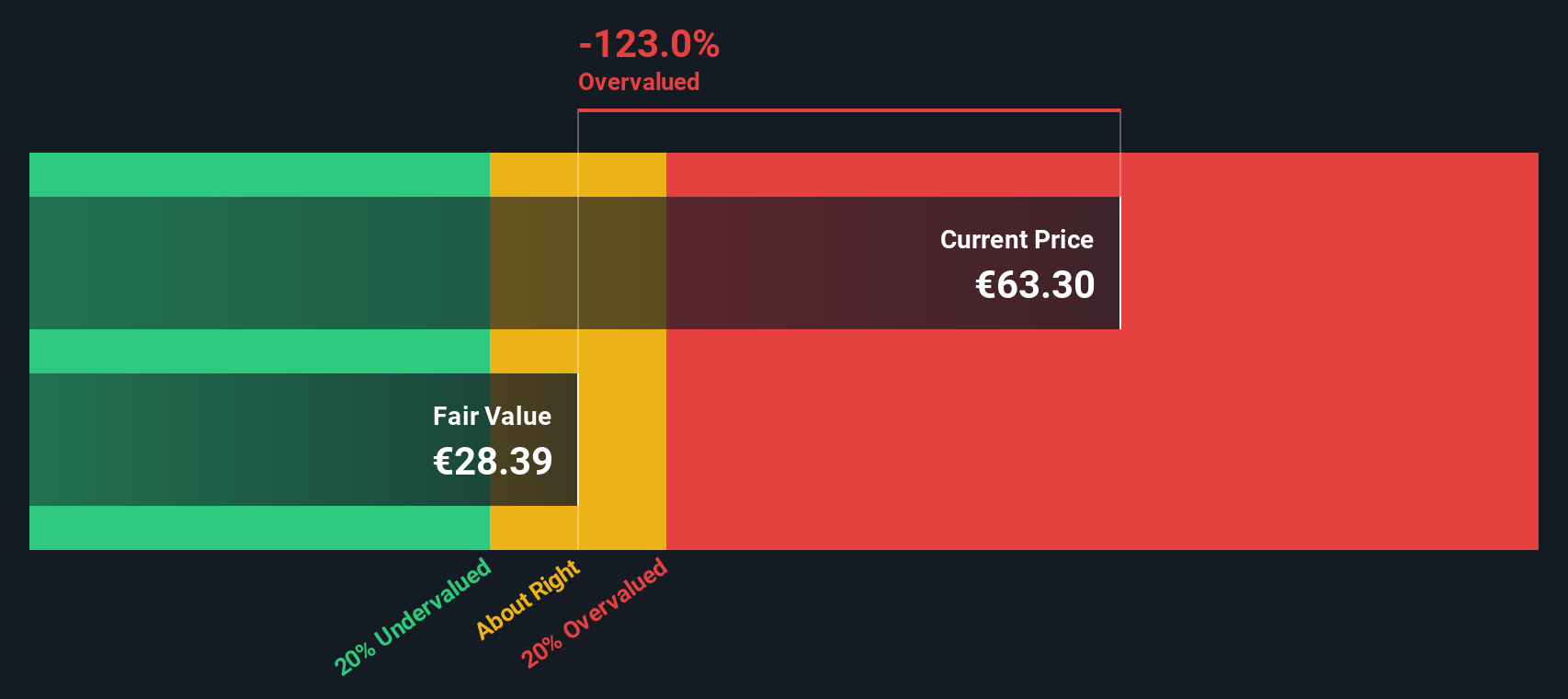

Result: Fair Value of €26.53 (OVERVALUED)

See our latest analysis for Cembre.However, short-term volatility or a slowdown in revenue growth could challenge the current valuation and shift market sentiment.

Find out about the key risks to this Cembre narrative.Another View: What Does Our DCF Model Suggest?

While the price-to-earnings measure suggests Cembre is expensive relative to its sector, our SWS DCF model arrives at a similar view. The shares are trading above estimated fair value, raising the question of which way investors should lean.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cembre Narrative

If you have a different perspective or want to run your own analysis, you can explore the numbers and craft your own view in just a few minutes, then Do it your way.

A great starting point for your Cembre research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock fresh opportunities by targeting investments that align with your goals and interests. Let Simply Wall Street’s tools point you to market moves you won’t want to miss.

- Pursue consistent cash flow by tapping into dividend stocks with yields > 3% that offer robust yields above 3% and dependable growth potential.

- Leap ahead in the artificial intelligence revolution and see which companies stand out among AI penny stocks as they make breakthroughs in tomorrow’s tech landscape.

- Strengthen your portfolio’s value with undervalued stocks based on cash flows identified by advanced cash flow metrics and strong fundamentals that others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives